Asia Pacific: The global engine of the Insights industry

The post-pandemic recovery is in its fifth gear.

The views presented here are part of the Global Market Research report. This report provides you with the most comprehensive overview of the state of the insights industry around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

ESOMAR’s Global Market Research 2023 report analyses how Asia-Pacific has emerged as a centre of development in the insights industry, marked by positive trends in the absolute growth rates of several countries. Most of the Asia-Pacific countries saw positive expansion since 2021, with an overall absolute growth (before factoring in inflation) of 5.3%.

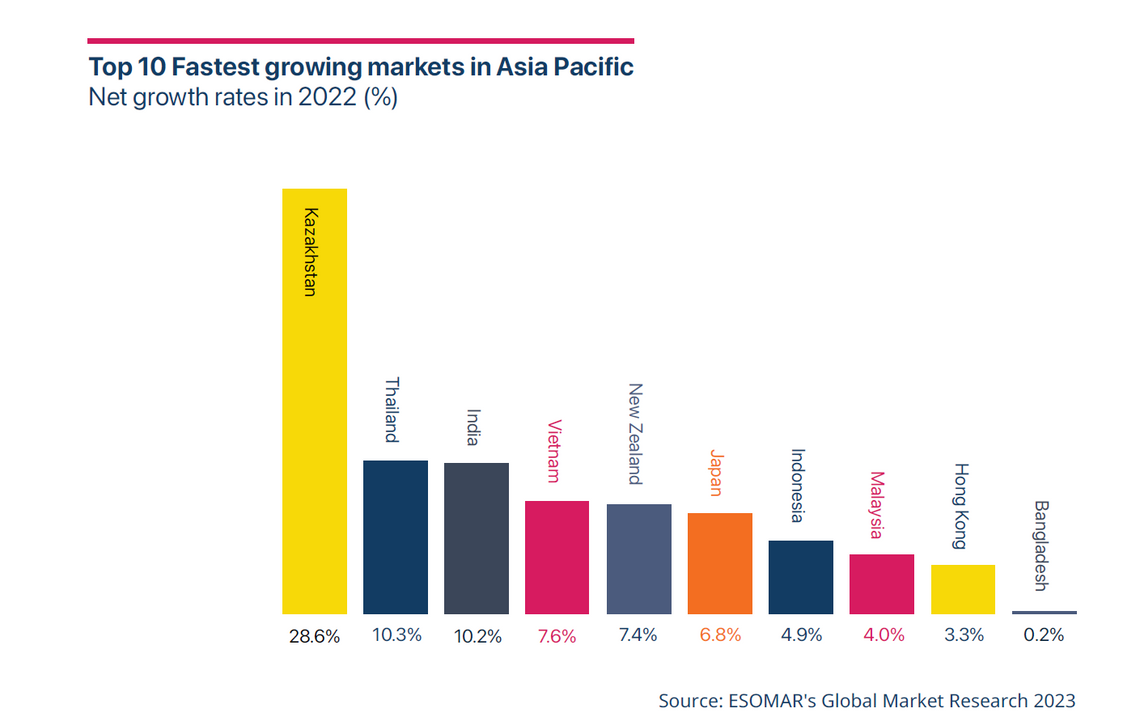

India, China, and Australia remain the countries with the highest insights turnovers in Asia-Pacific, while the turnover of nations including Thailand, Vietnam, New Zealand, India, Singapore, Indonesia, Mongolia, and Kazakhstan exhibited remarkable resilience in overcoming the disruptive impact of 2020, demonstrating a consistent growth trajectory since the onset of the pandemic.

On the other hand, Hong Kong, Malaysia, Taiwan, and Bangladesh, despite recording lower turnover in 2022 than their 2019 levels, are poised to approach or surpass those pre-pandemic outputs in 2023.

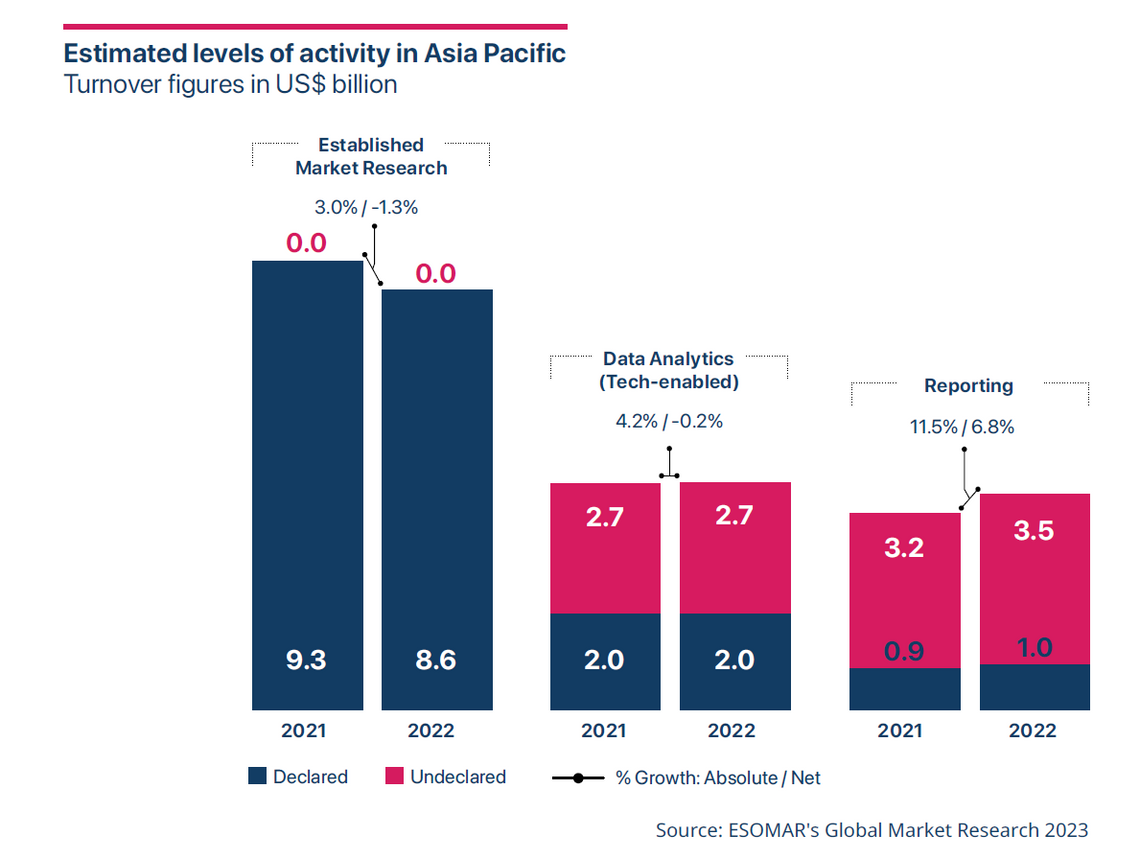

According to ESOMAR's data, the turnover in the region amounted to US$17.9 billion, reflecting a net increase of 0.9% compared to 2021 (after factoring in inflation). However, this result was adversely affected by a net growth decline of -17% in China, which was attributed to the enduring impact of Covid-19 restrictions on specific sectors of the economy. Despite accounting for approximately 14% of the total industrial production in the region, China ceded its status as the largest market in Asia-Pacific to India. This shift is primarily a result of China's measurement methodology, focusing solely on the size of the Market Research industry and not encompassing the broader Data Analytics and Reporting sectors, as India does. Nevertheless, China managed to uphold its position as the third-largest market globally.

India, representing 16% of the regional insights industry, stands out with a remarkable double-digit absolute growth of 17.6%, fuelled by its thriving Data Analytics sector and the resurgence of face-to-face interviews. Additionally, four countries with revenues between US$20 and US$500 million – Kazakhstan, Thailand, New Zealand, and Vietnam – achieved double-digit absolute growth rates. Kazakhstan, the fastest-growing country in the region, revolves around its ability to attract local and global companies driven by innovative market methodologies.

Last year, the Reporting sector was the only segment in the region to record positive net growth of 6.8%. In contrast, the Data Analytics and Market Research sectors posted year-over-year declines of -0.2% and -1.3%, respectively.

The expected recovery in industry turnover in numerous countries will be reinforced by the expected inflation rate – and lowest among all regions – of 3.9% for 2023. It's important to note, however, that actual performance can vary widely among countries as they struggle with their own challenges and circumstances.

While most countries have reached pre-pandemic turnover levels, there are still eight markets that may need all of 2023 and beyond to reach them. Barring any new shocks on the horizon that could further destabilise the industry, 2023 could be the year that Hong Kong, Malaysia, Taiwan, Bangladesh, Cambodia, Sri Lanka, and Laos officially recover from the worst effects of the pandemic.

The outlook for 2023 remains promising for most countries, with positive net growth anticipated across the region, excluding China, where a -3% reduction is expected. With an estimated net growth of 7.2%, 2023 holds the promise of a remarkable upswing for the industry, with an overall turnover in the region that could exceed US$19.9 billion!

Curious about the state of the Insights Industry? Get your copy of the Global Market Research report today.

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.