The Road to Business Impact

The insights industry has improved its ability to achieve real business impact over the past 15 years, as shown by the Insights Maturity Model. This series of articles explores key drivers and strategies to enhance corporate consumer insights functions.

From its very beginning, the market research profession was all about having a positive impact on the business. When Charles Coolidge Parlin founded the first commercial research function for Curtis Publishing in 2011, it was with the aim of increasing the messaging effectiveness of its advertisers. Pioneers down the ages from Arthur Nielsen Sr. to Daniel Starch to George Gallup to David Ogilvy were all focused on one thing – having an impact on their clients’ businesses. They were the McKinseys of their day, relating with their clients at the most senior levels of management.

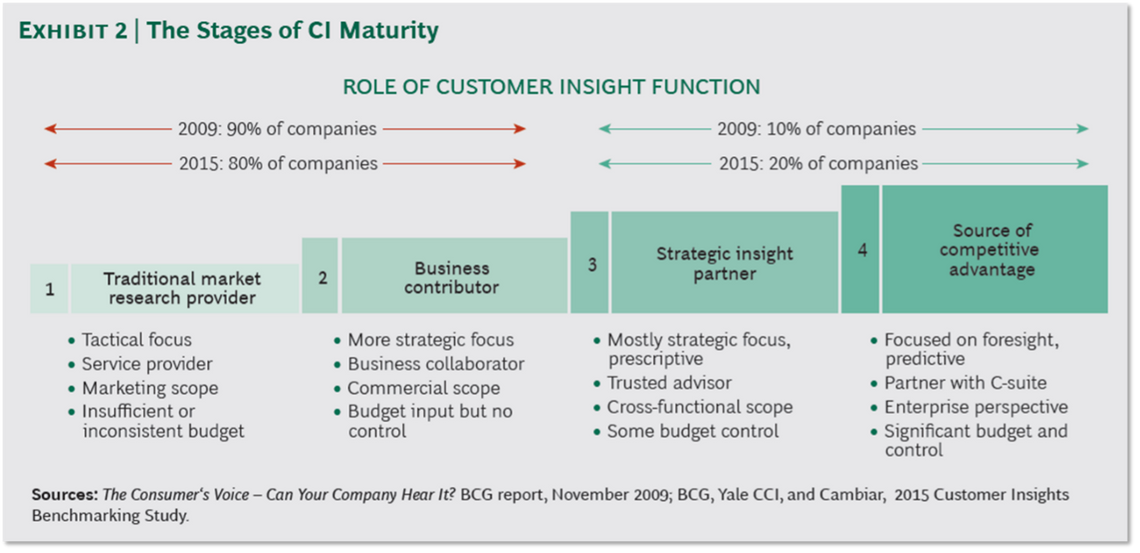

But as the efficacy of knowing and understanding more about your markets and your customers became widely recognised, a strange thing happened. Clients started their own research functions and senior management started to say, “have your people call my people”. Post-World War II, expenditure on research started to take off and, by the 1970s, the sector had begun to industrialise. MR functions started to become a unit of Marketing and increasingly were viewed more as support functions than anything strategically useful. So much so that by 2008, the year that Boston Consulting Group came up with the first Insights Maturity Model, only 10% of Consumer Insights functions were judged to be strategic in nature and in impact.

It has been a long road since. By 2015, 10% had become 20% and by 2024 35%. How has this improvement happened? What drove the climb back to being a source of positive business impact? And, most importantly, what can we learn as a profession that will take us even further?

In this and the next four articles, we will seek to provide concrete answers to these questions as well as solid advice on how to build impact in your own company or for your clients.

At this point, we should also acknowledge that, in an era of dramatic change and uncertainty brought about by both the advance of technology and geopolitical unrest, many would perhaps wonder whether our profession is indeed increasing its impact. However, there is little doubt in our minds that, while Consumer Insights and Analytics will undergoconsiderable change in the coming months and years, it can and will continue to develop in terms of maturity precisely because the ultimate goal will still be to have a positive impact on business and society.

But first, what is “Insights Maturity”?

Insights Maturity Modelling

At their most basic, maturity models are a means to segmenting certain functions within corporations or other types of organisation according to how well they achieve their fundamental reason for being. As such, they serve as guidelines for further development of these functions (or processes) and how that improvement might be achieved.

