The 2021 Insights industry M&A frenzy

What can we learn from the observed mergers and aquisitions activity?

During the early months of the COVID-19 pandemic, M&A activity in the insights industry dried up. Such was the uncertainty surrounding pretty much everything in modern life that nobody was willing either to buy or to sell. What was the point if you didn’t know that there would even be a market in the future or, if there was, what it would look like?

Come the end of 2020, everything changed. With the dawn of the vaccination era, optimism returned, and the M&A world (certainly in insights) woke up and how. 2021 has seen a veritable tsunami of deals all over the world, some of which have been eye-popping.

So, what’s going on? Who is buying and who is selling?

A little context

To find the answers to these questions, we have first to consider the seismic changes that have occurred in the capital structure of our industry in the last couple of decades.

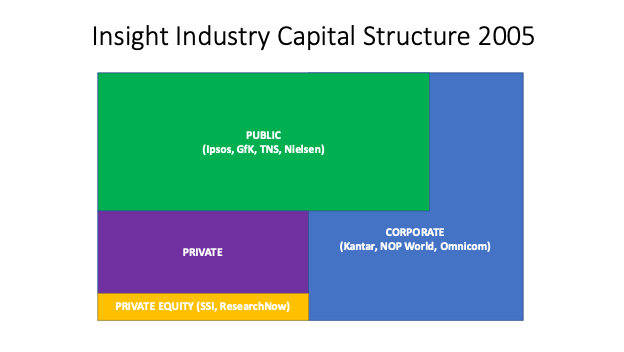

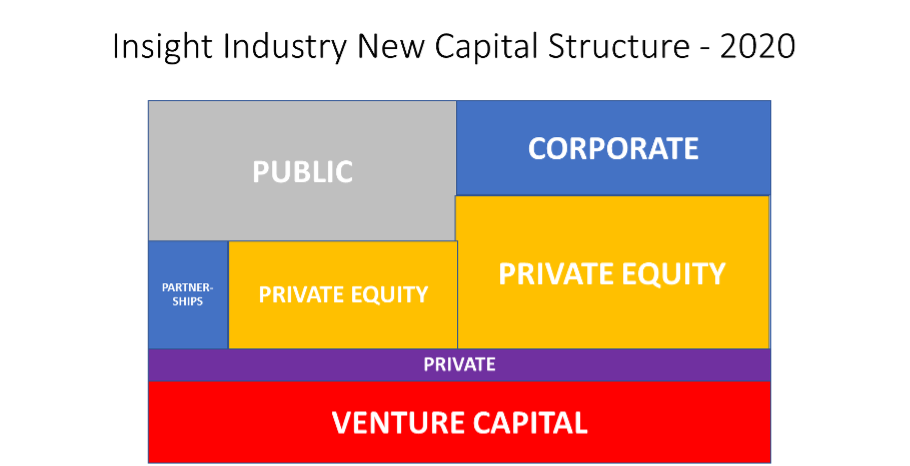

Just over 15 years ago, the insights landscape was relatively simple. The major research companies were either corporately owned by the likes of WPP, UBM and Omnicom, or publicly quoted on the world’s major stock exchanges. With the exception of a very few companies owned by Private Equity, the remainder of the industry was in private hands. Fast forward to today and the situation is very different.

The publicly- and corporately-owned slice of the industry has shrunk significantly, mainly as a result of Private Equity buying a series of key assets – Kantar (Bain Capital) and GfK (KKR) being two of the most prominent. Private Equity has also seen the benefits to be had in buying a series of major privately-owned entities such as Schlesinger Group, LRW (now Material), Escalent (born out of the merger of Market Strategies and Morpace) and FocusVision. In addition, in 2011 the industry started attracting investment from Venture Capital, especially in what is now known as ‘ResTech’. In the intervening ten years, over $30 billion has been invested by VC funds – something that had never occurred before.

As investment funds took more and more control of the sector, one segment felt the squeeze – privately-owned firms. Increasingly facing competition from companies with deep pockets, these firms had limited opportunities to raise capital for growth. They either had to fund it from profits or from bank borrowing.

Which leads us back to the central question: what was behind the M&A surge in 2021?

