Growing internal expertise, higher external demands in research

As portions of the research function were transferred from the agency side to the client side, so did the professionals themselves.

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution

As portions of the research function were transferred from the agency side to the client side, so did the professionals themselves. The internalisation of the insights function has put the usage of the label “clients” into question as companies became users and buyers. As insights departments matured, they, too, started employing professionals with prior experience in agencies.

Skills present within insights teams

Some qualitative comments to ESOMAR’s Global Users & Buyers of Insights 2023 report show resentment about the way agencies talk about users and buyers, probably portraying a reality that may have existed in the past. Far from unspecialised personnel haphazardly brought along to fulfil an attempt at internalisation, the current workforce includes a wide array of professionals, many of whom were sourced from the market research agencies themselves.

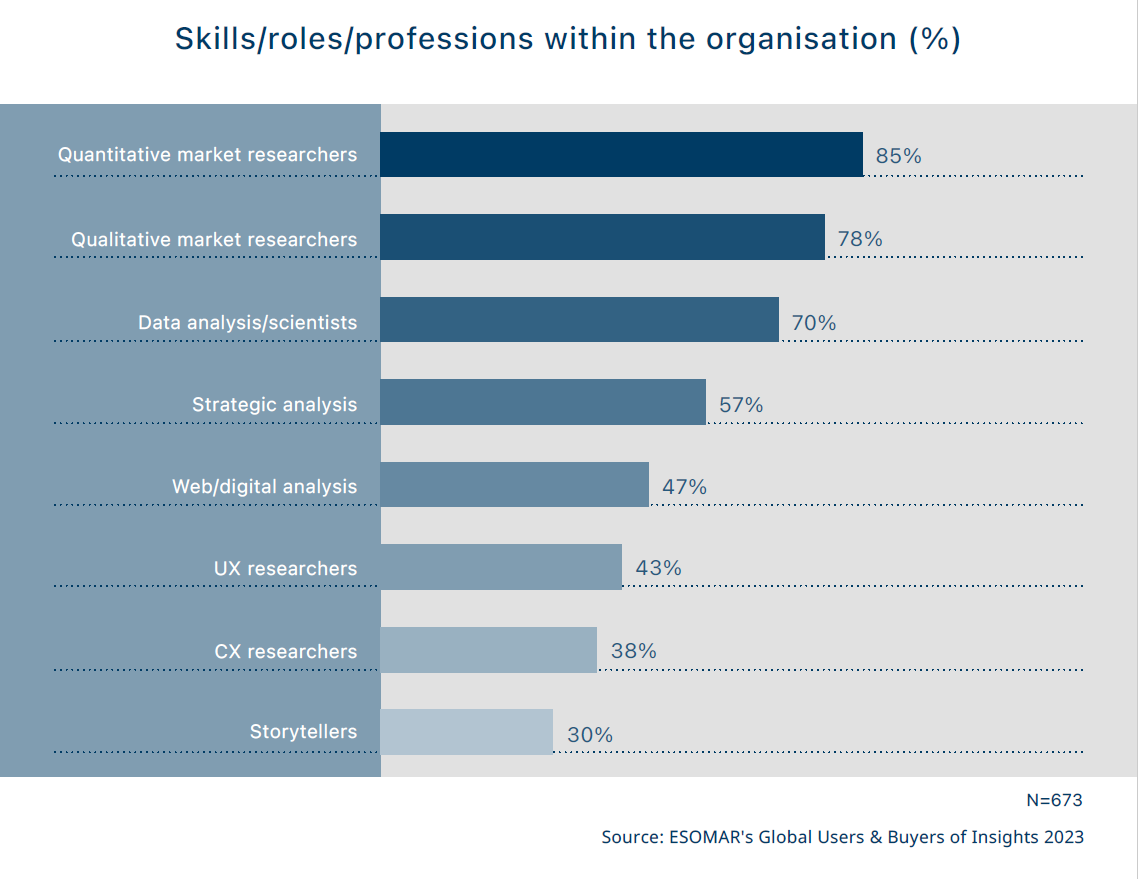

More than half of all respondents confirmed having a workforce skilled in four areas. The two most popular ones, hovering at around 80%, are quantitative as well as qualitative researchers (please note that the same individual may be skilled in more than one area).