The original Insights Maturity Model, developed by Boston Consulting Group in 2008, was based on a very thorough study of Consumer Insights practices in over 600 companies, most of them BCG customers. This was updated in 2015 by BCG in partnership with Cambiar Consulting and Yale University and then again in 2023 by Cambiar in partnership with GRBN, the Market Research Society and Insights Association. In each instance, adjustments were made to the model to reflect key changes in the practice of market research and analytics, but the basis of its principles remained faithful to its origins.

Those origins were derived from a segmentation exercise which revealed four fundamental stages of insights maturity, as shown below.

These four stages represent a roadmap for improvement not only in the corporate role that CI plays but also its impact on strategic decision-making throughout the organization. As with most maturity models, the real difficulty in achieving such improvement comes when trying to move from Stage 2 (Business Contributor) to Stage 3 (Strategic Insight Partner). This transition requires transformation not only in process but also in the very reason for CI’s existence – and, in so doing, its culture and ways of thinking. At this point, a ‘research function’ becomes a ‘business function’.

So, how does this metamorphosis occur? What are the key drivers?

The Four Key Drivers of Insights Maturity

Our 2023 update of the Insights Maturity Model revealed that the key in our modern age to becoming a strategic partner and/or a source of competitive advantage lies in four primaryareas:

• The structure and diversity of the consumer insights function

• The relationships that it has across the business

• The abilities for which it recruits and in which it trains its people

• The way and degree to which it measures and communicates proof of its value.

While we will delve into each of these in much more depth in the remainder of this series, a short tasting menu is provided below for those who are hungry for knowledge now.

Structure and Diversity

In most societies around the world, the structure and make-up of the consumer population is not something static. It constantly mutates and economic power shifts with each mutation. In the United States, for example, “minorities” (primarily non-white) will be in the majority within the next 15 to 20 years. They already are in the younger generations. At the same time, the country continues to get older as the birth rate persists in being below natural replacement levels. As these changes continue and society becomes more diverse, so does the need to reflect the society it seeks to understand. Strategic CI functions seek to do this through the composition of people they hire.

With a workforce that is more reflective of the wider world comes the need also to use all data sources at our disposal to understand that world. The data emanating from these sources need to be integrated, synthesised and communicated throughout the organisation. Recent evidence suggests that strategic insights functions are increasingly integrating with other data functions within the enterprise in order to make this happen.

Relationships

In addition to integrating data sources more effectively, these more mature functions also have much more involved relationships with their stakeholders who, in turn, are found across the business in a variety of disciplines. Indeed, recent studies indicate that, on average, such functions are interacting with no fewer than four diverse stakeholders in every study. No longer is research the sole domain of marketing, it can also be found to be strategically informing finance, human resources, supply chain management or any other functions that are critical to business success.

Abilities

As might be expected, CI functions that are considered as strategic partners (Stage 3) or providers of competitive advantage (Stage 4) make sure that the skills that they bring to the table go way beyond the technical skills of research design, management or analysis. They now both recruit and train for skills that build consulting and activation capabilities into the mix, enabling them to be seen as true leaders within the organisation.

Communication of proof of value

All of the above is fundamental to becoming strategically valuable to the company but none of it has impact unless it is seen to have value. As such, the way in which a consumer insights function communicates not only its knowledge but also proof of its value to the business and its management is vital to actually being a partner in the process of strategic decision making. And to do that, it needs to be able to measure and communicate the return on investment that it brings to the party in a way that not only the CMO but the CFO and CEO can see, understand and value.

In the four articles that will follow, we will dig deeper into these four drivers of insights maturity, basing our conclusions on solid evidence gleaned from the structure and behaviour of the some of the world’s most valued and successful consumer insights functions.

Stay tuned!

Simon Chadwick

Managing Partner at Cambiar Consulting, Editor in Chief of Research World at EsomarSimon founded Cambiar in 2004 to provide strategic assistance to research and insight companies as they face rapid and fundamental change. With 40 years of guiding and managing international organizations of various sizes and stages, Simon’s advice and counsel has helped many companies increase their value – to stakeholders, investors and clients.

He is an acknowledged industry leader, author and conference speaker. In addition to his role at Cambiar, Simon is also a Fellow of the Market Research Society, past Chairman of the Insights Association and Editor-in-Chief of Research World, ESOMAR’s global magazine.

He holds an MA in Philosophy, Politics and Economics from Oxford University, UK, and has done post-graduate studies at both Columbia and Harvard business schools in Change Management and Strategic Management.