Floating Power Plants: Redefining the Future of Offshore Energy

Floating power plants (FPPs) are gaining traction in the shifting global energy market, projected to exceed USD 8.6 billion by 2034, addressing electricity demand in land-constrained or unstable grid regions.

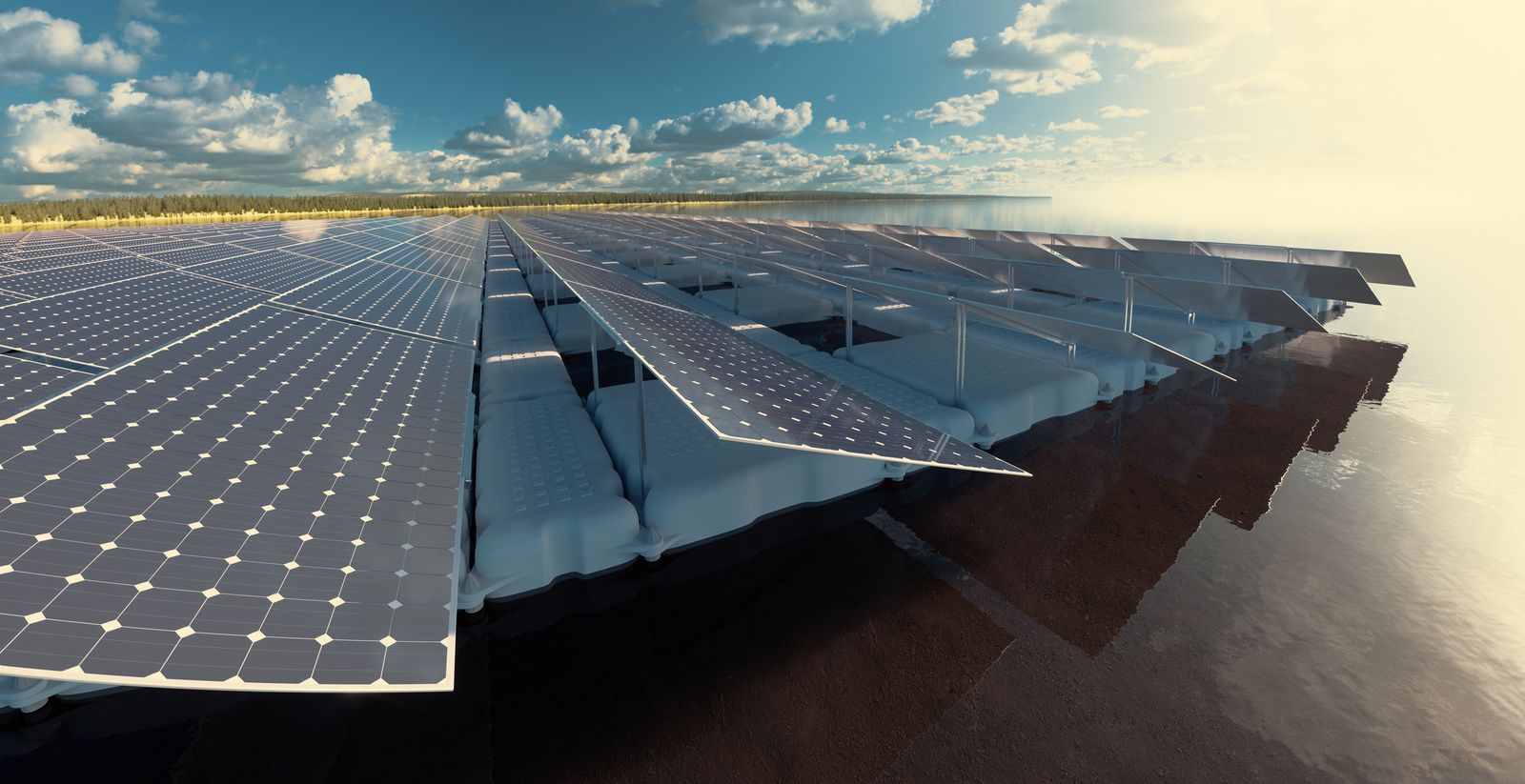

The global energy landscape is shifting, with nations racing to secure affordable, resilient, and low-carbon power solutions. Against this backdrop, floating power plants (FPPs) are emerging as a transformative force. With the floating power plants market projected to exceed USD 8.6 billion by 2034, these mobile energy hubs are positioned to bridge gaps in global electricity demand, particularly in regions with limited land availability or unstable grid networks.

From providing immediate disaster relief power to enabling offshore renewables, FPPs represent an innovation where engineering, mobility, and sustainability converge.

From stop-gap solutions to long-term assets

Floating power plants are not new. The concept dates back decades when ships equipped with generators provided emergency electricity to regions struck by natural disasters or infrastructure failures. For years, they were regarded as temporary stop-gap solutions — a “floating band-aid” for strained power grids.

But times are changing. Rapid urbanization, surging demand for electricity in coastal regions, and the urgent need for low-carbon energy sources have propelled FPPs from niche projects into long-term infrastructure investments. Today, floating power units are being integrated into national energy strategies — not only as backup but as reliable, scalable, and renewable-linked assets.

Market momentum and demand drivers

According to recent market assessments, the floating power plants industry is set to grow steadily at over 8.2% CAGR between 2025 and 2034. Several key factors are fueling this growth:

Energy demand in island nations and remote regions – Countries in Southeast Asia, the Caribbean, and Africa are adopting floating plants as alternatives to costly land-based infrastructure.

Flexibility and mobility – Unlike fixed power plants, FPPs can be relocated based on demand, offering governments and utilities unparalleled adaptability.

Integration with renewables – The next wave of FPPs combines gas turbines, solar panels, and even offshore wind into hybrid floating systems, advancing global decarbonization goals.

Rapid deployment timelines – While traditional plants may take years to build, floating units can be deployed in a fraction of the time.

Global electricity demand is expected to grow by 30% by 2034, driven by population growth, industrialization, and electrification of transport. Floating plants are emerging as a critical piece of this supply puzzle.

Cost advantages and infrastructure readiness

One of the strongest appeals of floating power plants lies in their cost competitiveness.

Reduced land acquisition costs – With real estate prices climbing in urban areas, floating facilities bypass the need for expensive land.

Lower construction times – Shipyards can fabricate FPPs in controlled environments, reducing project delays.

Adaptable energy mix – Units can be designed to run on natural gas, LNG, renewables, or hybrid combinations, allowing operators to balance economics and sustainability.

Regions like the Middle East and Asia-Pacific are particularly well-suited for large-scale deployment, thanks to existing port infrastructure and rising investments in offshore energy. For instance, Turkey, Indonesia, and the Philippines are expanding floating LNG-to-power facilities to meet peak demand while ensuring grid reliability.

Projects and partnerships shaping the industry

Floating power is no longer just a concept — major projects worldwide are reshaping how nations approach electricity supply.

Karadeniz Energy Group (Karpowership, Turkey) – Known as the pioneer of “power ships,” the company operates more than 30 floating plants across 15 countries, with a combined capacity exceeding 6 GW.

Mitsui O.S.K. Lines (Japan) – Developing hybrid floating platforms integrating LNG and renewable energy systems.

Siemens Energy & Wärtsilä – Collaborating on modular floating plants optimized for Africa and Southeast Asia.

India’s National Thermal Power Corporation (NTPC) – Exploring floating solar-hybrid power barges to serve inland demand centers.

These partnerships demonstrate the diversity of applications — from LNG-to-power ships in developing nations to hybrid solar-wind floating barges in advanced economies.

Challenges and risks

While opportunities are immense, scaling the floating power plant market is not without hurdles:

High capital costs – Though cheaper than many land-based options, initial investments in advanced FPPs can still be steep.

Environmental footprint – Deploying large floating structures can disrupt marine ecosystems, requiring strict compliance with environmental standards.

Logistical complexity – Mooring, grid connection, and fuel supply chains add layers of complexity, particularly in remote regions.

Political and regulatory risks – Maritime laws, cross-border agreements, and shifting energy policies can complicate project execution.

Without careful planning, these risks could undermine the market’s credibility and slow adoption.

Competition and global race

The floating power market is increasingly competitive, with multiple regions vying for leadership:

Asia-Pacific – Expected to dominate, thanks to archipelagic nations like Indonesia and the Philippines needing decentralized energy.

Middle East & Africa – Leveraging LNG reserves to fuel floating LNG-to-power projects.

Europe – Exploring floating renewables as part of offshore wind expansion strategies.

Meanwhile, countries like Chile and Australia are exploring synergies between floating hydrogen production and floating power platforms, creating new hybrid export opportunities.

Sustainability and the road ahead

Floating power plants have the potential to contribute meaningfully to global decarbonization, but only if deployed responsibly.

Integration with green fuels – Transitioning from LNG to hydrogen or ammonia could reduce lifecycle emissions.

Hybrid models – Combining floating solar, wind, and storage systems ensures lower carbon footprints and greater efficiency.

Automation and smart grids – Digital platforms like COPA-DATA’s zenon® software can manage complex floating assets, from monitoring energy output to optimizing distribution.

Strict certification, transparent reporting, and sustainability commitments will be key to winning global trust and investor confidence.

Outlook: A new frontier in offshore energy

Floating power plants are no longer stop-gap measures — they are strategic assets for nations navigating the energy transition. As the market heads toward USD 8.6 billion by 2034, its success will hinge on innovation, cost efficiency, and sustainability.

The global race to deploy floating power is on. Countries that move fast, invest wisely, and integrate digital and renewable solutions will shape the next chapter of offshore energy.

With momentum building, floating power plants are set to anchor the world’s clean and resilient energy future.

Source: https://www.gminsights.com/industry-analysis/floating-power-plants-market