Inside the $153bn Insights Industry

A US$ 153 billion insights industry – What has changed since 2023?

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry

The following article is an excerpt from Esomar’s Global Market Research 2025. This flagship report of ESOMAR, often dubbed as the “Bible of Market Research”, provides you with the most comprehensive overview of the state of the insights industry and the market research sector around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

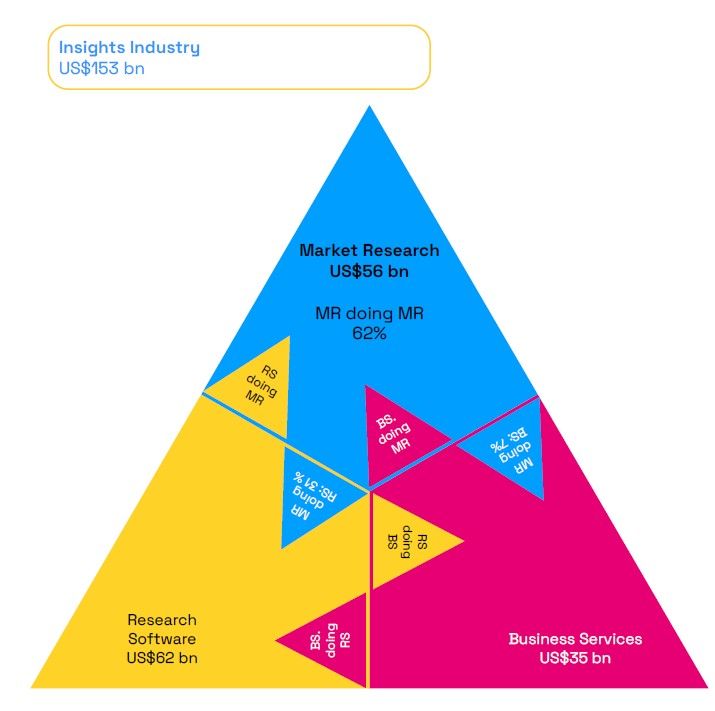

As the industry reflects ongoing changes, Esomar’s global survey on the insights industry, shared with the world’s associations as well as ESOMAR representatives and experts, continues to adapt to its demands and shifting dynamics. Continuing from last year's edition, the questionnaire proposes a funnel-like approach where the respondent first estimates the size of the overall insights industry in their country, before then drilling down to understand the specifics of the market research sector. Isolating the market research activity allows for a better understanding of its practices and how they intersect with the other two sectors—research software and consultancy and business services —as illustrated in the image below.

Globally, the insights industry is estimated to have surpassed US$150 billion as of 2024 and is expected to surpass US$160 billion by the end of this year. Of these, the market research sector accounts for US$56 billion, the research software sector for US$62 billion, and the reporting sector for US$35 billion. Please turn to Chapter 9 to access this data in more detail.

When breaking down the US$56 billion market research sector, approximately 62% is attributed to full-service and market research services (including fieldwork), 31% to firms providing subscription-based and research software services, and the remaining 7% to consultancy services. For the first time, these results can be compared with the Global Market Research 2024 edition, reflecting the methodological changes introduced last year. The comparison shows that the share of global turnover related to firms within the market research sector conducting market research declined by about 3 percentage points compared to 2023. This result reflects a progressive shift towards either offering more research software services or a higher demand from clients for these tools provided by the market research firms.

When looking at where growth came from in 2024, one sector clearly stands out: the research software sector, which continues to drive most of the growth of the insights industry.

While 2023 was a year characterised by limited industry growth resulting from the relatively high interest rates imposed as a response to post-pandemic inflation, 2024 gave signs of incipient recovery. By sector, market research reflected the characteristics of a mature and consolidated industry, expanding by 4.8%. In contrast, research software continued to lead with growth of 11.5%, while the reporting sector advanced at a steady pace of 8%.

A more heterogeneous industry makes the role of Esomar and the other associations around the world even more consequential. The revision of the 2025 ICC/Esomar code, combined with our collaborative efforts to ensure ethical and fair practises, will help ensure the industry's longevity and success for years to come.

The saga continues in Esomar’s Global Market Research 2025. Download your copy now!

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry