Plus ça change…

“The only constant thing in life is change.” So (apparently) said Heraclitus of Ephesus, a Greek philosopher of about 2,500 years ago.

“The only constant thing in life is change.” So (apparently) said Heraclitus of Ephesus, a Greek philosopher of about 2,500 years ago. Heraclitus was a bit of a miserable old sod – the Eeyore of philosophers who bemoaned the ever-changing nature of life and pined for a state of being that was more predictable, just a little more static.

You could never accuse Steve Phillips, Founder and CEO of Zappi, of being a miserable old sod, but the other week at IIeX Europe he certainly made a number of attendees wish for a state of being that was more predictable, just a little more static. Here’s what he had to say:

AI will lead to abundant insight. Our industry is going to be

disrupted, digitised, democratised and demonetised.”

Yikes – demonetised? That sounds incredibly scary! Indeed, Generative AI, in particular, sounds hugely scary, especially after its inventors got together and published a letter that essentially said, “Oops! Sorry!”. And isn’t AI going to take away all our jobs, essentially making up research results from interviewing digital respondents and then writing reports that will be as interesting as those that we write today (i.e., not very)?

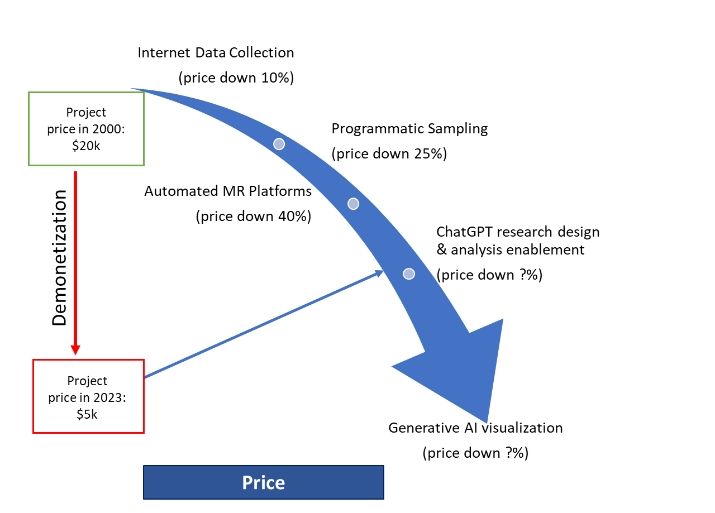

But as Steve knows better than pretty much everyone else in the research industry, demonetization has been going on for the last two decades, accompanying a period that has led to more innovation and growth than any other in our history. What I think he’s saying is “it’s not over yet, but that’s not a bad thing”.

The advent of the Internet, programmatic sampling and automated MR platforms have enabled the price of research to come down by 75% over the past twenty years. It’s very likely that ChatGPT and other forms of Generative AI will drive prices down even further. Insights, research – whatever you call what we do – is now much more affordable than it ever was, and yet it is arguable that it is now more important and central to decision-making, whether commercial, political or social, than it has been in decades. In other words, demonetisation does not necessarily lead to commoditisation.

Nonetheless, it is probably fair to say that the question must now become, “How do we remonetise the industry in this new environment of artificial intelligence?”. As is often the case, the answers to such a question may be found not only in the environment as it exists today but also as it existed in the past.

Just go back ten years when all one could hear and read about in the trade and business media was ‘Big Data’. Big Data was going to solve all sorts of problems and issues, decision-making would become ‘data driven’ (and therefore better), and there would no longer be a need for primary research. Zero-party data was now the thing! Some CEOs were even daft enough to believe this mantra and to dismantle their consumer research functions only to have to hastily rebuild them a few years later. Why? Because data may be good at showing the what of the past but not necessarily the what or the why of the future. We saw that big time when COVID decided to disrupt our lives, and virtually every single model of consumer behaviour became redundant. And who did the C-Suite turn to then? Consumer Insights and their pesky primary research.

While it might not always be the case going forward, right now, the same conundrum faces all those who are hailing Generative AI as the 21st-century equivalent of the steam engine. Because AI is trained on the data of the past. It knows what it thinks happened (“thinks” because it could be training on false or biased data), but it does not necessarily know why it happened. As such, it cannot be expected to understand present or future choices or drivers of human behaviour. That takes human intelligence.

Similarly, at present, AI runs on the basis of looking for patterns in enormous amounts of data, a capability that is of huge utility to researchers and analysts of all stripes. It expands the scope of data with which we arrive at conclusions and make decisions and does so in ludicrously small amounts of time, increasing our efficiency exponentially. But sometimes, it is the data point (often in small data) that is “off” that kick-starts us to understand things we didn’t understand before. The data point that shouldn’t be there or that is counter-intuitive or that just feels plain wrong. Sometimes there’s nothing specific we can pin down, but we intuit that it’s important. For now, at least, AI will not be able to do that because it takes human intelligence and experience to do so.

Which leads us back to the question of how we “remonetise” our industry. The answer right now is to upscale. By this, I don’t mean to scale up (which implies volume and size) but to increase and demonstrate the incremental value that we bring through our own unique human intelligence and experience. No longer is the insights industry about collecting data. It’s about curating and intuiting the learning that exists in human-derived data with human intelligence. The fact that this can now be done on a scale and at a speed that was previously unimaginable only increases the opportunities that we have to impact business and social success. Yes, it will involve us learning new skills and harnessing new technologies, but when have we not been able to do that? Just as we did during COVID, we can rise to the challenge of not only answering the question “What’s happening?” but all its counterparts: “What will happen?”, “how can we compete?” and “What should we do now?”.

So, if I may rephrase Mr Phillips’ prognostication just a wee bit:

AI will lead to abundant insight. Our industry is going to be

invigorated, digitised, democratised and remonetised”.

Simon Chadwick

Managing Partner at Cambiar Consulting, Editor in Chief of Research World at ESOMARSimon founded Cambiar in 2004 to provide strategic assistance to research and insight companies as they face rapid and fundamental change. With 40 years of guiding and managing international organizations of various sizes and stages, Simon’s advice and counsel has helped many companies increase their value – to stakeholders, investors and clients.

He is an acknowledged industry leader, author and conference speaker. In addition to his role at Cambiar, Simon is also a Fellow of the Market Research Society, past Chairman of the Insights Association and Editor-in-Chief of Research World, ESOMAR’s global magazine.

He holds an MA in Philosophy, Politics and Economics from Oxford University, UK, and has done post-graduate studies at both Columbia and Harvard business schools in Change Management and Strategic Management.