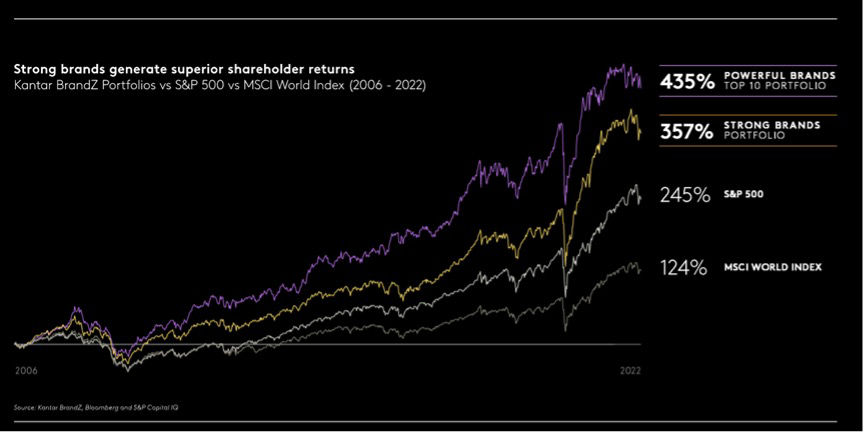

In recent years, the world’s most powerful brands have created stellar growth, leaving the rest of the market behind. So, what do these top brands do differently? How can other brands emulate their success? And which brands will top this chart in 20 years' time?

Today’s market is complex and challenging. Consumers have almost limitless access to products and can compare them instantly, attention spans are shorter, and the media landscape is crowded. The climate crisis is ongoing, and the fallout from the pandemic and the war in Ukraine has led to rising prices for energy and raw materials. Questioning capitalism has become mainstream, and many consumers are concerned about their impact on the world.

When the market is this tough, we believe that the key to unlocking growth is to go beyond brand building based on consumers’ current needs and focus on what we at The Forge have named Future Consumer Value. (See whitepaper for details).

What is Future Consumer Value?

Top brands such as Apple and Nike have grown by anticipating consumers’ future wants and needs, including developing products and services, creating and entering new categories and designing end-to-end brand experiences - collaborative innovation such as the Nike sports kit for iPods, launched in 2006, being a great example.

By combining a focus on the future with clarity on what consumers will want and need, brands will unlock commercial value. We believe that Future Consumer Value (FCV) is the only dependable and sustainable way for a business or brand to grow.

The opposite of Future Consumer Value

So, why do so many brands stagnate and miss out on opportunities to grow? Instead of adopting an FCV mindset, brands are focused on what is easy to do, such as existing product capabilities, or what meets immediate goals, such as driving short-term sales. We’ve named this mindset Short-Term, Manufacturer-led, and Sales-driven (STMS) – the opposite of FCV.

Five symptoms of stagnant brands

As strategic consultants, like our clinical counterparts, we have to diagnose what is wrong before we can offer a cure. We typically see five key symptoms that enable us to diagnose whether an organisation is stuck in STMS.

1. Different proposition, same need

Symptom: you’re continually developing new products but not reaping the rewards.

Diagnosis: you’re stuck in a classic manufacturer-centric cycle.

Organisations can get stuck focusing on what is easy to make rather than what consumers really need. Take retail banking, for example. For years, banks created products that suited them rather than their customers. Then came Monzo, which took a radically consumer-centric FCV approach and disrupted the status quo. Monzo’s app-based banking and customer communities addressed previously unmet needs, such as for transparency and trust, thereby building genuine customer loyalty.

2. Imitative, not innovative.

Symptom: a previously successful approach isn’t working any more.

Diagnosis: you are trying to manage risk by sticking to what you know.

If two blades on your razor is better than one, then five blades must be better than two, right? Wrong. This is ‘innovation’ for its own sake, and it isn’t meeting a consumer need. It’s merely easy to do, so it presents as low risk.

Often, the big opportunities in a category aren’t surprising or hidden. It just takes one brand to have the courage to take a leap. For example, non-alcoholic drinking has been growing for over a decade, but it took Heineken launching Heineken 0.0 to convince the rest of the lager industry that there was a viable opportunity.

