Is the growth slowdown of research software a sign of trouble?

The $142 bn insights industry – Which sector drives the insights industry’s growth? What challenges did these segments face in 2023?

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data

The following article is an excerpt from ESOMAR’s Global Research Software 2024. This report provides the most comprehensive overview of the state of the insights industry and the evolving research software sector worldwide, using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

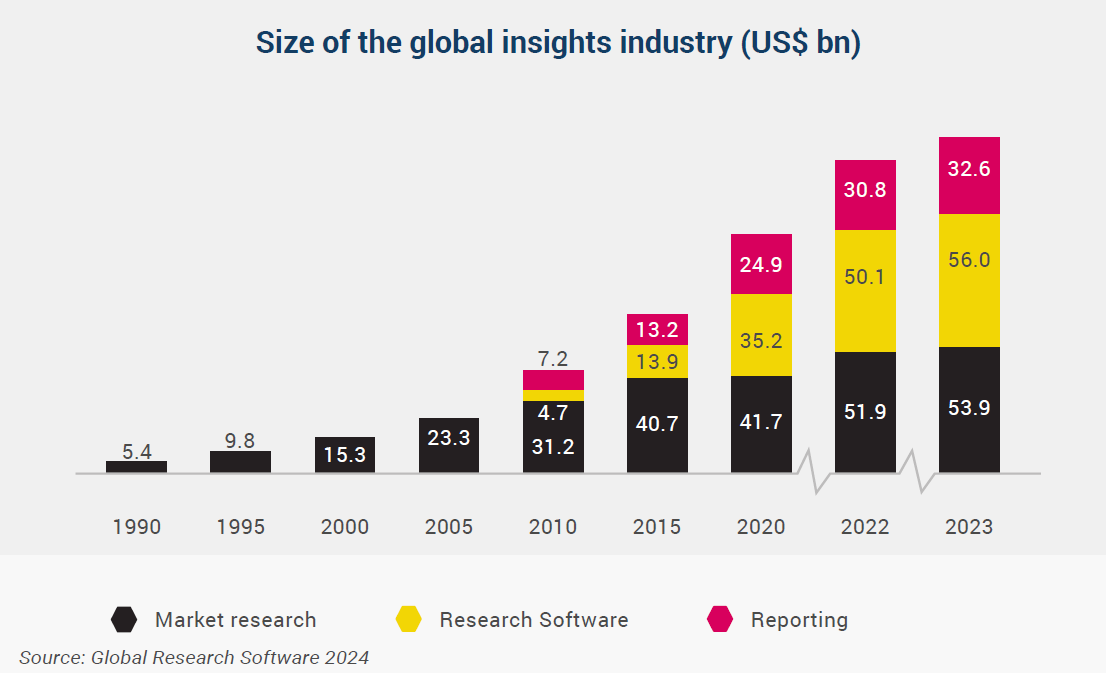

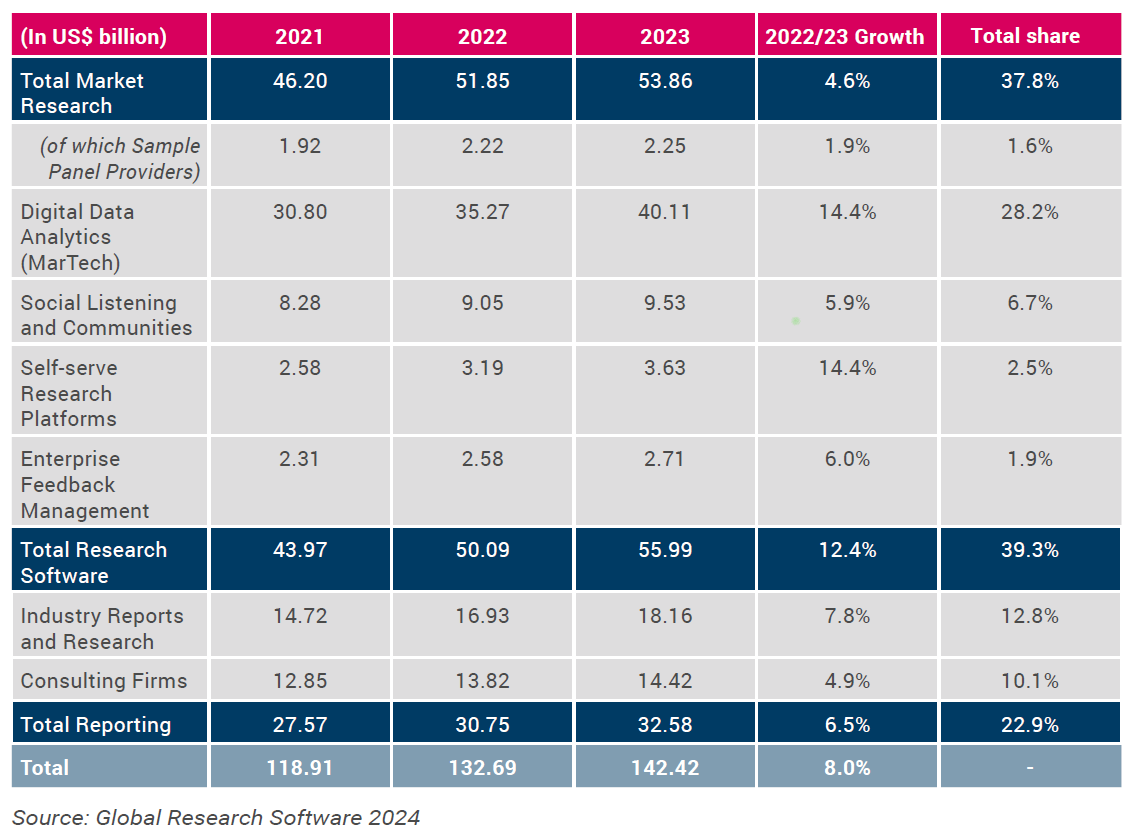

Globally, the research software sector continues to widen the gap with market research. While their turnover was almost the same in 2022, by 2023, the divergence was over US$2 billion, with no slowdown in sight. The reporting sector, composed of consultancy firms and other reporting companies, lost some of its ground and now represents around 23% of global turnover, up from 24% in 2022.

2023 saw central banks around the world react to the spike in inflation by increasing interest rates. In turn, high interest rates slowed down investment and hampered the ability of debt-intensive companies to honour short-term due payments. Some of these were technology companies that proceeded to adjust their employee bases through massive layoffs. The result is a research software sector that, despite being the engine for industry growth at 12.4%, did not grow as much as in previous years.

The market research sector presented a more moderate growth of 4.6%, a sign of a mature and more consolidated industry with mostly organic growth. This sector includes sample panel provider companies that act as a fundamental piece in many research projects. This segment presented relatively low growth (1.9%) as companies try to diversify their business by adopting new technological solutions in their portfolio.

Check out ESOMAR’s Global Market Research 2024 report, which sheds further light on this core sector and its place within the overall insights industry.

The slowdown in investment experienced during 2023 is reflected in the more moderate growth of the research software sector. While growth for each of the four segments that make it up was in double digits during 2022, only two of them maintained this trend in 2023 with growth of 14.4% each: digital data analytics and self-service research platforms.

Digital data analytics remains one of the largest segments globally and appears ready to challenge the market research sector in the next five years—it has already done so in some markets like the United States! The commentary drafted by the U.S. association in this report will provide readers with more insights on this and other local trends.

Starting from a small historical base, self-service research platforms have now surpassed the US$3.5 billion mark after stupendous growth over the years and do not seem to show signs of saturation.

The breadth of the industry and the centre of growth, which represents companies with a business model quite different from the familiar project-based agencies, make it ever more important to remind the entire industry of the necessity of self-regulation. A more heterogeneous industry makes the role of ESOMAR and the rest of the associations around the world more consequential. As mentioned in the previous edition of this report, by collaborating to ensure that ethical and fair practices are followed, we can help guarantee the longevity and success of the industry for years to come.

The saga continues in ESOMAR’s Global Research Software 2024. Download your copy now!

Also, for an extra EUR 90, readers can now download the report on the core market research sector—ESOMAR’s Global Market Research 2024.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data