Innovation in inflationary times Part 2

A playbook for innovation leaders in the CPG/FMCG industry

Article series

Inflation

Inflationary times are challenging times as innovation leaders face choices to either completely redraw their pipeline, launch inflation resilient innovations, or renovate to reduce pricing vulnerability. Last week we shared Ipsos experiences on making an inflation resilient innovation portfolio, this week we put more focus on existing products.

When price increases to existing products are inevitable, marketers still face the choice to directly increase, or alter their value proposition through other tactics such as changing the size or modifying products to lower costs. This week we examine the pros and cons of these alternative approaches to direct price increase.

Downsizing vs price increase

Renovating existing products through downsizing is commonly used by marketers as a discrete alternative to direct price increases. At Ipsos we have helped numerous clients evaluate downsizing vs price increase options. Due to the discrete nature of downsizing (changes are not communicated to consumers), evaluation of downsizing effectiveness generally uses observational techniques where consumers are observed interacting with downsized products while shopping on realistic virtual shelves. In many of these evaluations, downsizing, or a combination of downsizing and price change indeed offers effective ways to prevent short-term user alienation compared to direct price increases.

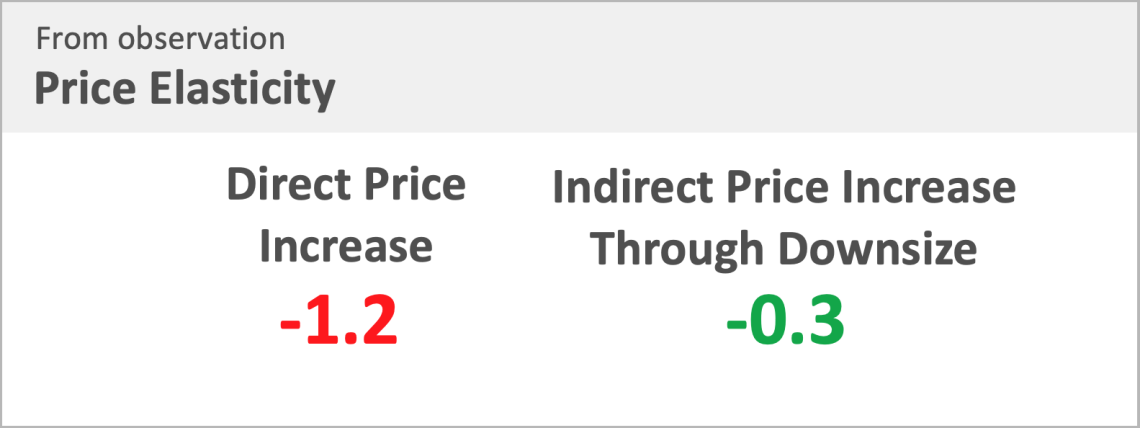

In one such observational experiment done for a US Salty Snack manufacturer, consumers were exposed to shelf settings that contain various downsize and direct price increase scenarios and are asked to shop as they normally would. For the test product, we observed a -1.2 price elasticity when we directly raise price. But for the same product, when the price increase is concealed with a downsize, the elasticity drops to only -0.3. In other words, consumers are a lot more sensitive to a direct price increase than to hidden price increase through downsizing, this is at least the case at trial purchase which can be effectively predicted through a simulated shelf test.

Downsizing also offers marketers an opportunity to add new news to further conceal price increases in a brand renovation, this is flexibility not possible with direct price increases. When done right, the excitement created by a brand relaunch can even completely offset the negative impact from downsizing.

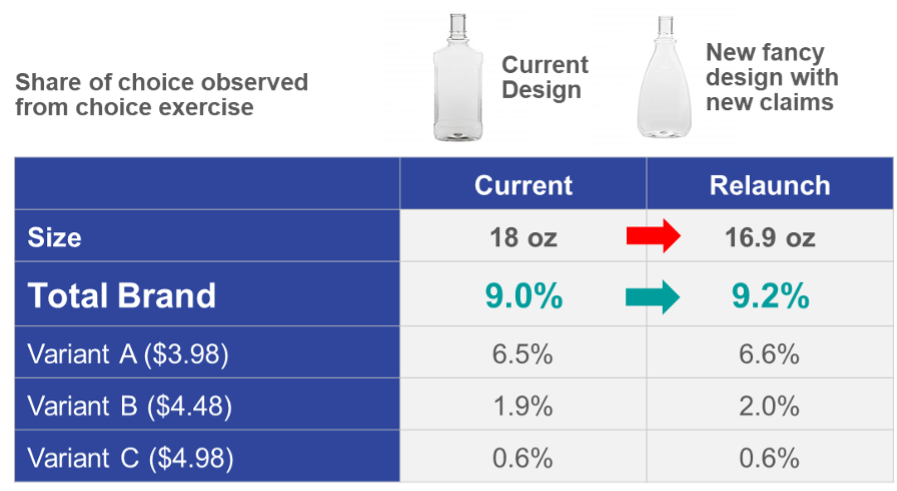

In one such successful case researched in the US mouthwash category, a 6% downsized bottle for a leading mouthwash brand is presented in a sleek and modern new design together with new pack functionality claims. Consumers were positively impressed by the renovated brand and the new bottle design and paid little heed to the reduced size. In this case, the relaunch was able to completely avoid share of choice erosion for the brand, even achieving a small growth.

In both examples, downsizing provided effective alternatives to price increases at trial purchase, which can be measured at the shelf. But there is a lot to watch out for as repeat purchases continue. Besides the reaction of consumers to a downsized product on the shelf, at Ipsos, we assess how consumers perceive and notice the downsizing through product tests in a central location or in-home, depending on the category. This research reveals some hidden long-term risks:

Honesty, transparency and brand authenticity are increasingly valued by consumers. Downsizing, when eventually noticed, has the risk of breaching trust, causing long term damage to the brand.

For frequently purchased categories, downsized products expose consumers to accelerated re-purchase cycles that come with an increased risk of brand switch.

Downsizing could bring new costs due to redesign of packaging, reconfiguration of manufacturing equipment for the new sizes, etc. Such indirect costs can sometimes offset the savings on the cost of goods.

Other means of cost reduction

Apart from downsizing, product modifications in ingredients, and packaging materials are some other popular approaches by marketers to avoid direct price increases when facing inflation. At Ipsos we have conducted a lot of cost rationalisation research as part of our product testing practice. To move such a project forward, we need to understand whether the potential gain from a cost reduction initiative outweighs the potential loss. More specifically marketers are encouraged to:

Assess the impact of product change on consumer acceptance, confirming either no decline in acceptance or a notable increase.

Regardless of the change, ensure no notable franchise erosion/alienation.

Fine-tune product/communication based on risk assessment powered by consumer data.

Evaluate whether the cost to redevelop products and re-aligning supply and manufacturing would offset savings made.

Aim high, target at improving the product, beyond just statistical parity vs. today.

Pay attention to competitive reaction and especially targeted hostile communication

In summary, there are alternatives to direct price increases, but these approaches should be evaluated with caution through consumer research to balance short term and long term gains.

Next week, we will discuss how to understand your pricing landscape and how your category might change in the inflationary time

Jiongming Mu

Global Head of Innovation Testing and Forecasting at IpsosManager of a portfolio of global research products in the Innovation Testing and Forecasting space, including a few fully digital and automated services operated globally. Responsible for maintaining the portfolio while designing and scaling new offers globally at the same time to deliver growth on an 8-digit revenue stream. Manage a global inter-disciplinary team in product development, implementation and execution.