The research industry is awash in hype around new technologies that promise unprecedented insights into consumer behavior – but it can be a challenge to separate substance from mere flash.

At its core, the power of neuroscience in market research presents the ability to bypass the conscious mind and tap into the true, unconscious drivers and barriers that underlie behaviour. And yet, the activation of this neuro lens can amount to mere gadgetry, leading some teams to quickly abandon ‘neuro.’

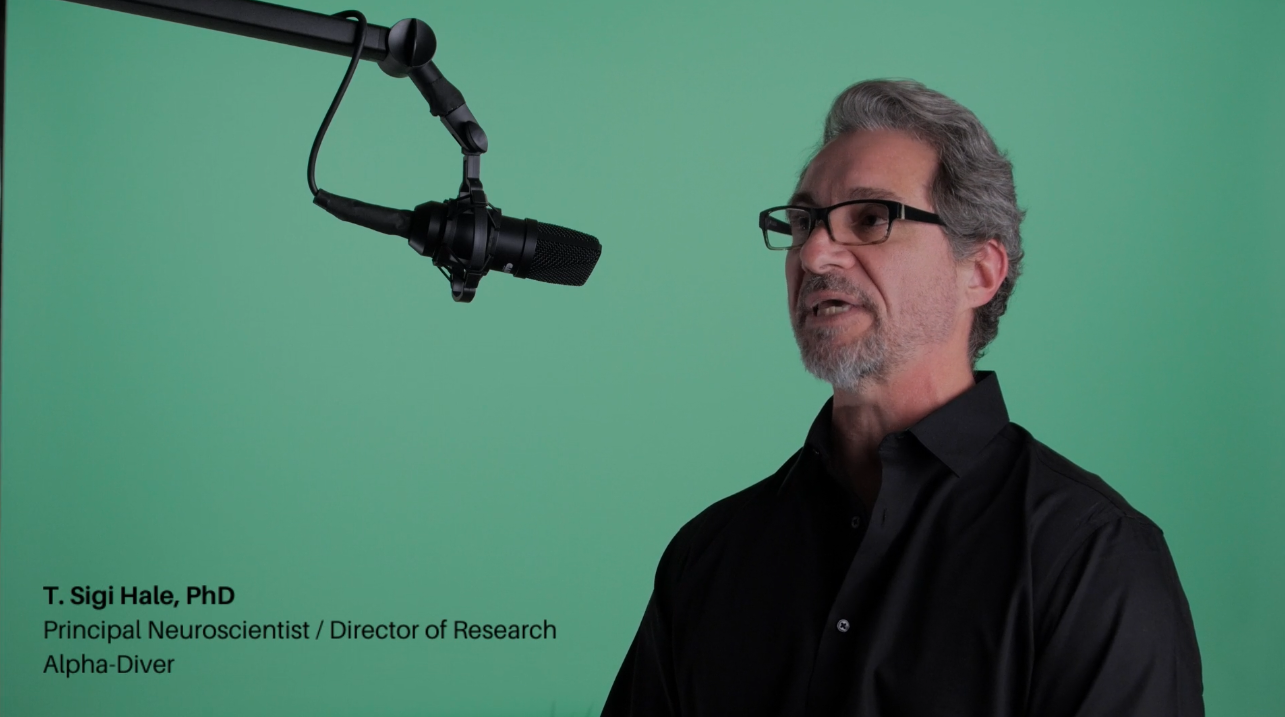

In 2011, neuroscientist T. Sigi Hale PhD left academia to pioneer the behavioural science movement in market research. He quickly observed conventions, themes, habits, and some downright mistakes being made in the MRX space. Sigi also emerged as a foremost expert in applying what ‘behavioural science’ truly has to offer marketing insights and strategy – getting beyond the hype to what drives results in real-world activation.

Sigi’s experience reveals three core insights that can guide more effective brand activation…

Observation 1: Market research is model-free; academic research is model-based.

The most fundamental – and likely the most instructive – difference between the world of academic research and that of market research is the fundamental philosophical divide between “model-free” and “model-based” research.

The vast majority of conventional market research remains model free. Under this philosophy, researchers go forth into the world to collect data (whether physically or digitally, qualitatively or quantitatively). They do so without a model, simply observing consumer behaviour, asking people why they do one thing over another, or compiling data points related to various behaviours of interest. Then, they return to their huddle rooms and Zoom screens to analyse the data; in essence, the effort to reveal “the model” from the data.