Up to 70% of all respondents declared having data analysts and scientists in their ranks. The change from 2021 shows how corporate research is preparing itself for the irruption of some new technological advances like artificial intelligence, which is still mentioned as one of the main challenges in the medium term. In just two years, the presence of data analysts/scientists in insights user and buyer companies has grown from 54% to a remarkable 70%.

Strategic analysts, the fourth most popular skill, falls slightly from 62% in 2021 to a level of 57%. Still present in more than half of all respondents’ companies, this skill corresponds with one of the main wishes for external partners. Namely, for them to provide more strategic advice rather than purely observational input. As internal control over the insights function increases, so do the requirements and expectations, allowing for findings to have an increasingly strategic approach.

The remaining functions mirror quite precisely the results from the 2021 edition of ESOMAR’s study, with just a few percentage points of deviation. Web/digital analysts drop by two points from 49% in 2021 to 47%, UX researchers increase slightly from 39% in 2021 to 43%, CX researchers remain at the same level of 38%, and, lastly, storytellers fall two points from 32% in 2021 to 30%.

The quick, simple and practical nature of internal research projects may be the reason why storytellers remain the most infrequent skill within insights teams. Storytelling may not be as crucial when the scope of the project is rather small, when the turnaround is short or when stakeholders are not as diverse. Poor storytelling, however, tends to affect the impact of research, which also happens to be one of the main challenges in the medium term.