3. Brand confusion

Symptom: you’ve launched some new brands, but you aren’t seeing growth.

Diagnosis: your brand architecture is confusing.

Launching a new brand can be a good way to reinvigorate your category or introduce an innovation. In the pet food category, for example, we see many signs of manufacturer-led innovation – packaging such as a pouch or food format such as a pate – resulting in new brands. However, brands are expensive to support and maintain. An innovation should only warrant a new brand if it brings a distinct set of consumer benefits.

4. Limited leverage

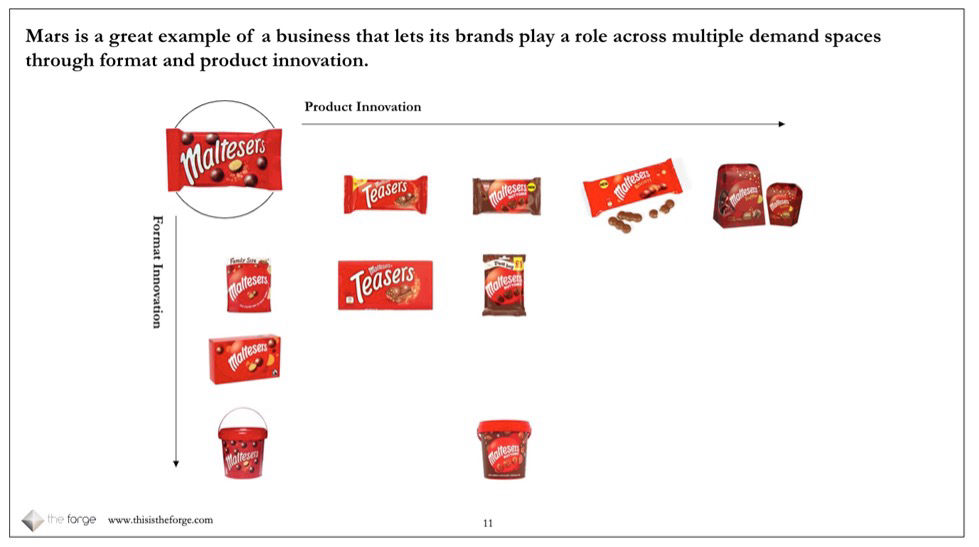

Symptom: you have identified new consumer spaces but don’t know how to exploit them.

Diagnosis: you have failed to leverage your brands.

The antidote to a confusing brand architecture is to better utilise your existing brands. We frequently see brand owners that have identified new consumer spaces but lack the plan to stretch the brand into them. The cure? Emulate Maltesers, (figure 2), a brand with an FCV mindset which consistently demonstrates a solid understanding of the needs of its consumers, enabling it to unlock a range of formats for every opportunity: treat, grazing, share, party, cinema, gifting, seasonal etc.

5. Bargain basement

Symptom: your promotions don’t create growth

Diagnosis: you are addicted to short-term price promotion which erodes value.

This is a classic symptom of STMS. Price promotion can be an effective short-term tactic, but it works by eroding your existing brand equity. We see this in so many categories, but a prime example is furniture retailer DFS. The brand is stuck in a cycle of discounting that works against its need to build desire and increase margins, increases stress among customers and destroys brand equity.

How to get unstuck and create Future Consumer Value

Our whitepaper identifies four practical ways that brands can move on from a STMS mindset. In short, these involve identifying who your most important (valuable) consumers are and using that knowledge to improve your targeting and focus; understanding what drives choice in your category and using that insight to underpin and drive an effective and efficient portfolio; mapping existing and future category motivations against existing and potential solutions; and refocus your innovation back on the customer.

If you are seeing symptoms of growth stagnation in your organisation and are interested in how to get unstuck and build sustainable growth, then read the full whitepaper here.

Adam Rowles

Marketing and Business Development Director at The ForgeAgency marketing and business development lead with 14 years' experience gained at agencies and consultancies spanning right across the marketing mix - research, insight, brand strategy, design, digital, strategy, media and advertising.