Global evolution of market research projects

This excerpt from ESOMAR’s Global Market Research 2024 offers a comprehensive overview of the global insights and market research sectors.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry

The following article is an excerpt from ESOMAR’s Global Market Research 2024. This flagship report of ESOMAR, often dubbed as the “Bible of Market Research”, provides you with the most comprehensive overview of the state of the insights industry and the market research sector around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

The funnel-like approach proposed in ESOMAR’s Global Survey 2024 allowed to isolate the portion of turnover related to market research practices i.e., full-service and market research services (qualitative and quantitative surveys including focus groups, expert interviews, and audience measurement) and fieldwork services (including sample, panel, and data services).

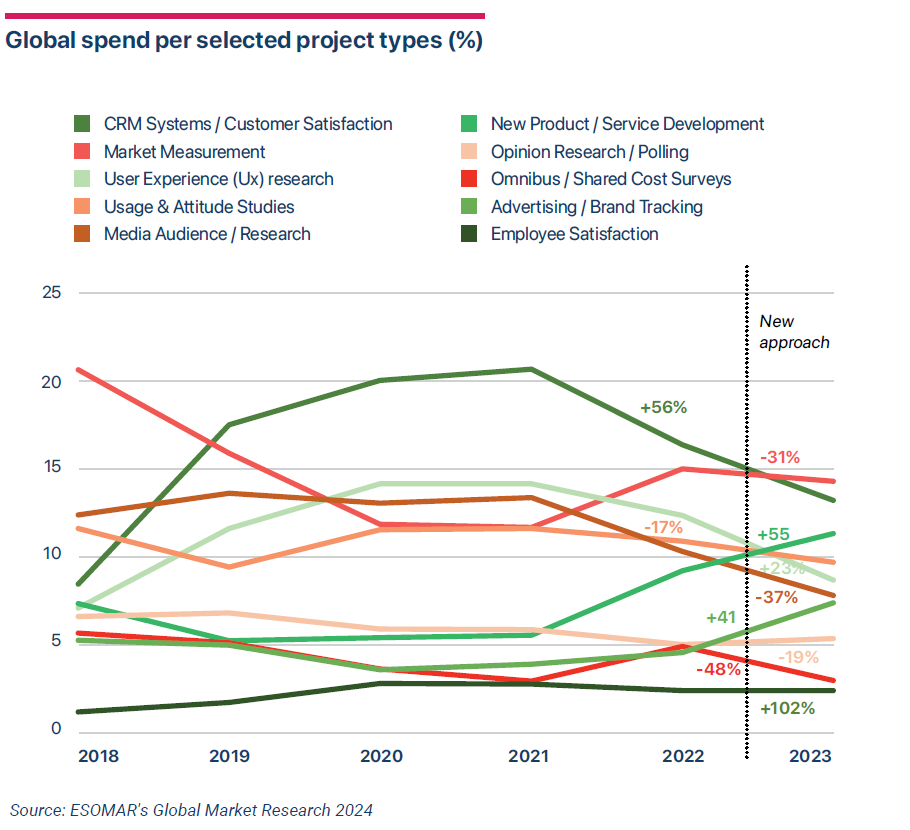

The two main types of projects commissioned in 2023 continued to be market measurement (14.3%) and CRM research/customer satisfaction (13.2%), which together account for more than a quarter of the projects carried out worldwide. As mentioned, changes in the methodology of the ESOMAR questionnaire make it difficult to analyse trends, but it should be noted that market measurement is back in first place, having lost out to CRM/customer satisfaction in 2019. After the various crises that affected many regions (COVID-19, wars, inflation, etc.), the need to assess market transformations prevailed in 2023. Against this backdrop, brands are also continuing to innovate, and new product development is the third most common type of project overall (11.4%).

Readers may notice that the share of spending on CRM systems/customer satisfaction and user experience projects has decreased slightly over the last couple of years. One potential reason could be clients conducting these types of projects internally (see ESOMAR’s Global Users and Buyers of Insights 2023 report), while the other, more plausible, reason is mathematical. By isolating the turnover related to market research practices, the model is able to paint a more precise picture of the spending on these project types rather than, as was done until last year, factoring in the entire insights turnover, which would otherwise include non-project-based turnover.

Slightly behind, usages and attitudes, user experience, media audience/research, and advertising/brand tracking each account for less than 10% of projects (9.7%, 8.7%, 7.8%, and 7.5%, respectively), but advertising/brand tracking is regaining momentum after the slump experienced during the crisis years.

As usual, opinion research/polling is less important in terms of turnover (5.4%) than in terms of the sector's visibility and reputation, even though the exclusion of self-service from the 2023 data and the election campaigns in several countries have increased its share of projects compared with previous years.

The main types of projects occupied quite different positions by region: market measurement is by far the most important type in Africa (29%), Latin America (22.3%), the Middle East (19.8%), and Asia (14.7%). On the other hand, it only comes fourth in Europe (8.7%) since 2023 can still be considered a year of transformation rather than stabilisation in several European countries, where new product development (20.1%), advertising/brand tracking (15.1%), and CRM/satisfaction (10.4%) are more frequent. While CRM/satisfaction (17.8%) and market measurement (16.6%) were in the lead in North America, this region stands out for the high weighting of media audience/research and user experience (13.3% and 13.2%, respectively).

Finally, Opinion accounted for 10% or more of projects in emerging regions, depending on election calendars and polling regulations: Middle East (16.5%), Latin America (12.2%), and Africa (9.5%).

John Smurthwaite

Ambassador for the Asia-Pacific Region at Esomar, President at Marketing Research Society of MalaysiaJohn Smurthwaite is the ESOMAR Ambassador for the Asia Pacific region which covers 18 countries from NZ in the south to Mongolia in the north, Philippines in the east and Pakistan in the west. John took on this role after retiring from KANTAR in 2016.

The role of Ambassador is to work closely with all the ESOMAR representatives in the region as well as link up with the national associations to support your needs in the region. In normal times, John manages ESOMAR Best of Series events as well as assisting in the many ESOMAR events in APAC.

John is based in Malaysia and is currently the President of the Marketing Research Society of Malaysia.

John began his research agency career with an Australian company in Melbourne called Frank Small and Associates which was later acquired by Sofres/TNS/KANTAR and continued working with the acquiring companies John transferred to Malaysia in 1977 and then to Hong Kong in 1981 to begin developing Frank Small and Associates throughout the region developing offices in Philippines, Indonesia, Korea, Taiwan, Japan, Vietnam and India. John managed the APAC region as TNS CEO/Chairman for many years until his retirement.

John is a member of ESOMAR advisory panels and committees such as on Global Market Research and Pricing reports as well as the Association Executive and Representative committees.

Philippe Guilbert

Consultant at Syntec ConseilPhilippe is the former Managing Director of Toluna France and Senior Vice President Quality of the Group. He is now a consultant in research methodology for companies and SYNTEC Conseil, and contributes to the dissemination of rules, standards and best practices in the industry through conferences, academic courses and articles, including his "Did you know?" section on the French website MRNews.

In the 1980s, he developed advanced statistics, survey methodologies and new marketing approaches in research agencies. Then in the 90s, he initiated the survey digitisation by launching an international panel of Internet users, the web audience measurement and the sampling/questionnaire adaptation to the Internet. In 2007, he joined Toluna, a French start-up, to bring his methodological expertise and make it the world's #2 online panel and survey solution.

Philippe is a member of the ESOMAR Professional Standards Committee since 2014.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry