2023’s Market Research Anchor Europe’s Insights Industry

A $34 Billion Insights Industry. How Europe Stands Resilient Against Inflationary Pressures?

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry

The following article is an excerpt from ESOMAR’s Global Market Research 2024. This flagship report of ESOMAR, often dubbed as the “Bible of Market Research”, provides you with the most comprehensive overview of the state of the insights industry and the market research sector around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

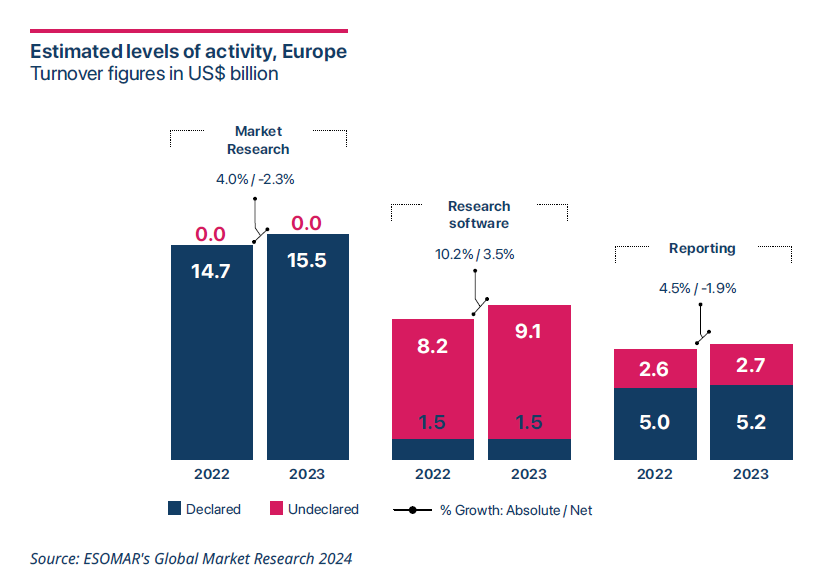

The European insights industry achieved an estimated 6% absolute growth in 2023, expanding to $34 billion, making it the second-largest market globally. Changes introduced by ESOMAR to this year’s survey questionnaire enabled a more precise measurement of each insights sector.

The market research sector grew by 4% to US$15.5 billion in 2023, maintaining its position as the largest segment of the region's industry. This growth was supported by updated estimates from the United Kingdom, Spain, Finland, and Russia. In particular, the UK continues to occupy a prominent position as an industry leader in terms of market size, reaching a total market research turnover of US$4.7 bn. However, persistently high inflation across many European countries turned what would have been modest positive growth into negative net growth for the market research and reporting sectors.

The declared turnover for the research software sector in 2022 was revised down from US$4.4 billion to US$1.5 billion, highlighting the challenges countries face in accurately capturing the size and scope of their local insights industries.

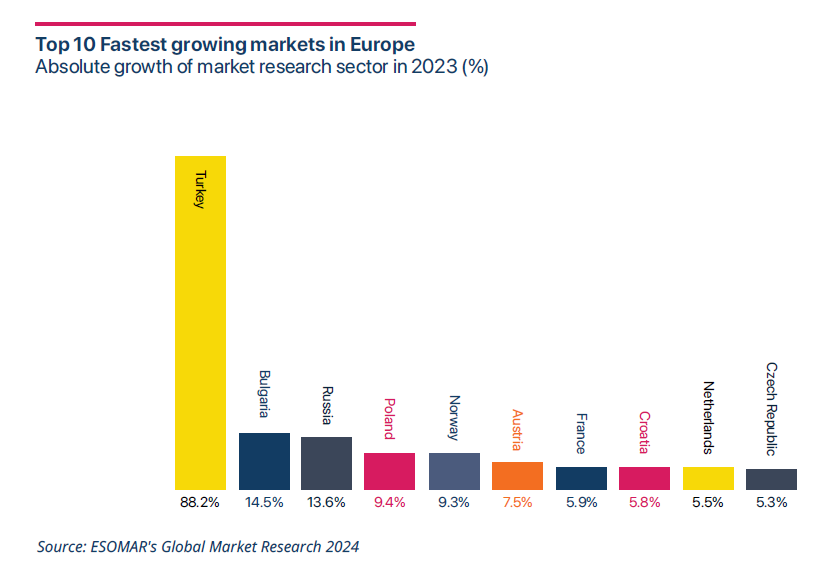

The top 10 fastest-growing countries in absolute terms were led by Turkey, with an impressive growth rate of 88.2%. However, due to significant inflationary and currency depreciation pressures, Turkey’s net growth was a more modest 22.3%, making it the fifth most inflationary country in the Global Market Research dataset, following Zimbabwe, Lebanon, Sudan, and Argentina.

Bulgaria and Russia claimed the second and third spots, both achieving growth rates exceeding 10%. Bulgaria’s growth was driven by increased activity in public opinion and polling, while Russia’s 2023 growth stemmed from preparations for the 2024 presidential elections, alongside advancements in self-serve platforms and heightened research demands tied to the current market conditions.

The remaining countries reported growth rates exceeding 5%, all surpassing the European market research sector's regional growth rate of 4.0%. Poland and Norway stood out with growth rates above 9%—Poland benefitted from heightened interest in consumer insights during a period of economic uncertainty, while Norway experienced a strong year expected to moderate in 2024.

The other countries in the top 10 exhibited solid absolute growth, although in some cases, this turned negative when adjusted for the region’s persistently high inflation in 2022. Inflation rates were estimated at 6.2% for the historical “core” EU 15 (including the United Kingdom), 10.7% for the remaining EU 27 countries, and 7.0% for the rest of Europe.

The outlook for Europe in 2024 is optimistic for most countries. The region is expected to achieve robust growth of 6.7% and an estimated industry turnover approaching US$36 billion!

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry