Respondent experience management Part 1

How to be a respondent-centric researcher?

Article series

Respondent experience management

- Respondent experience management Part 1

- Respondent experience management Part 2

“Only less than half of the respondents globally are satisfied (Top 3 Box) with their experience participating in research”. This was one of the key findings of Global Respondent Engagement Study[a] across 15 countries.

In February 2016, Quirk’s published a study “The impact of survey duration on completion rates among millennial respondents” [b] which found that there’s a major dropout inflection point among millennial respondents after 15 minutes.

Of course, these results could not be generalised on the entire world, but at least it gives an indicator for the picked sample and shows the need for keeping our eyes open to apply a customer-centric approach when dealing with the respondents.

The customer-centric approach is a model for business success and growth. The core of the approach makes the customer the heart of business decisions. It is worthwhile for the marketing research industry to adopt the same ideas when dealing with respondents and to be respondent-centric researchers (RCR); for several reasons:

Insights are unlikely to be generated without respondents.

Respondents are human.

Respondents fatigue impacts the quality of responses.

Respondents have to be encouraged and engaged.

Respondents are the customer of our client.

Sustain the respondents’ participation intention. Studies reveal that, survey satisfaction affects the future participation of respondents [c]

Developing a stronger relationship with respondents that relies on their honest input, active participation, and eagerness to be a part of a long-term conversation about brands and activities in their lives is vital to success in this industry.[d]

Surveying the respondents is like making a chemical experiment, but the major difference is that we are dealing with humans, not chemical elements. People have extremely different characteristics (e.g. emotion, feeling, confidentiality) which make the task more challenging.

It is necessary to take the respondent's experience into consideration during the research design. Creating an effortless (as much as we can) and engaging experience for the respondents is not only good for the participants; it gives a chance to improve the quality of responses that you will receive.

According to the above, there is a need for Respondent Experience Management (RXM).

Through two articles, I will try to highlight how respondent experience can be managed? Let us start with a question; what is Respondent Experience Management (RXM).

RXM is a non-linear cycle and ongoing measures at different stages to ensure that every market research exercise is designed around respondents’ expectations.

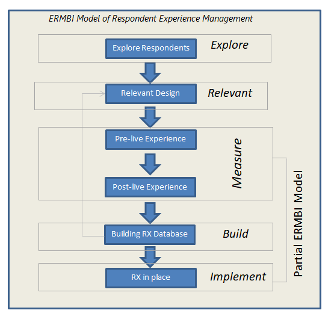

ERMBI model is the way for putting RXM in place. ERMBI stands for Explore, Relevant, Measure, Build and Implement. Figure-1 describes the five stages of the model and details for each one is given later. Note, that the model is applicable for quantitative research, but could not be the best way for qualitative research.

Figure1: Five stages of respondent experience model – ERMBI

Figure1: Five stages of respondent experience model – ERMBI

1. Explore the respondents

Understanding the respondent's needs & preferences should be first to understand more about the respondent's point of view, preferences and styles of participating in market research exercises. We need to come up with research initiatives for different countries and regions. This kind of study will establish an understanding of the current experiences and future preferences. The study should answer the following questions:

What is the satisfaction of the past experience of participating in the research?

What is the satisfaction with the value of the incentive?

What is the satisfaction with the type of incentive?

What is the satisfaction with the interview length?

What are the reasons for dissatisfaction?

What would be the acceptable length of the interview? [duration in mins]

What are the things that can encourage the respondents to participate in the research?

What are the things that could kill their intention to participate in the research?

Do you think that knowing the research sponsor would affect your decision to participate in the research?

What are the preferred types of incentives? [cash - voucher - gift - other specify]

The above questions are essential to understand the respondent preferences; moreover, additional questions can be added whenever required.

It is understood that exploring the respondents requires investment and it couldn’t be affordable for every research provider. Therefore it is a call for different co-operations, here are some thoughts:

Cooperation between multiple research providers in the same country/region, so the budget would be distributed across the providers.

A sponsorship agreement between research buyers and providers – Research buyers can get a discount on their future research projects.

Market research associations with the research providers can bring something to the table.

Find a way to make a partnership with statistics bureaus in your country to fund the exercise.

2. Relevant design

The objective here is to propose a research design that meets the respondent's needs and preferences.

Any design should meet the respondent's expectations which have been determined in the first stage. Before proposing the design consider “exploring the respondent”.

An expected barrier is the research buyer who may want to implement an irrelevant design (e.g.) request a lot of information that can exceed the accepted interview length by the respondent. Here is the added value of “exploring the respondent” by using the researched output to prove your proposed design, tell the client this will affect the respondent experience, hence the quality of responses and the research findings would be affected as well. Let the client decide on the risk, either to take it or avoid it. As you can see, exploring the respondent goes beyond discussion, it works as proof of your design; the client should understand the maturity of the industry and the rationale behind the proposed research design.

That is all for today, but what if we did have enough resources (for many reasons) to implement the above two stages of the model? Does it mean there is no chance to manage the experience and offer a positive setting for the respondents? Or do we have room to continue and achieve our goal (be respondent-centric researchers)? In the next article, I will reveal the answers to these kinds of questions, and highlight how to implement the rest of the stages of the ERMBI model. Stay tuned!

References

[a] GreenBook,“Global Respondent Engagement Study” https://www.greenbook.org/pdfs/GRIT_CPR_Final_42017.pdf

[b] Quirks Media, “Article of Dan Coates, MaryLeigh Bliss, Xavier Vivar” https://www.quirks.com/articles/the-impact-of-survey-duration-on-completion-rates-among-millennial-respondents

[c] Market Research Institution International, “Article of Bill MacElroy” https://blog.mrii.org/respondent-engagement-boosting-survey-satisfaction-and-participation/

[d] eBook of Innovate, “Improving and Amplifying Respondent Engagement” http://blog.innovatemr.com/boost-and-encourage-engagement-from-survey-respondents

Ahmed is a marketing research analyst focusing primarily on quantitative research. Throughout more than 18 years of experience, he held different roles at research agencies and corporate research departments. His experience extends to several countries, business sectors and research types. While working on the client side, he got an opportunity to be part of the customer experience department to support its mission of offering a memorable experience. He holds Insights Professional Certification (IPC) from the Insights Association, BA in business administration, a diploma in applied statistics in the opinion research major, and advanced analytic techniques badge from University of Georgia. In addition to his practical experience, he designs and delivers training in marketing research topics. Furthermore, he shares his thoughts and professional practices through articles. He is also the winner of the 2023 Insight250 award.

Article series

Respondent experience management

- Respondent experience management Part 1

- Respondent experience management Part 2