Shaping insight into foresight

A conversation with Matthew Nelson, CEO of Mintel, about the shift in their consumer foresight approach.

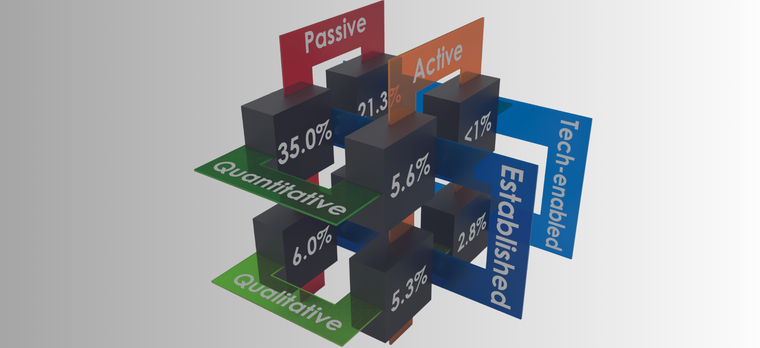

The global insights industry continues to evolve at a rapid pace. In 2024, it generated over US$147 billion in turnover, growing by 8.1% year-on-year. Concepts that once generated industry-wide excitement—automation, agile research, and, more recently, artificial intelligence (AI)—are now part of everyday operations. As these technologies become the norm, attention turns to the next frontier: foresight.

In this excerpt from the interview, Matthew Nelson, CEO of Mintel, shares his perspectives on the evolving insights industry and how his company, Mintel, approaches consumer foresight. You can now read the full interview in the report Forecasting the Data and Insights Industry: A 2027 Outlook.

Being part of the insights industry for over 50 years, Nelson observes that Mintel has helped clients understand consumer behaviour; however, he adds the last few years have truly revolutionised the insights industry.

Advances in technology, the rise of behavioural data, and breakthroughs in data science have transformed how we work—from static surveys and siloed reports to an always-on view of people and markets that was inconceivable even 15 years ago.”

With this transformation comes complexity. Nelson observes that clients are now juggling DIY platforms, siloed research, and a proliferation of dashboards and analytics tools.

The result is more data and more noise, but rarely more clarity. What clients really want is a sharp diagnosis and confident direction.”

Boundaries between segments are continuously blurring, and Nelson views this blurring of boundaries as a positive thing.

The silos between research, analytics, consulting, and software are breaking down. And that is a good thing—because clients are not asking for category-specific solutions but for answers. “

The real challenge, Nelson added, is understanding that growing toolkit (social analytics, aka quantitative research with a powerful new lens; synthetic data) and knowing when to use what. The role of agencies, he added, is to bring coherence to these fragmented methods and help clients cut through noise. This shift is also accelerating collaboration and prompting consolidation. Mintel’s recent acquisition of BlackSwan Data, which allowed them to combine predictive social analytics with cultural and commercial expertise to deliver foresight at scale.

The changing nature of the industry, Nelson adds, is also reshaping the kind of talent required to succeed.

We need hybrid people who are as comfortable with behavioural signals and biometrics as they are with survey design and storytelling.”

Ultimately, Nelson believes that focusing on the customer, rather than the capability, is what delivers value.

If we drop the silos and focus more on the customer rather than the capability, we can deliver insights that are sharper, faster, and far more powerful. That is what clients need. And that is where the industry should be heading.”

While the industry around us has changed dramatically, Nelson insists that Mintel’s foundation remains the same.

Great marketing still starts with great diagnosis. That’s the foundation we’ve built on for 50 years, and it’s what will keep clients coming to us for the next 50.”

Nelson’s reflections are just one perspective shaping the future of insights. At the recently concluded Esomar Congress in Prague, Julie Lizer, Global President of Research and Insights at Mintel, joined other industry leaders to discuss Investment in the age of geopolitics, one of the highlights of Day 1 of Esomar’s Congress.

For those preparing to navigate the industry’s next chapter, the full interview and market outlook can be found in ESOMAR’s report Forecasting the Data and Insights Industry: A 2027 Outlook. It combines qualitative insights with data-driven projections to guide strategy through 2027. While not a crystal ball, it may be the next best thing.