Four drivers of M&A activity

There are primarily two types of buyers for research agencies in today’s market: Private Equity and privately-owned mid-sized firms. To these, we should add companies recently launched onto the world’s stock markets. Driving these buyers are a series of factors:

Private Equity: There are three motivators behind the continuing interest of Private Equity firms in the insights industry:

Those PE firms already owning insights assets are busy making add-on acquisitions to bolt on to their ‘platform’ companies. A good example of this is Tailwind Capital, the owners of LRW (a Material company), who well before the pandemic were funding an acquisition spree to enable Material to emerge as a true twenty-first century insights firm. Dynata, owned by Court Square Capital Management and HGGC, have also been active recently in adding on acquired capabilities to their core offering such as ad effectiveness measurement (Ameritest) and AI and machine learning (0ptimus). Kantar, majority-owned by Bain Capital, has recently made some bold acquisitions, including Numerator, a leading shopper behaviour firm.

Private Equity (PE) firms that showed interest early on in the capital evolution of the industry did well from their investments. For the most part, they were able to grow the companies into which they had sunk money and sell them on for a handsome gain, either to other PE firms or via IPOs. This has led other PE firms to join the fray, resulting in considerable interest in acquiring strong research or ResTech firms to act as platforms for further acquisition. (A ‘platform’ company is one that is bought with the express intention of making it the anchor in a group of related firms that are acquired along the way, so building a new entity that is worth more than the sum of its parts). As the CEO of many a solid mid-sized research firm will tell you, they have been receiving calls and propositions from PE all year long.

And then there are the unicorns. Over the past two years, a handful of companies have achieved the status of being valued at over $1 billion. These are mainly research or analytics technology entities such as Qualtrics or, more recently, Cint and Lucid. While you and I may scratch our heads in amazement at these valuations, they do tend to cause something akin to the annual migration of a herd of Wildebeest among investors convinced that pots of gold are to be found in our industry.

Venture Capital offload: As I mentioned above, a huge amount of money has been invested in our industry over the last ten years, mostly by Venture Capital funds. Some of these have already profited handsomely from their investments, while others are now seeking to offload their earlier prodigies as the funds used to acquire them come to the end of their lives. Very often, they accomplish this by selling to Private Equity (unless, of course, the valuations of their investments top $1 billion, in which case they take the company to IPO or sell to a similarly valued firm already in the public domain. This is what happened in the acquisition of Lucid by Cint). While this increases the industry stake held by PE, it does not necessarily decrease that held by Venture Capital as the level of new investment coming into the sector continues to be extremely high.

Mid-size bulk-up: It has long been said that being a mid-sized research agency is an uncomfortable place to be – too small to compete with the resources of the majors but too large to be as nimble as small, boutique agencies. Today, however, that picture is being challenged by a series of mid-sized agencies who see an opportunity to leverage their strengths and grow into new markets. This has led to a spate of smaller transactions that are nonetheless significant in terms of the future landscape of the industry. Such firms may be publicly listed (for example, YouGov), corporately owned (Savanta) or privately held (Insites Consulting, Directions). All are moving into new segments and new geographies, usually with business models that challenge the old status quo.

Seller reconsideration: Before the pandemic, many of the companies being sold came to market as their owners decided that it was time to retire and garner the benefits of their life’s work. In the ResTech arena, the calculation was somewhat different – many of the companies passing into new ownership had been set up from the beginning with a sale in mind. However, there were many in both camps who were content to wait it out a little longer, grow a little more or become more profitable so as to maximize the ultimate price that they would be paid. COVID upended that notion rapidly. No longer could managements plan in a seemingly stable environment. Now, uncertainty tends to be the rule of thumb, in which case the urge to sell earlier rather than later becomes all the stronger. If a business is profitable, has a history of growth and has a differentiated business model or product portfolio, it will be attractive to any of the buyers mentioned above. And with unsolicited approaches from buyers multiplying, the temptation to take profit now becomes more tempting.

The combination of these four drivers not only explains the seeming frenzy of the M&A market in insights today, it will likely fuel the continuation of a strong transaction scene for at least a couple of years to come. It may also result in a strengthening of valuations and prices paid as the demand for attractive research assets continues high and their supply slowly dwindles. Only time will tell.

Simon Chadwick

Managing Partner at Cambiar Consulting, Editor in Chief of Research World at EsomarSimon founded Cambiar in 2004 to provide strategic assistance to research and insight companies as they face rapid and fundamental change. With 40 years of guiding and managing international organizations of various sizes and stages, Simon’s advice and counsel has helped many companies increase their value – to stakeholders, investors and clients.

He is an acknowledged industry leader, author and conference speaker. In addition to his role at Cambiar, Simon is also a Fellow of the Market Research Society, past Chairman of the Insights Association and Editor-in-Chief of Research World, ESOMAR’s global magazine.

He holds an MA in Philosophy, Politics and Economics from Oxford University, UK, and has done post-graduate studies at both Columbia and Harvard business schools in Change Management and Strategic Management.