Is the “Right Price” in the room now?

Eight “dummy” projects to describe the pricing mechanism within the Market Research Industry.

Article series

Global Prices Study

- Is the “Right Price” in the room now?

- Two cents on the price of research

- Is online research becoming costlier?

- Internalisation of research and its impact on social listening projects

- Challenges in recruiting participants and its impact on the cost of online modes

- Advantages and challenges of running a Random Probability Project

- Rising cost of market research professionals: skill shortage or rising inflation?

- An insight into the rising demand for Data Analysts

- The future of F2F and CATI

- The Rising Costs of Labour-Intensive Data Collection in Africa: Challenges and Realities

- What’s behind the rising cost of online quantitative studies?

- Challenges of online studies

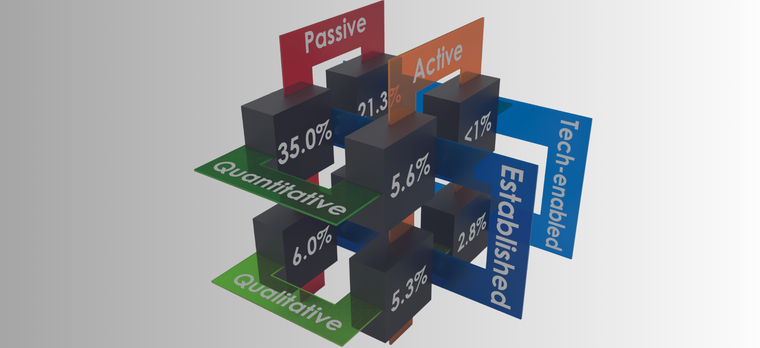

ESOMAR asks one of the vital questions every two years- “What is the price you charge for a specific market research project with typical specifications?”. The subsequent answers are analysed and published as the comprehensive and one-of-a-kind pricing report agencies and clients have relied on to benchmark their pricing structures: the Global Prices Study. The recent release of ESOMAR’s Global Prices Study 2023 marks the 14th edition of this report.

The 2023 update is based on the responses from 506 agencies ranging from 122 countries. This edition provides an exclusive insight into how research pricing has adapted in a world that has been recovering from the effects of the global pandemic, rising inflation, the energy crisis, and the disruptions in the global supply chain. All of this unfolds against the backdrop of the ongoing armed conflicts, placing this report in a unique position to offer unrivalled guidance in the planning and purchasing of primary data projects.

In addition to the seven standard market research projects studied in the 2021 edition, the latest update has introduced a new project – Random probability sampling – to understand the evolving market research industry. This type of project enables agencies to employ techniques designed to extract a representative sample from a population, thus reducing bias and ensuring the findings are highly likely to be representative of the market.

Back to normal or new normal?

With the ease of restrictions that drove up prices during the pandemic, the 2023 edition notes a decline in the nominal prices of F2F and CATI methodologies in the U&A project and Tracking study, compared to 2021, signalling that the prices are settling back. For instance, a Tracking study using G2F is 9% cheaper than in 2021, while the same study using CATI is 28% cheaper than the prices reported in the previous edition. This study also finds evidence to support the trend of online methods being cheaper than traditional methods, which has been flagged in previous editions. For instance, the cost of conducting a U&A project using F2F is 79% more expensive than online, a level that is less expensive than the 2021 edition (105%) but in line with the 2018 edition.

The previous edition noted the negative impact of the lockdown on the “human factor” through the sharp decline in the rates charged by all types of professionals. Juniors, mid-levels, seniors, and marketing scientists. The 2023 edition reports a nominal increase in the rates compared to the 2021 edition. Particularly, those of juniors, mid-level and seniors increased by 21-33%, while the rates for marketing scientists increased by 7%. Though this is a good sign, the rates for various professionals are still lower than 2018 prices, suggesting the long-lasting impact of the pandemic.

In addition to reporting the median prices at global, regional, and local levels, prices are also reported for the key markets. The figures shown in the key markets are based on the average of the median results for the USA, the UK, India, China, Australia, France, Germany, and Japan. The inclusion of India and China to the list of key markets, which used to be comprised of higher-income countries, may result in variations of some of the trends when compared to previous years. However, the current composition of countries still represents up to 75% of global insights turnover (as per the Global Market Research 2023 report). It is important to retain this faithful picture of the global market in order to ensure the representativity of the data.

The Global ranking is one of the important metrics that has been tracked over the years. This ranking is formed by combining the cheapest way to offer the U&A project with the cheapest way to offer the Focus groups and is indexed to the global median price. This way, we get an overall picture by combining a quantitative and qualitative study. The 2023 edition reports a shake-up in the ranking, especially at the top level. The USA has become the most expensive country in the global price ranking, jumping from its 7th position in 2021. In second place is the UK, jumping from its 13th position in 2021. Switzerland dropped from first to third place after holding that position since 2016.

Since the right price is in the room now, are you curious to know how your agency’s prices compare to the median prices at global, regional, and local levels? Head over to Global Prices Study 2023 to download the report as well as the data tool to benchmark your agency’s prices. The report also includes relevant topics for the industry, such as the cost of standalone F2F/virtual presentation, the choice of data collection methodologies, and the evolution of professional tariffs. A must-read for both suppliers and buyers in the industry, available on the ESOMAR website.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Prices Study

- Is the “Right Price” in the room now?

- Two cents on the price of research

- Is online research becoming costlier?

- Internalisation of research and its impact on social listening projects

- Challenges in recruiting participants and its impact on the cost of online modes

- Advantages and challenges of running a Random Probability Project

- Rising cost of market research professionals: skill shortage or rising inflation?

- An insight into the rising demand for Data Analysts

- The future of F2F and CATI

- The Rising Costs of Labour-Intensive Data Collection in Africa: Challenges and Realities

- What’s behind the rising cost of online quantitative studies?

- Challenges of online studies