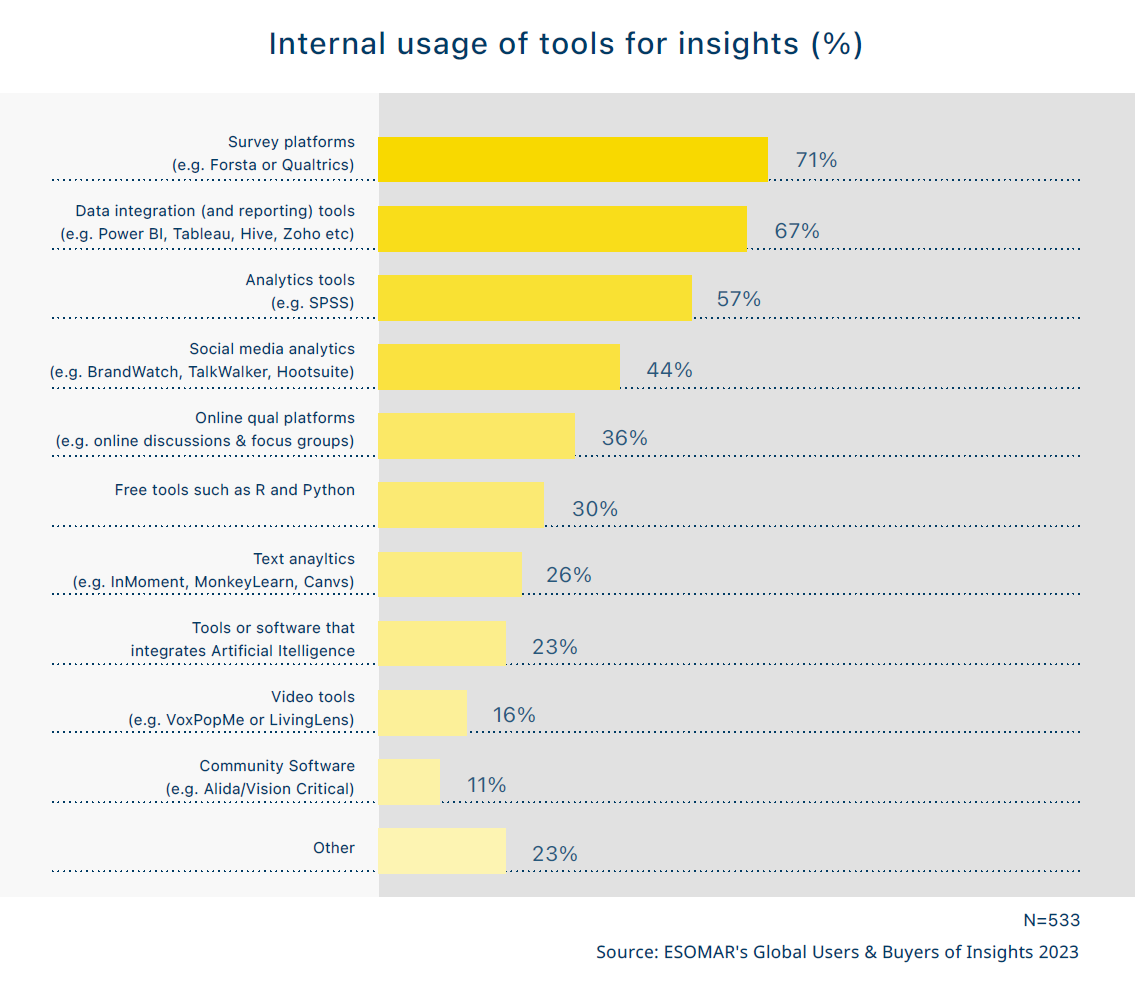

Needs from external research providers

When users and buyers bring research in-house, they usually internalise lower-risk or small-scope projects, usually in the shape of questionnaires delivered to a known audience through internal datasets or those projects that require very specific knowledge of the company. To enable them, users and buyers make use of self-serve research platforms for execution, specialised tools for analysis, and data integration and visualisation tools for the reporting part. What do they ask from research providers for the projects they commission externally?

Because they will seek the increased expertise of research suppliers, their unique insight into specific market-wide data, their guidance to understand unknown segments of the population or the strategic direction they should provide for the company, it is of primary importance that they act as partners and not as simple suppliers. Gone are the days when agencies provided simple technical market research support. Users and buyers can do all that internally now.

To fully support the client company, it is crucial to understand their problem and their ask and act as partners. Users and buyers need to perceive that agencies are providing guidance which could not be churned out of any “insights extruder” because it applies to the specific situation of their client. This feeling is shared by almost one-fifth of all respondents.

Being able to differentiate which elements of research are primarily internalised and which ones are externalised through this global study shows the strategic nature of the required guidance. As such, up to 14% of respondents wished for a more strategic analysis of their situation and to include elements more related to consultancy. As explained in other ESOMAR reports such as ESOMAR’s Global Top-50 Insights Companies, or ESOMAR’s Global Market Research, this is supported by the increased encroachment observed from the reporting sector into the market research function. This desire, after all, is fuelling demand that allows for their advisory business model to expand into full-service research.

Of equal importance (14%) is to show expertise in those methodologies and practices that the client cannot implement, be them particular or hard-to-reach populations like the vulnerable, doing business-to-business research, delving into specific industries like education, or employing alternative ideas for research beyond the usual “tried and true.”

The wish to provide faster insights and to be more flexible takes 9% of all mentions. Especially when the priority is in the delivery of the insights, depth of research may be sacrificed in favour of more timely execution. However, often, it is adaptability and flexibility that are lauded by clients rather than repeating the same old schemes. This speaks to the desire for increased specialisation from agencies and treating the client as a true partner.

Up to 8% of mentions involved focusing on actionable insights rather than on basic descriptions. The idea of actionable insights is understood as making clear recommendations instead of “sitting on the fence.” These comments often warned against delivering data dumps or all-purpose decks of slides – these do not work any longer – and focusing instead on storytelling and data visualisation, especially when results are shared with a broad range of stakeholders with varying levels of data literacy.

By listening to users and buyers of research, agencies can better tailor their services and identify how to shift some of their business models to serve their clients, a.k.a. partners. As the insights practice shifts and allows more research to take place in-house, agencies ought to offer services that cover areas of need. While lower prices are not a substantial priority for users and buyers (3% of mentions), camaraderie and a deep understanding of the client’s situation, strategic guidance and advisory, unique expertise and impactful delivery of insights seem to be the areas where suppliers can truly stand out from the competition.

Want to learn more about the Users and Buyers of Insights? Get your copy of the study today:

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution