Can Europe’s research software catch up to its potential?

Digital data analytics dominates the research software sector in Europe, but what about the other segments?

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data

The following article is an excerpt from ESOMAR’s Global Research Software 2024. This report provides the most comprehensive overview of the state of the insights industry and the evolving research software sector worldwide, using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

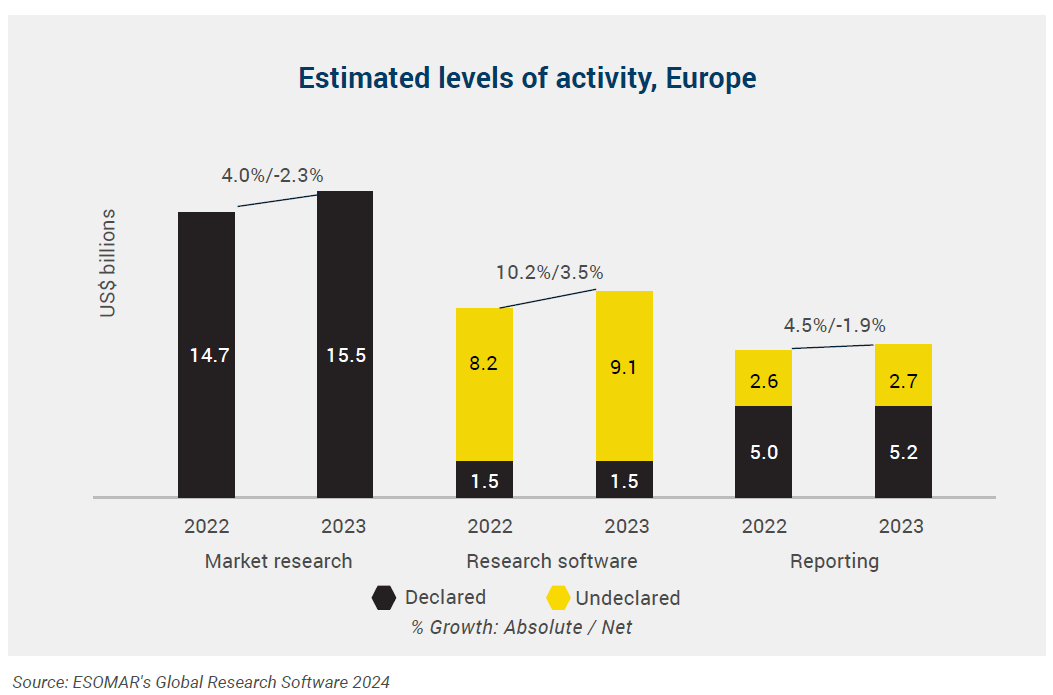

The European industry continues to develop modestly and shows positive growth in absolute terms. A sticky, high level of inflation, however, puts into question the effectiveness of this growth since, for the market research and reporting sectors, growth has turned negative in net terms. All in all, the market research sector in 2023 expanded by 4% to US$15.5 billion and maintains its prominent position as the largest one in the region’s industry. Read more about this sector in ESOMAR’s Global Market Research report.

Improvements in the measurement of the industry revealed a size of the market research sector for 2022 of US$14.7 billion, which compares to a level of US$15.5 billion for 2023.

Similarly, the turnover for the research software sector in 2022 stood at US$9.6 billion and compares to US$10.6 billion in 2023, reflecting the room for expansion some companies have ahead of them to continue to develop businesses practices, perhaps related to research software, as seen in other regions.

Overall, the European industry in 2023 grew an estimated 6% in absolute terms to a level of US$34 billion and is expected to remain at this level throughout 2024 with growth of 6.7%.

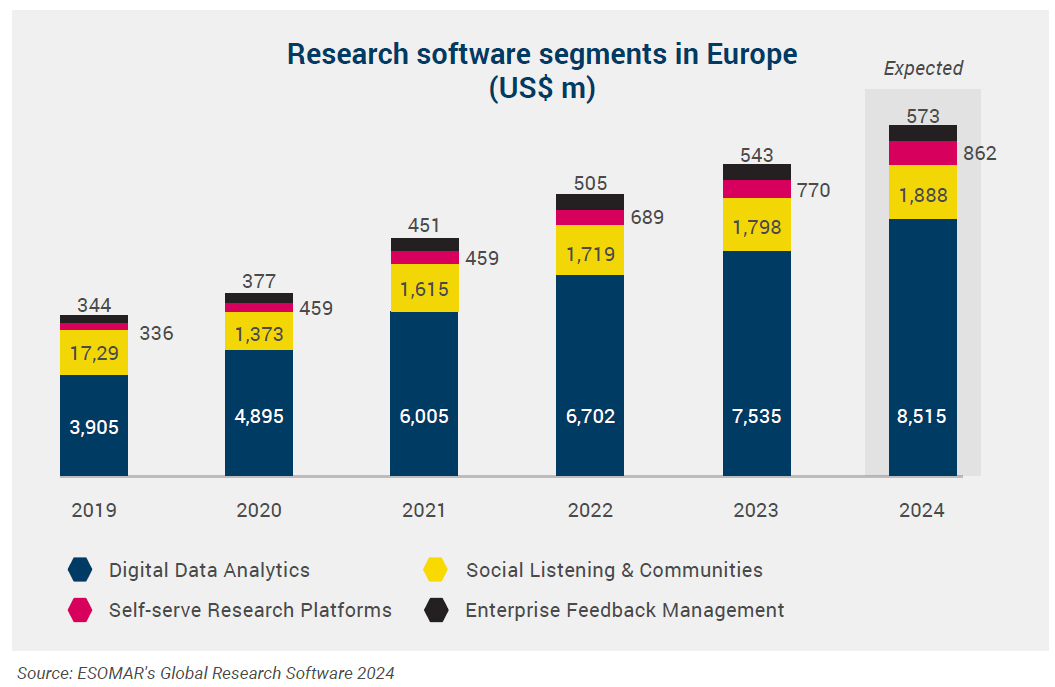

The European research software sector has been steadily growing from 2019 to 2023, primarily driven by digital data analytics. In 2023, this segment reached US$7.5 billion, marking a 11.9% increase from 2022. Digital data analytics accounts for 71% of Europe’s total research software turnover, indicating the region's growing reliance on data-driven insights for business decisions. Although Europe’s digital data analytics market is smaller than the US, it remains a critical segment in the region’s overall research software landscape.

Social listening and communities experienced modest growth of 4.1% between 2022 and 2023, with a turnover reaching US$1.8 billion. Despite being the second largest segment, accounting for 17% of the region’s research software turnover, its influence is relatively less dominant compared to the US, where analytics tools are given higher priority.

Self-serve research platforms saw an 11.1% growth to reach US$770 million and accounted for 7% of the region’s market research turnover in 2023. The increasing adoption of self-serve platforms in Europe reflects a rising demand for flexible, affordable research solutions. However, the rate of growth in Europe lags behind the more rapid adoption seen in the US.

Enterprise feedback management (EFM) grew by 7.1%, reaching US$543 million in 2023, representing 5% of the market. The steady growth in this segment suggests that European companies are gradually prioritising feedback systems, albeit at a slower pace than other regions.

The saga continues in ESOMAR’s Global Research Software 2024. Download your copy now!

Also, for an extra EUR 90, readers can now download the report on the core market research sector—ESOMAR’s Global Market Research 2024.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data