The evolving insights landscape in the Rest of the Americas

The Rest of the Americas is experiencing steady growth across its insights industry despite inflation’s moderating effect. But what’s really driving this momentum? Let’s break down the sectors shaping the region’s future.

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data

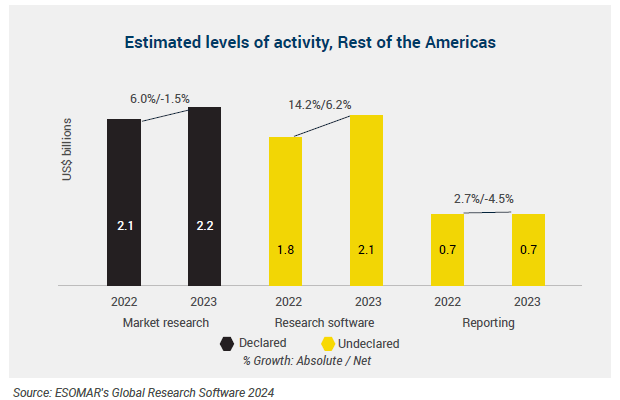

The industry in the Rest of the Americas (a US-centric division of the continent that includes Latin America and Canada) continues apace with positive growth in all its industry sectors and an aggregated 8.7% in absolute terms. Persistent inflation, however, manages to moderate this growth to a more modest 1.1% in net terms.

Like for the rest of the world’s regions, the engine behind this satisfactory growth level was the research software sector, with an absolute growth of 14.2%. The market research sector followed with 6.0% absolute growth and reached a turnover of US$2.2 billion, and lastly, the comparatively smaller reporting sector grew a limited 2.7% and remained flat with respect to 2022 at US$0.7 billion.

The research software sector in the Rest of the Americas experienced steady growth from 2019 to 2023, with digital data analytics leading the way. In 2023, digital data analytics reached US$1.5 billion, showing a 16.8% increase from 2022 and accounting for 73% of the region’s total research software turnover. This significant share reflects the growing reliance on data analytics across industries in the region, even though the segment’s size remains smaller compared to the US and Europe.

Social listening and communities grew by 8.6% from 2022 to 2023, reaching US$363 million. This segment contributed 17% to the region’s research software turnover, highlighting its role in monitoring consumer sentiment, although with a smaller market share compared to digital data analytics. The growth in this segment indicates steady but slower adoption.

Self-serve research platforms, which grew by 10.2%, reached US$109 million in 2023, representing 5% of the market. The slower adoption compared to other regions suggests that the demand for flexible, do-it-yourself research tools is still emerging in this diverse region of Latin American countries and Canada.

Enterprise feedback management (EFM) experienced modest growth of 2.7%, reaching US$101 million and representing 5% of the market. The slow and steady growth of EFM suggests businesses are gradually adopting more structured feedback systems.

Overall, while the Rest of the Americas market exhibits robust growth in analytics, other segments, particularly self-serve research platforms, are growing at a slower pace, indicating a potential area for future expansion.

The saga continues in ESOMAR’s Global Research Software 2024. Download your copy now!

Also, for an extra EUR 90, readers can now download the report on the core market research sector—ESOMAR’s Global Market Research 2024.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data