Innovation in inflationary times Part 1

A playbook for innovation leaders in the CPG/FMCG industry

Article series

Inflation

As the Covid pandemic relents, central banks, as well as global supply chains, start to show signs of exhaustion. In the new inflation cycle that ensued since the second half of 2021, rising consumer prices once again dominate news headlines and dinner table discussions around the world. 75% of the global consumers are concerned that price increase in 2022 will outpace their income growth (Ipsos, Global Advisor Predictions 2022, December 2021). On the other side, leaders in the consumer goods sectors have their innovation pipelines disrupted as they fire-fight emerging priorities such as rising cost of goods, stock shortages, and rapidly shifting consumer sentiments…...

It is a challenging time as innovation leaders face choices to either completely redraw their pipeline, launch inflation resilient innovations, or renovate to reduce pricing vulnerability… even when price increases are inevitable, the choice to directly raise prices, downsize or take other indirect methods still present tough choices to make. At Ipsos, as one of the world leaders in innovation and pricing research, we are eager to share what we have learned from the past that helped our clients navigate through similar difficult periods.

In the 3-part series, we will share with you the Ipsos experience in

Creating an inflation resilient innovation portfolio

How to choose between raising the price, downsizing, or other means to reduce cost

Discerning the pricing landscape for your next innovation

Part 1: Creating an inflation resilient innovation portfolio

Bring differentiation, whether innovating or renovating.

At Ipsos, we evaluate thousands of innovation propositions each year, and the relationship between concept performance and pricing resilience is often examined. One performance KPI continuously stands-out to show a high correlation with price resilience: Differentiation. Innovations that offer distinctive benefits reduce substitutability and consistently outperform competitors in withstanding price increases.

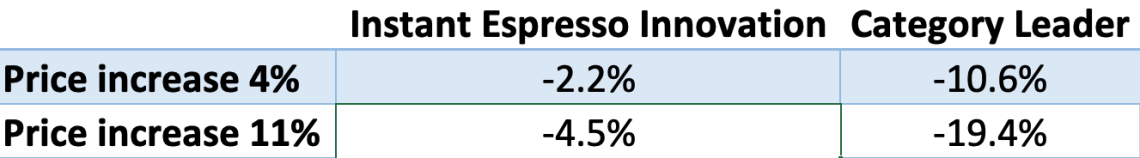

Consider this example. A Brazilian client who owns a stake in the highly homogenised and commoditised instant coffee category searches for innovations that will bring the brand out of severe pricing competition while offering premiumisation. After rounds of development, Ipsos helped the client land on a highly unique proposition for an “Instant Espresso” concept that claims a café-like experience aimed at indulgence occasions. Consumers viewed the proposition as highly differentiated and hence much less substitutable, in the pricing pressure test that followed, this unique proposition is revealed to have only a fraction of the price elasticity vs the category leader in share of choice.

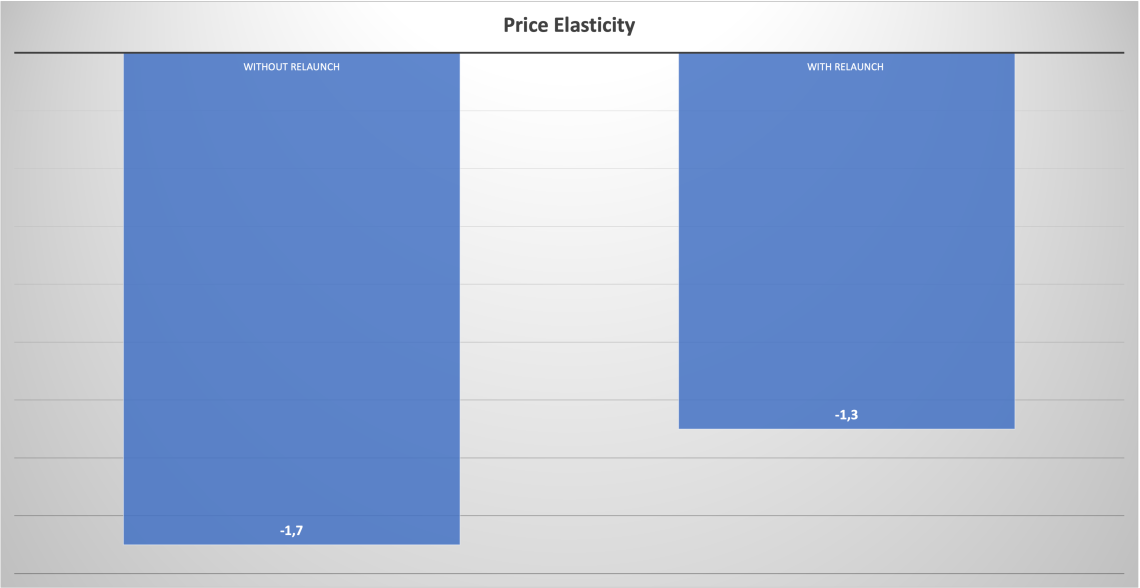

Using Differentiation as a path to price resilience is not only common with new product launches. Established brands can also revitalise with “new news” to differentiate against competition and increase pricing resilience. In this example, a leading internal analgesics brand in the US decides to relaunch to reduce vulnerability to pending price increases. The relaunch is to be led by a new technology with which the brand could claim superior absorbency and faster action that further sets it apart from lower-priced rivals. In the validation pricing test that followed, the relaunch proposition was proven to offer significantly higher resilience to price increase over the current state:

Boosting pricing resilience with overlaying claims that create meaningful difference

Of the innovation propositions tested by Ipsos, we have found innovations that make meaningful claims BEYOND category entry requirements create differentiation vs competitors and make them more resilient to price increases. During inflationary times as consumers diligently seek value for money, overlaying claims beyond basic efficacy claims often provides the justification consumers' need to pay a little more than the absolute minimum to get the job done.

To illustrate this phenomenon, Ipsos recently introduced US consumers to some hypothetical new shampoo propositions. Several new propositions are introduced that are only different on the claims made. Some made only category-average efficacy claims, while others included overlaying claims that went beyond the core, such as “sustainable packaging”, “Sulphate-Free”, and “no Silicon”, etc. Consumers are then asked to choose between these new ideas vs leading brands in pair-wise forced-choice exercises. With each choice exercise, the price for the new products would vary based on a carefully planned rotational design.

For each $1 increase in price, we found propositions that offer only basic claims suffer an average loss of 11% in win rate vs competition, while for ones with overlaying beyond-the-core claims, the resilience to price increase improves significantly to only -6% loss with an increment of $1 in price.

Example choice screen from one of the innovation iterations by price and claims.

Example choice screen from one of the innovation iterations by price and claims.

Example choice screen from one of the innovation iterations by price and claims.

Finding the right claims for permissibility to charge more

The above shows a simplified illustration of the power of overlaying claims on price resilience. It is however important to note that not all “beyond the core” claims are equally effective. The term “Permissibility to Price Increase” indicates the power different claims carry in supporting price increases without losing volume. At Ipsos, each year we conduct many pricing permissibility tests for our clients in quest for premiumisation or price increases.

In one such example, a global beverage company looked for claims they can make on their renovation projects that could sustain the largest price increase without losing volume. Consumers are led to a behavioral exercise shopping for beverage products each making an array of carefully designed claims. The share of choice for the client brands are observed as the combination of claims change. The study tested over 20 possible claims and revealed that 2/3 of these claims are not effective in sustaining price increases at all. Only a handful of claims were effective, among which the best performing claim carried a “functional wellness” message and packed an ability to support a 29% price increase while maintaining the share of choice parity to current. The vast disparity of performances by different claims highlights the importance of understanding “permissibility” before major projects are decided.

As a second step to “permissibility” understanding, marketers need to understand the level of fit these promising claims have with their brands. In a different Pricing Permissibility test conducted by Ipsos, a maker of Italian food products in the US discovered the claim “imported directly from Italy” with the highest permissibility overall. However, when they drilled down to individual brands, they found that only one of their current brands had the equity to carry this claim, when other brands in their portfolio made the same claim, believability was called into question by consumers.

Next week, we will discuss how to choose between tactics to raise price, downsize, or other cost reduction methods.

Jiongming Mu

Global Head of Innovation Testing and Forecasting at IpsosManager of a portfolio of global research products in the Innovation Testing and Forecasting space, including a few fully digital and automated services operated globally. Responsible for maintaining the portfolio while designing and scaling new offers globally at the same time to deliver growth on an 8-digit revenue stream. Manage a global inter-disciplinary team in product development, implementation and execution.