Insights in Flux: What clients are taking research into their own hands?

Information for this article was extracted from ESOMAR’s Global Users & Buyers of Insights 2025, and can be further expanded by making use of the online dashboard that comes with the report.

In today’s increasingly data-driven environment, client organisations are re-evaluating how they generate, manage, and apply consumer insights. What was once the exclusive domain of external market research agencies is now being brought in-house, not just as a cost-saving measure but also as a strategic response to the increasing need for speed, flexibility, and closer integration with core business functions.

The internalisation of the insights function is one of the most significant shifts in the industry. Enabled by technological advancements, intuitive analytics platforms, and access to diverse data sources, client organisations are going from passive consumers of insights to active producers.

ESOMAR’s Global Users & Buyers of Insights 2025 examines how this transformation is occurring across industries and regions, showing that internal research accounts for approximately half of all insight activities. It also explores workload, available resources, team structures, and emerging technologies, particularly artificial intelligence (AI), which are enabling this shift. Furthermore, it considers the changing role of external research partners in a context where the boundaries between client and supplier are becoming increasingly fluid.

Internalisation rates vary significantly by sector, influenced by structural and operational dynamics. For example, the pharmaceutical industry shows a low internalisation rate of 23%, which is likely a reflection of regulatory complexity and global coordination needs. Conversely, sectors such as academia and education reach up to 71%, supported by research-driven cultures and strong in-house expertise.

Given the continued development of in-house insights capabilities over the years, client organisations are drawing sharper boundaries between what can be efficiently managed internally and where external expertise remains indispensable. Internal teams are increasingly well-positioned to handle routine research operations, especially projects involving regular data collection or requiring rapid turnaround. However, external partners remain vital in areas where scale, complexity, or strategic depth are needed. According to the data, clients most frequently outsource brand studies (14%), consumer research (11%), and large or highly specialised projects (10%). This highlights a persistent demand for methodological rigour, extended reach, and an objective perspective.

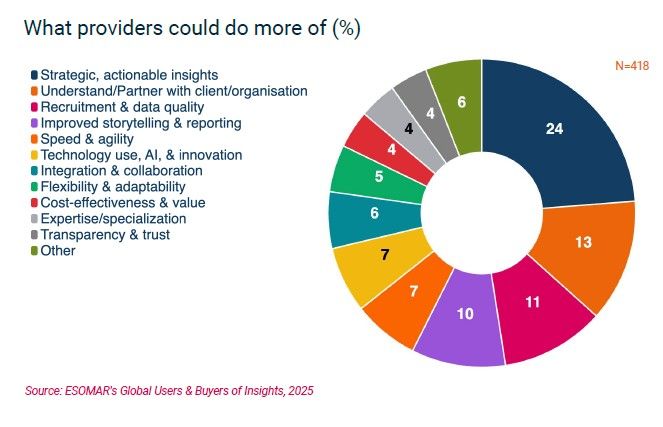

At the same time, expectations of external providers are shifting. Agencies are no longer seen solely as execution partners but are increasingly valued for their strategic input. Delivering actionable insights was the top priority for 24% of respondents; this reflects a growing emphasis on translating findings into clear narratives that drive business decisions. In second place, “understanding and partnering with clients” was cited by 13% of the respondents.

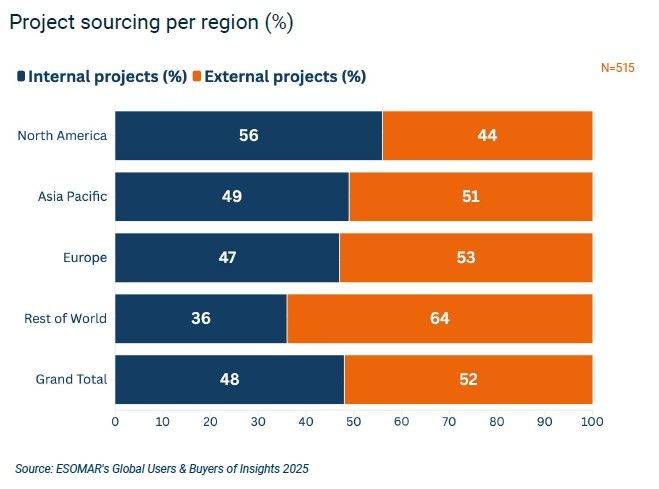

Differences in project sourcing across regions suggest varying levels of internal capabilities and reliance on external support. North America appears to lean more heavily on in-house resources, with 56% of projects reportedly conducted internally—a significant increase of 6 percentage points compared to 2023.

In contrast, the "Rest of the World" region, which includes responses from Latin America, the Middle East, and Africa due to limited individual representation, shows a stronger trend towards outsourcing. Only 36% of projects are managed internally, which potentially reflects more limited internal research infrastructure and/or a strategic reliance on specialised external expertise.

Asia Pacific and Europe exhibit a more balanced split in the share of internal projects, accounting for 49% and 47%, respectively. While in Asia Pacific this share remained stable year over year, Europe recorded a more nuanced increase of 2 percentage points compared to 2023.

At the global level, the split between internal (48%) and external (52%) project sourcing reflects a stable, lasting share of internalisation. This suggests that while more organisations are taking on certain types of internal research, the role of external partners remains critical, particularly for complex, resource-intensive, or high-impact initiatives.

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.