How is research internalisation defined in 2025?

Information for this article was extracted from ESOMAR’s Global Users & Buyers of Insights 2025, and can be further expanded by making use of the online dashboard that comes with the report.

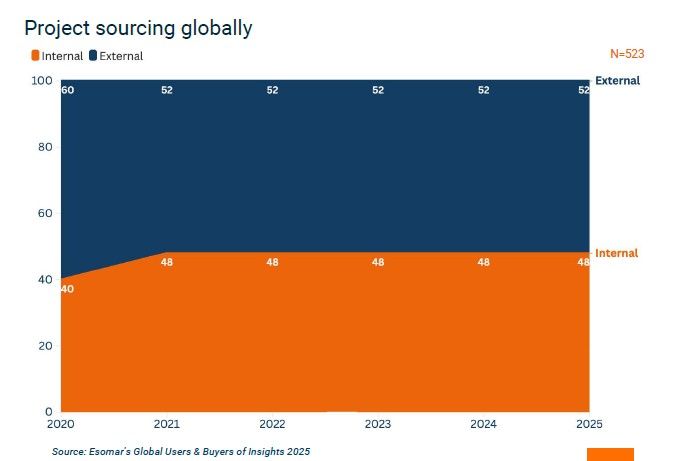

Project sourcing globally

By 2025, nearly half (48%) of all research projects are conducted internally within client organisations—a share that has remained steady for four years. Advances in self-serve research platforms and AI-driven analytics have lowered barriers, allowing internal teams to independently manage more agile, business-focused projects. The COVID-19 pandemic accelerated this shift, as companies relied on in-house capabilities amid restricted budgets and disrupted operations. What began as a necessity has since become a lasting structural change. Today, internal teams leverage their closeness to the business to deliver faster, more relevant insights, while external agencies continue to play a crucial role in complex, resource-intensive, or large-scale research. The result is a rebalanced ecosystem—where internal teams handle tactical, iterative work, and agencies provide the methodological expertise, reach, and neutrality required for strategic decision-making.

Regional project sourcing

The reported levels of project internalisation are broadly similar for Europe and the Asia Pacific region, standing at 47% and 49%, respectively, in 2025. Since 2020, Europe has shown a steady, gradual increase in internalisation, whereas the Asia Pacific region has experienced some fluctuations over the five-year period, with a modest decline of one percentage point in 2025 compared to 2023.

In contrast, North America has undergone a more notable shift. The region recorded a sharp increase in project internalisation, from 41% to 58% in 2021, largely driven by the effects of the COVID-19 pandemic, before declining to 50% in 2023, suggesting a renewed collaboration with external partners. Between 2023 and 2025, however, internalisation rose again by six percentage points, indicating a reduced reliance on external agencies.

Due to limited data availability, it was not possible to track sourcing trends over time for Latin America, Africa, and the Middle East. We hope that future editions of this study will include broader participation from these regions to improve their representation and shed light on their specific challenges and developments.

Project sourcing per industry

Project sourcing varies widely across industries, reflecting their research maturity, complexity, and available resources. In 2025, academia and education lead in internalising research functions, with 71% of projects conducted in-house—supported by skilled researchers and established analytical infrastructure. Conversely, sectors like fast-moving consumer goods (FMCG) and pharmaceuticals rely more heavily on external agencies due to the complexity, scale, and geographic scope of their studies, resulting in lower internalisation rates of 30% and 23%, respectively. The overall spread in internalisation across industries exceeds 40 percentage points, underscoring the diversity of operational models. Notably, the pandemic-driven shift toward in-house research in 2021 has persisted, with sectors such as media, broadcasting, and advertising increasing their internalisation from 51% in 2023 to 58% in 2025. Meanwhile, FMCG shows the opposite trend, becoming increasingly dependent on external research partners to meet specialised methodological and logistical demands.

Expected change in project sourcing

The general expectation across companies is either increasing internal research activity (53% of respondents) or maintaining the current balance (46%). As might be expected, organisations that already manage a higher proportion of research in-house are also the most likely to anticipate further project internalisation. This observation is particularly evident among mid-sized companies (1–199 employees), where those projecting increased internalisation internalise around 59% of all projects. Conversely, smaller firms* (2–9 employees) report a more modest internalisation share of 44%, which may reflect limited resources or in-house expertise.

Among companies expecting internalisation to decline, the current share of internalisation is the lowest (44%), regardless of size.

Larger enterprises (>1,000 employees) show internal shares stabilising between 43% and 51%, substantially combining internal and external resources. Overall, the data reflect a stable yet dynamic environment where internalisation is evolving according to size, capability, and strategic priorities.

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.