Why the demise of tracking cookies signals a win for market researchers

This excerpt from ESOMAR’s Global Market Research 2024, known as the “Bible of Market Research,” gives a global overview of the insights industry using data from various sources.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry

The following article is an excerpt from ESOMAR’s Global Market Research 2024. This flagship report of ESOMAR, often dubbed as the “Bible of Market Research”, provides you with the most comprehensive overview of the state of the insights industry and the market research sector around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

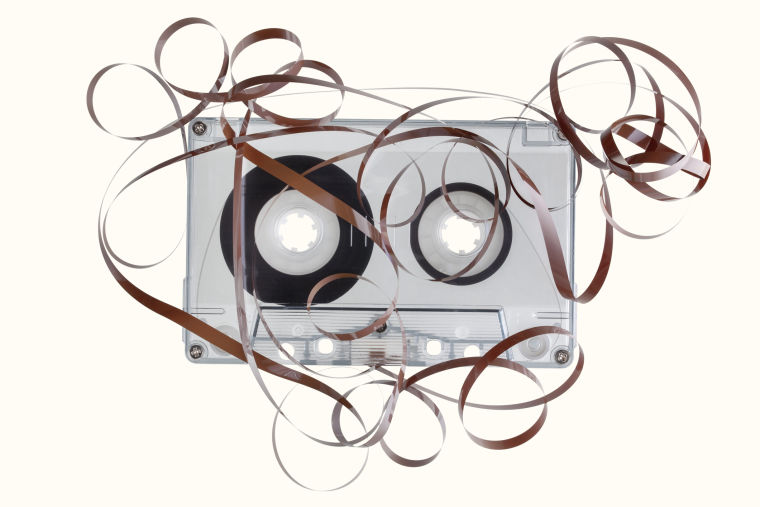

Oh, crumbs!

Tracking cookies were let loose on the world back in 1992 when Netscape created them to enable websites to recognise users. Sites would place a little parcel of data, the cookie, in a user’s browsing history, which the site would recognise if that user came back for another visit.

Cookies have since evolved into an easy, inexpensive way of observing consumers’ digital lives, informing businesses about preferences, opinions, and online habits. They have generated immense volumes of data on consumer behaviour.

Opportunity is knocking

The loss of cookies results in what’s called “signal loss” for brands and agencies that have relied on consumers’ data trails to know which advertising to serve them where and when. But other signals are available and are getting stronger. Market researchers are tracking many of them and are well-placed to step in to fill the void.

“I think this is going to be a positive outcome for the market research industry — easing participant anxiety around privacy and increasing the demand for first-party data from market research agencies — actually speak to participants!” said James Endersby, Chief Executive of Opinium and Chair of the UK’s Market Research Society.

One of the options for businesses looking to make up for the loss of signal from third-party cookies is what’s being called “zero party” data: information that comes directly and explicitly from consumers themselves, usually in response to questions.

It’s a world away from trenchcoat-style data collection; Forrester VP principal analyst Fatemeh Khatibloo has described zero-party data as “gold”.

When a customer trusts a brand enough to provide this really meaningful data, it means that the brand doesn’t have to go off and infer what the customer wants or what their intentions are.”

Then, there’s first-party data, which is often collected via first-party cookies. That means it’s done with consent but passively. A site can track what a user clicks on, how long they stay, what they click next, and whether they buy. What they can’t see is beyond their own site.

For a highly digital business, first-party data is both plentiful and valuable. Direct-to-consumer brands have a wealth of first-party data; what they might not know is how best to mine the gold they have buried within it and what to do with the treasure they dig up. Again, market researchers are well-placed to be able to step in.

Another option is perhaps best described as “cookies by another name”. This is essentially another form of ID-based tracking that is not technically a cookie but from a privacy point of view is very similar. It means a straight swap rather than a fresh approach but does nothing to allay the concerns that have led to cookies’ demise.

Then, there are panels — well-known and very much tried and tested in market research.

“You might think of panels as a relic of broadcast measurement, where once upon a time, a tiny sample was extrapolated into the entire universe,” said Mark Osborne, Vice President, Growth & Strategy, Analytics, North America at Kantar.

Or you might assume that cookies and their replacements are accurate tools for capturing complex digital interactions at every keystroke. The reality might surprise you.”

In fact, Steve Silvers, EVP of Media and Creative at Kantar, says the world of cookies is simply a panel by another name, albeit a large one.

“I think there is an emotional loss more than an actual loss at this point,” Silvers says.

“Originally, when all browsers had third-party cookies, we could pretend that we had this universal, unbiased, passive view of ad exposure that gave us a universe from which we could calculate, but that was not really ever true. And what you have today is a panel, whether it’s explicitly a panel or not, it’s a panel of consumers who use the Chrome browser.

“Once you accept that you're using a panel, then this opens up lots of opportunities for different types of measurement. To some extent, ripping the band-aid off and accepting that you don't have this perfect view of the universe is really, really helpful.”

New tools, fresh approach

There is a fresh imperative to do what they (marketers) should have been doing anyway: being more creative and using other technological advances to drive relevance and results. And, of course, provide better transparency for consumers and value for the data they provide.

Silvers says: “Market research is really founded on this; this deep relationship with the consumer that I think is more valuable now than it's possibly ever been before.”

Are you interested in hearing the continued views of the experts interviewed in this article? Download the latest edition of Global Market Research now!

Jo Bowman

Journalist at FreelanceA journalist for more than 20 years, Jo wrote for newspapers in Australia before moving to Hong Kong to specialise in business writing with a focus on branding, marketing and research. She has since worked in Italy and the UK as a writer and editorial consultant. Jo has worked with ESOMAR since 2009. jo@rjbmedia.net

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry