Sustainable Brands & Urban India: Future Scenarios

Indian consumers have diverse views on sustainability. This research aims to help brands in Urban India understand the factors influencing sustainable product purchases and identify challenges and opportunities.

For the Urban Indian Consumer to adopt Sustainable products in their lifestyle, it is about un-learning and challenging existing entrenched habits. While interest and intrigue are high about sustainable products, with one in two consumers stating that they searched for sustainable products in the last three months, the bigger challenge is sustainability as a mindset versus existing habit.

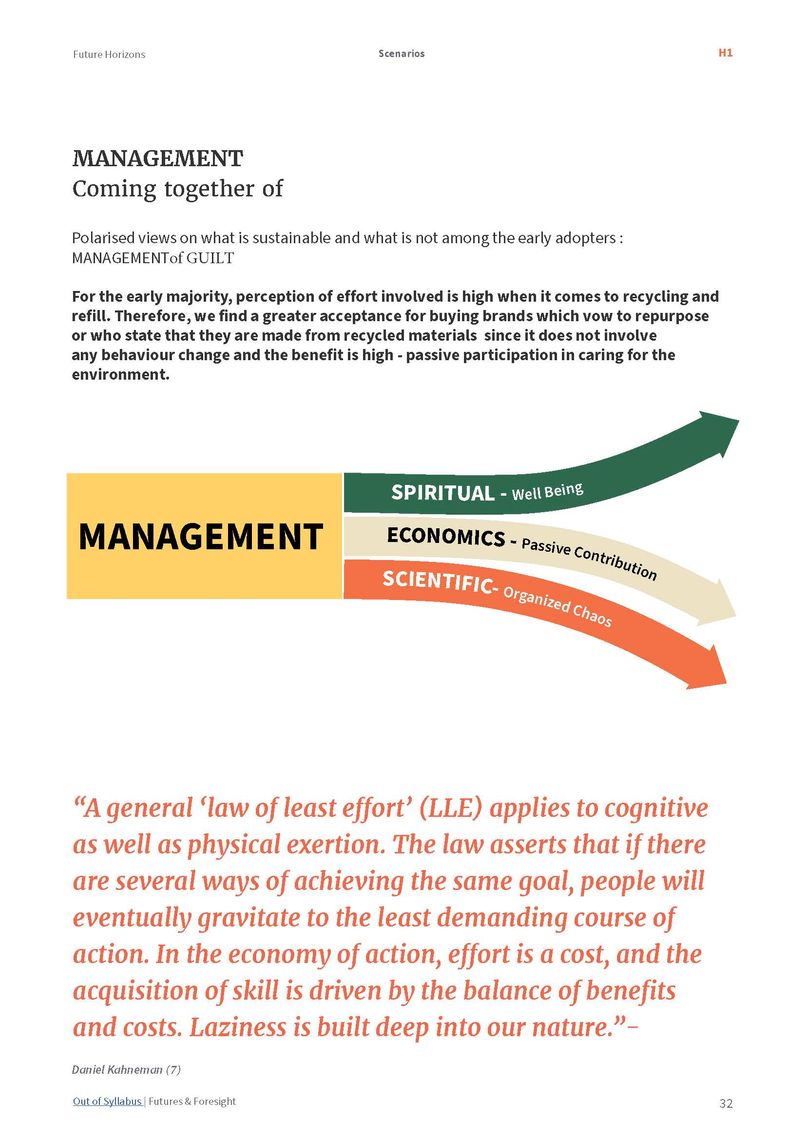

Sustainable products in the Indian marketplace cater to distinct value propositions and perceived benefits. Some are changing the way the consumer uses the product (powder versus gel in skincare), some are focusing on the post-use of the product (refill, recycle, repurpose). And yet others are claiming to be sustainable because of their production process. The perceived benefit to the consumer is then divided between Active participation and Passive contribution.

This is also reflective of how we observe the consumer segments as per the Diffusion of Innovation curve[1] which explains how innovation spreads from ‘The Early adopters’ to the ‘Early majority’.

Actively contribute: In our research we find ‘The early adopter’ mindset is concerned about the manufacturing process, the ingredients, the packaging and product labels. This segment is not willing to accept lip service to sustainability and is more inclined towards verifying claims, the possibility of refills, recycles offered and less towards repurpose. ‘The Body Shop’ was stated by the Early Adopters consumers as a benchmark in being a sustainable brand from production to usage. Here the need is Commitment and the brand must display it too. 47% of respondents stated buying a sustainable brand using recycled packaging and at least 1 in 5 had recycled bottles, boxes in stores.

Brands will need to be clear and transparent in their ‘how’ & ‘what’ while catering to this segment. Transparency using QR codes could be a non negotiable.

Passively participate: The early majority mindset consumer wants to passively contribute. They are interested in contributing towards Climate Change and other environmental issues albeit the personal effort. Initiatives like planting a tree on every product purchase, using Pet plastic in their packaging are bound to find favor with this segment. They are happier contributing towards climate change funds, buying brands which contribute towards sustainability and happiest if their existing brands espouse Sustainable practices in their existing products. Here the need is compliance, and the benefit desired is guilt reduction. Even programs like recycle, refill find less favour among them since it involves physical effort. Brands will need to focus on the ‘why’ and ‘where’ while catering to this consumer segment.

With a social narrative promoting self-improvement and solutions targeted at atomic change at an individual level, we see increased demand for sustainable products targeted at an individual. A significant part of demand for sustainable products is being led by the food category and supplemented by the adjacent category of skin care. As the positive impact of using sustainable products becomes apparent to the Early adopters, we foresee the next big pull to be from apparel and other lifestyle categories. Sustainable products which promise health benefits are high in demand. Many food companies have capitalized on the ‘preservative free’ ‘back to the roots,’ homemade route. There is a subsequent behaviour in Early Adopters wherein they are beginning to check the authenticity and gain knowledge about products in other consumption categories.

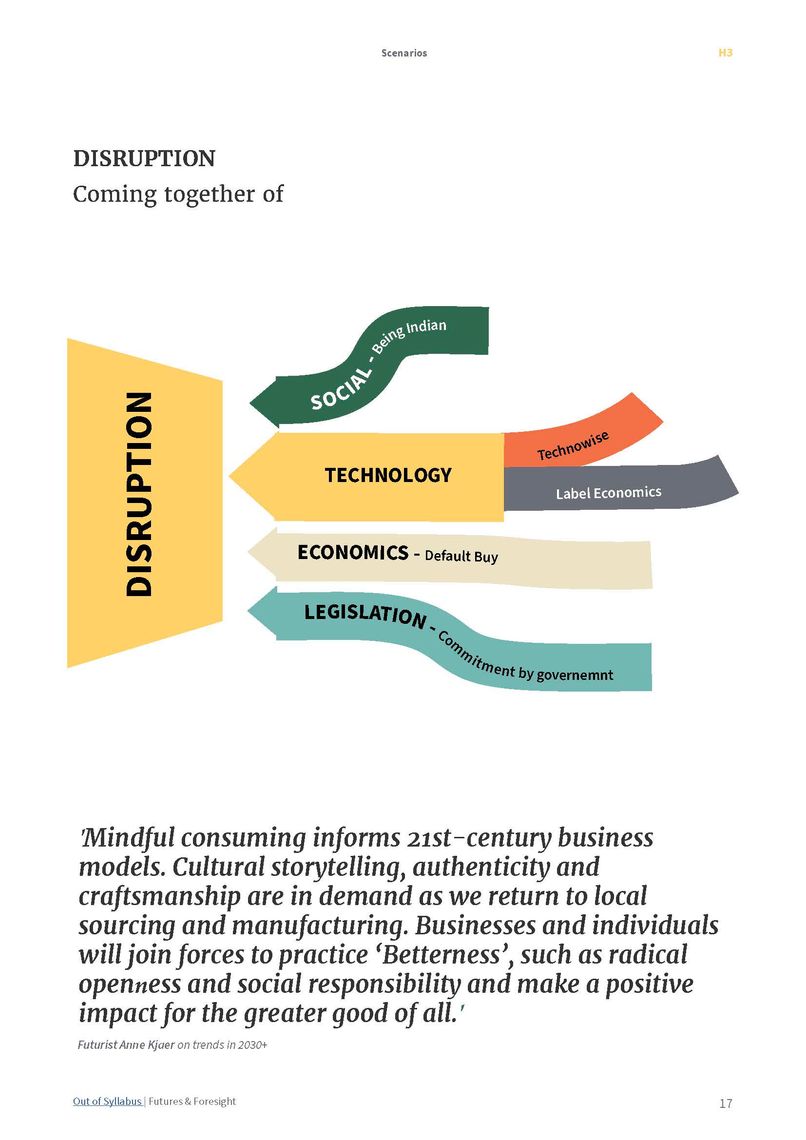

The inflection point where in the adoption of Sustainable products moves from Early majority to late majority will come when consumption moves from individual to household products and the government creates an atmosphere of compliance.

We are witnessing weak signals among the early adopters, but they are not new or innovative. They are being practiced as wisdom grows about negative effects of existing solutions. Early adopters have started championing and telling other people in their networks about reading labels, avoiding plastic as much as possible, being mindful of their purchases, trying to influence those in their households to adopt sustainable products. This signals newly formed rituals and behavior change.

Lack of planned narrative building has led to organized chaos driving the demand for Sustainable products. Brand led conversations show a shift in consumers moving from awareness to knowledge about sustainable solutions, though we do not observe a deeper, wider shift in social culture where we uncovered multiple myths and preconceived notions about sustainable products. For example, paper is perceived to be a better alternative to plastic simply because it can be recycled. Paper packaging is one of the biggest drivers of Sustainable products. Even glass is believed to be sustainable, nevertheless how much carbon is utilized in its production. Lack of proper narrative building has led to organized chaos driving the demand for Sustainable products. Our research shows that 67% of most consumers would choose a product with a brown color bottle because it is perceived to be better for the environment. Respondents were divided on their view of glass, with 56% stating that glass is harmful and 44% stated that is better for the environment.

For the early adopters, personal incidents have triggered a trial and led to adoption of products in food and skin care which claim to be part of sustainable consumption. This has been accompanied by reverting to their childhood practices, or home-made solutions to skincare and consuming natural products in Food and beverage. There is this belief that Indian practices were always more sustainable and better suited for them as compared to the more modern solutions.

We do observe a trickling of the same parameters of evaluation in other sectors, but it has not reached the level of friction with existing solutions yet and has not become mass. In broader categories like apparel, fragrances, cosmetics, early majority, and early adopters stated being satisfied with their existing products.

The future of how Urban Indians will shop for Sustainable products will depend on how brands in the category shape the narrative on how they are solving Micro problems (resulting impact on health, skin) and Macro problems (carbon footprint, carbon emissions) related to Climate change. In our market intelligence, we uncovered brands adhering to Extended Producer responsibility and adopting PET Plastic. Some brands have taken to Ayurveda, many have taken the Purpose route, attaching them to a purpose in the Sustainability category and trying to attract consumers via that. Our recommendation would be to understand which of the two mindsets works for your brand and adopt that.

References:

[1] The theory describes how Innovators are crucial to disruption but Early Adopters are crucial to spreading the word about Innovators and their disruptive ideas. Unlike Innovators, who are more insular in terms of their approach and almost operate in their silos, Early Adopters like to transfer ideas and spread word of mouth about their ideas, latest products they have adopted. They represent 13.5% of the population and are influencers who use their curiosity, empathy knowledge, experience and ability to connect people to ideas (and ideas to people!) in ways that attract our Innovators but which, crucially, also reassure and convince our Early Majority. Early Majority are trend followers and a large part of our paper focusses on what will move the demand from Early Adopters to Early majority.

Aditi Garg

Founder at Out of SyllabusThe founder, Aditi Garg is a Consumer behaviour expert with over 17 years of experience in research, brand development, Customer experience. A consumer strategist has worked on projects that cover customer insights, customer experience, and brand strategy. During her stints in the TATA Group, Dentsu Group and the Reliance Group, she has built her niche in gathering, collating and analysing attitudinal and behavioural data and deriving actionable insights for various entities.

As a member of the Centre for Customer Insights, Tata Sons, she has led many large-scale research studies, such as uncovering opportunities for the TATA group to target the Silvers segment and unlocking the potential for the TATA group in developing premium products and services.

Her love for research and passion for uncovering deep and meaningful insights was honed by her stints in research agencies such as Quantum Consumer Solutions, IRIS Retail and 9dot9 Media. A social scientist, Aditi holds a Master's degree in International Studies from NUS, Singapore and an undergraduate degree in Economics (Hons) from Shri Ram College of Commerce, Delhi University.