2024: A turning point for the Middle East and Africa?

In the face of enduring economic, social, and political disruptions that have long impacted these two regions, ESOMAR’s Global Market Research 2023 reveals a noteworthy recovery in 2022 for both the Middle East and Africa.

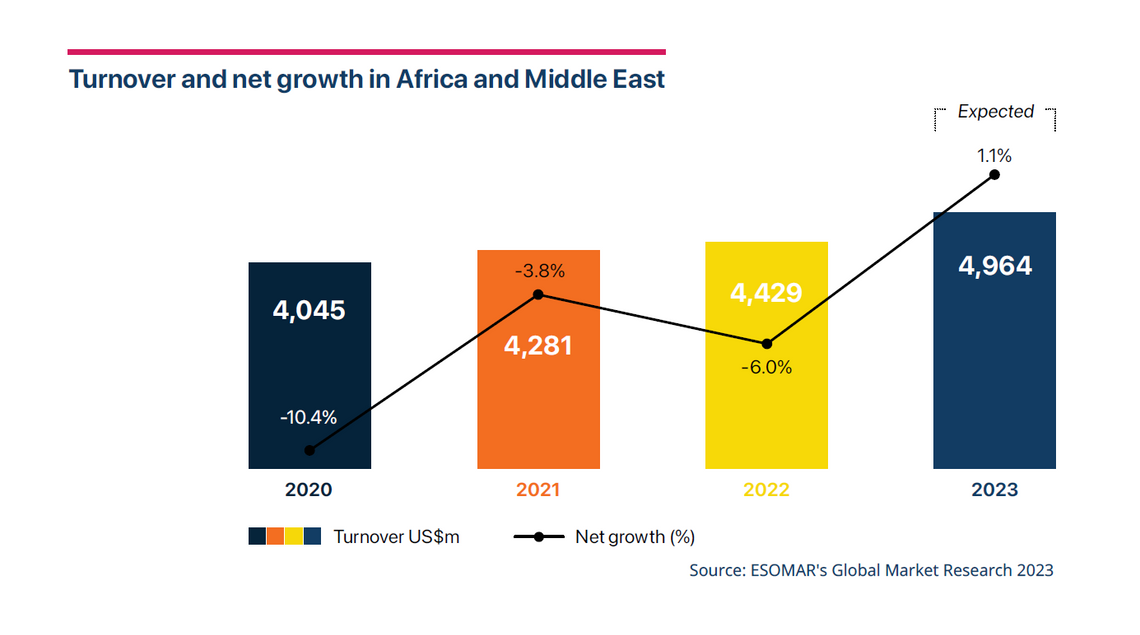

In the face of enduring economic, social, and political disruptions that have long impacted these two regions, ESOMAR’s Global Market Research 2023 reveals a noteworthy recovery in 2022 for both the Middle East and Africa. Following a significant decline of over 10% in turnover, accompanied by a stagnant trend in 2021, the region experienced absolute growth of 9.9%, accumulating an overall regional turnover of US$4.4 billion.

Noteworthy achievements within the countries that reported their turnover in this latest edition of the report include double-digit absolute growth for Tunisia, Iran, and Iraq, each managing to report pre-pandemic or higher output levels. Moreover, an additional 19 countries or subregions demonstrated positive absolute growth trends.

However, as observed in other areas of the world, these regions faced a significant decline in industrial production when factoring in the inflation rate. Africa recorded a net growth of -1.4% and eight countries turned their absolute growth into negative in net terms. This result contrasts with that of the Middle East, which recorded a positive net growth rate of 6.8%, with only Pakistan turning its absolute growth of 6.0% to -5.5% after accounting for inflation.

What characterises these regions is that a significant portion of the industry turnover is challenging to collect. Data collection has proven particularly difficult for some countries with a particularly delicate political and economic situation, such as Lebanon, where official data on exchange rates and inflation may not necessarily correspond with everyday reality. As a consequence, estimates for this year are based on the official GDP growth rate reported by the local authorities and may need to be revisited in the future. For this reason, ESOMAR is committed to providing our readers with the most comprehensive information possible by working to acquire broader and broader data.

Within the group of countries showcasing the most rapid growth, Tunisia, Iraq, and Iran stand out with notable net growth rates of 20.0%, 19.1%, and 11.1%, respectively. These figures signify a complete rebound from the adverse impacts of the pandemic, reflecting a robust recovery.

On the other hand, the sector that contributed the most to revenue growth for the industry, featuring a total revenue of US$1.9 billion, is the Established Market Research segment. The significant absolute growth of more than 6.2% of this sector highlights a business framework in which the conventional focus on data collection plays a greater role compared to the other sectors, according to industry observers.

In contrast, the absolute growth of 3.1% for Data Analytics and 2.6% for Reporting, though turned negative after accounting for inflation, suggests the possibility of new companies entering the market in these regions.

Lastly, in Africa and the Middle East, two countries, Tunisia and Lebanon, are expected to feel the impact of 2023's economic turmoil. Among the countries that reported turnover in 2022, it is unclear whether Nigeria, South Sudan, Mozambique, the Democratic Republic of Congo, Kenya, Somalia, or Pakistan will declare 2023 revenues that surpass the figures recorded in 2019.

With an anticipated net growth recovery from -6.0% to 1.1% in 2023, the forecast for Africa and the Middle East region in 2023 looks more positive, with an estimated industry turnover of nearly US$4.9 billion!

We would like to remind our readers that this year, we will be collecting data on the industry’s performance in 2023. The findings from this upcoming data collection will be meticulously analysed and presented in September, offering valuable insights into the industry's ever-evolving landscape.

Curious about the state of the Insights Industry? Get your copy of the Global Market Research report today.

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.