This effort to divine the signal from the noise of all the data they’ve amassed is doomed to introduce subjectivity, bias, and inaccuracies. What’s more, this approach fails to leverage all that’s known from previous research or existing knowledge.

Academic research looks much different. In academia, the first stage is to identify a reliable, established model that will frame the data collection. Then, fieldwork is driven not by collecting lots of disparate data, but rather mapping data collection back to the model. Not only does this dramatically reduce the churn which so often paralyses market research analyses, it “stands on the shoulders” of all previous research and learning to instil confidence and assure objectivity in the findings and implications.

While this comparison between these two approaches to research sounds simple, it’s quite cathartic in the implications. Consider an analogy from everyday life: imagine you wanted to go for a hike. There are two basic choices you have…

Choice 1: consult a trail map, and follow an established path the destinations you’d like to explore.

Choice 2: forge off into the woods and simply wander around.

Aside from the obvious perils of choice 2, most people would agree that having a map is a more reliable, rewarding experience. And yet, most market research projects look a lot more like wandering in the woods than they do consulting a map.

Model based research leverages the trails blazed by predecessors too much more reliably guide explorers to their desired destinations and discoveries.

Observation 2: Human beings are incapable of explaining WHY they do things.

In an interview, Gopuff founder and co-CEO Rafael Ilishayev discussed the notable popularity on the platform of having pints of ice cream delivered. He pointed out his team’s early assumption that this was surely driven by Gopuff’s reliably-speedy delivery service and consumer assurance that their ice cream would not melt in transit.

However, Ilishayev shared a more insightful explanation of Gopuff’s performance in ice cream: simply, the fact that ordering ice cream for home delivery spares the shopper from social judgement.

Picture yourself walking into a convenience store and awkwardly carrying three pints of Chunky Monkey to the front counter. Not exactly an occasion you’d rush to share on your Instagram feed. The cashier might even raise his eyebrows as you tumble the pints onto the counter.

Now picture tapping and swiping your way to order not three but FOUR pints on Gopuff, and having them dropped on your doorstep minutes later. No judgment, embarrassment, or hesitation – just pure enjoyment.

And yet, in traditional research, respondents insist that convenience and time savings drive their behaviour; in other words, they cite the rational, plausible reasons for their behaviour.

But the social aspect of the behaviour is much more accurate as to they WHY of the behaviour. To wit, Gopuff actually sells more pints of ice cream in a given order than traditional retailers. All of this is an excellent demonstration of the fallibility of our perceptions as to the causation of our own behaviour. Said plainly, from the brain-science perspective, human beings are incapable of explaining WHY we do (or don’t do) things.

So, instead of gauging what consumers THINK they think, neuroscience techniques can leverage decades of past research to reveal the durable factors that explain and even predict human behaviour…

Observation 3: Behaviour is predictable.

The neuroscience definition of predictability relates to the durable aspects of human behaviour. Most everyone can relate to the experience of walking around a corner and being startled by someone unexpectedly appearing. When this happens, what does the person who’s startled do? You know the answer intuitively – they jump, flinch, or otherwise physically recoil from the unexpected surprise. This is predictable.

Likewise, there are predictable lenses through which a person views everyday decisions, including purchase decisions.

The PRACTICAL lens – making decisions based on knowledge and comparing options.

The SOCIAL lens – making choices based on tribal knowledge and collective social agreement.

The EXPERIENTIAL lens – personally exploring and discovering new, exciting experiences.

The INSTINCTUAL lens – simply following natural impulses to do what feels good in the moment.

Just as hiking with a map still requires endurance and effort, it takes some work to identify and quantify which of the above is driving consumer behaviour within a given context – but they’re surely present. And, when you’re studying a marketspace with an established model of WHY people behave in the ways they do, business-building discoveries become a much more reliable and enjoyable endeavour.

Hunter Thurman

President at Alpha-DiverHunter Thurman is president of Alpha-Diver, the market research & consulting firm that applies neuroscience to more deeply understand marketplace behavior. The firm’s neuroscientists and strategists work with leading brands, retailers and the Wall Street analyst community to explain consumer behavior in ways proven to help clients drive double-digit brand growth via activation.