Shifting Client Trends in Global Market Research

In 2023, there's a notable shift from domestic to international clients, reversing trends seen during the pandemic.

The following article is an excerpt from ESOMAR’s Global Market Research 2024. This flagship report of ESOMAR, often dubbed as the “Bible of Market Research”, provides you with the most comprehensive overview of the state of the insights industry and the market research sector around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

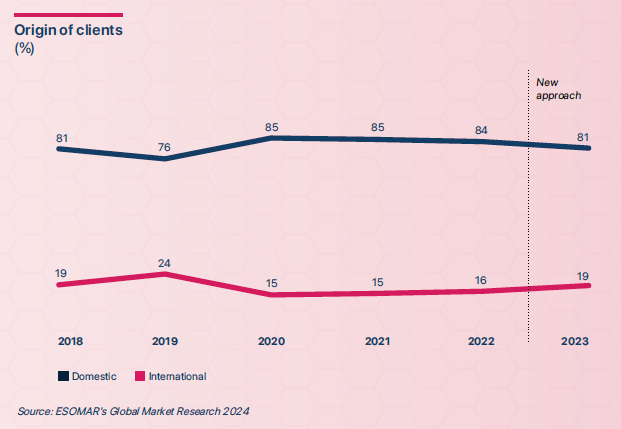

Domestic/international clients

In 2023, the trend towards fewer domestic clients and more international ones has become more pronounced, confirming a shift that had been observed before the COVID-19 pandemic. Between 2020 and 2022, domestic clients gained prominence as companies focused on their own markets due to pandemic-related constraints. However, this pattern has started to reverse.

Economic crises and inflation in various countries have led companies to seek new opportunities beyond their borders, revitalising the demand for international research. Centralising studies across multiple markets is now viewed not only as a cost-saving strategy but also as an efficient way to gather broader, more tailored insights from diverse environments.

On a global scale, although domestic clients still represent a significant portion of the total research spend, their share has declined compared to recent years. As the global economic landscape stabilises and logistical barriers diminish, investment in research from international clients has regained momentum. Companies are once again diversifying their efforts, pursuing more globalised market strategies aimed not only at efficiency but also at capitalising on the synergies offered by operating across different geographies.

Africa remains the region with the lowest level of domestic investment in market research, reflecting its strong dependence on international clients. In contrast, Europe leads in domestic investment, highlighting a more Eurocentric research landscape. Notably, Canada and the UK stand out, with 100% of their research turnover coming exclusively from domestic clients, underscoring the strength of their internal markets. On the other end of the spectrum, Iraq presents a stark contrast, with 95% of its revenue derived from international clients, emphasising its heavy reliance on cross-border research funding.

Type of client

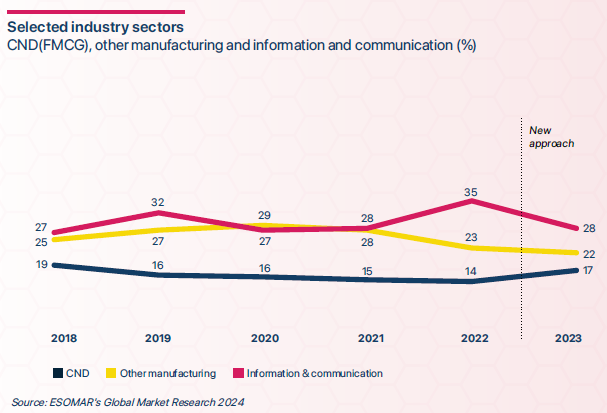

In 2023, 68% of the global market research turnover came from three key client sectors: information & communication (media and broadcasting), manufacturing of consumer non-durables, and other manufacturing industries. Despite this significant contribution, shifts within individual client segments have been notable.

The media and broadcasting sector experienced a reduction in research spending this year. The rise of new information consumption formats, coupled with the inability of some traditional media outlets to adapt, has likely forced them to cut back on their investments. Additionally, the growing reliance on algorithms and secondary data to analyse media consumption patterns has further reduced the need for commissioned studies. Despite these trends, media and broadcasting remains the largest client sector, driven by the United States, which accounts for 75% of the total global spending in this category.

Although the data might not be comparable due to the new approach of the GMR, the graph in this section shows the share of the different client types. The consumer non-durables sector seems to have regained some of its market share, although it is still the smallest one of the three types of clients analysed. It is important to consider that five countries — the USA, the UK, India, France, and China — concentrate 69% of the total revenue coming from this sector.

Breakdown of consumer non-durables

In 2023, while the consumer non-durables sector saw a slight increase in market share, the overall trend of declining research spending in this category continued. A more detailed breakdown of this sector reveals that over half of the spending is concentrated in the food, beverages, and confectionery segment, which remains the dominant force within consumer non-durables.

Geographically, more than two-thirds of the total expenditure in consumer non-durables is concentrated in just three countries: the United States, France, and China. In both the U.S. and France, the majority of spending is focused on the two largest segments: food, beverages, and confectionery and OTC medicines, cosmetics, and hygiene. However, in China, there is a notable divergence, with a significant portion of the budget also allocated to other consumer non-durables, reflecting a more diversified spending pattern within this sector. Despite the challenges and budget reductions, these three countries remain pivotal in driving global research spending within consumer non-durables.

Also, within the consumer non-durables sector, there seems to be a resurgence of research investment in the tobacco and cigarettes category. After experiencing a consistent downward trend over the last 15 years, with its share shrinking from 2% in 2007 to just 0.22% in 2022, this segment has seen a small recovery. In 2023, its share increased to 0.7%, likely driven by the rapid growth of the vaping industry. The rise of new products and consumption habits within the tobacco sector has reignited the need for research as companies seek to better understand this evolving market and adapt to changing consumer preferences.

Please stay updated with the upcoming Global Market Research 2025 report in September!

Urpi Torrado

CEO at Datum InternationalCEO of Datum International, President of APEIM (Peruvian Association of Market Research), and ESOMAR representative in Peru and Latin America Ambassador.

Urpi is also Board member of WIN and Executive Member of the Global Research Business Network (GRBN). MBA from Universidad del Pacífico, with more than 25 years of experience in marketing, communication and market research. She taught (for ten years) Market Research in post-graduate programs at Universidad del Pacífico and other local universities. Speaker at national and international events such as ESOMAR, TalkIN, IIeX, CIIM, among others. Urpi is a collaborator for several magazines and publications aiming to influence and contribute to the transformation of the insights and analytics business community.