Why some industry sectors internalise more of the insights function

Is the eternal risk of complete internalisation real?

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution

Industry developments over the years have had a dual effect: they have made research more attainable as well as more affordable. This has translated into more of those purely research client companies acting, instead, as users of insights and developing their own projects.

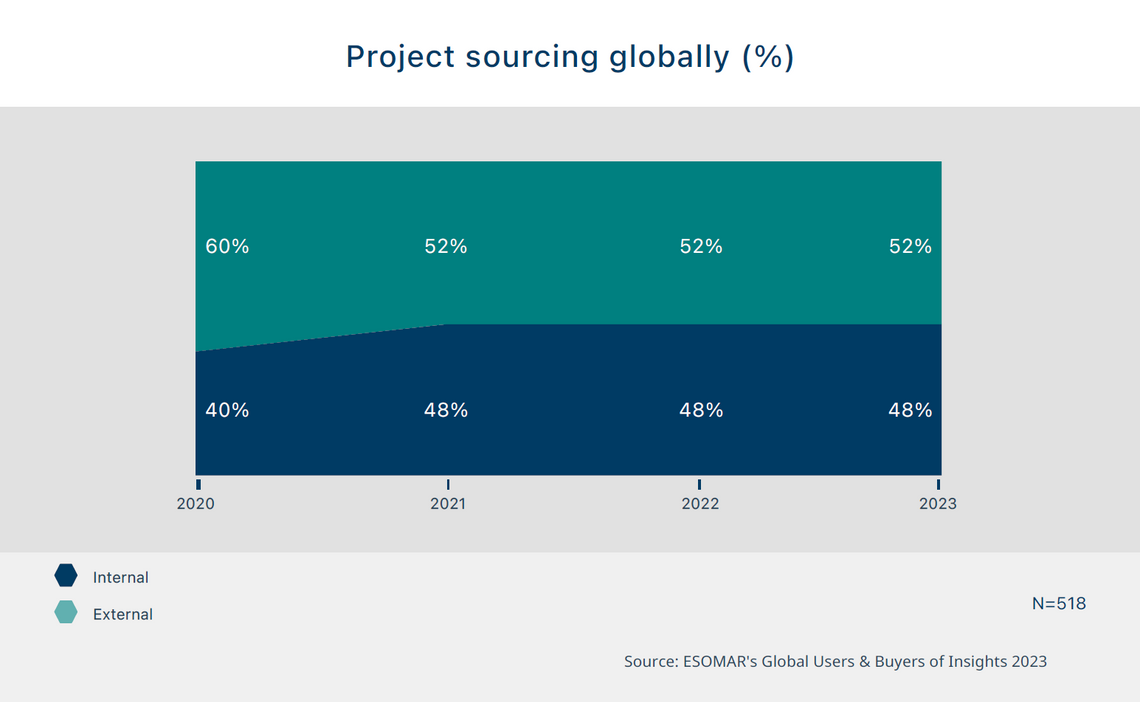

Quantifying the extent to which the insights activity has become internal is challenging – assigning price tags to internal projects is not something companies usually do. However, ESOMAR’s Global Users & Buyers of Insights 2023 report shows that around half of all projects (48%) are conducted internally, with signs hinting at a preference for simpler, likely cheaper projects being chosen for internalisation.

This level seems to have stabilised over time, and further commentary on the types of projects more suitable for internalisation compared to those left for external partners indicates an intuitive division between the two.

Not all industries are created equally

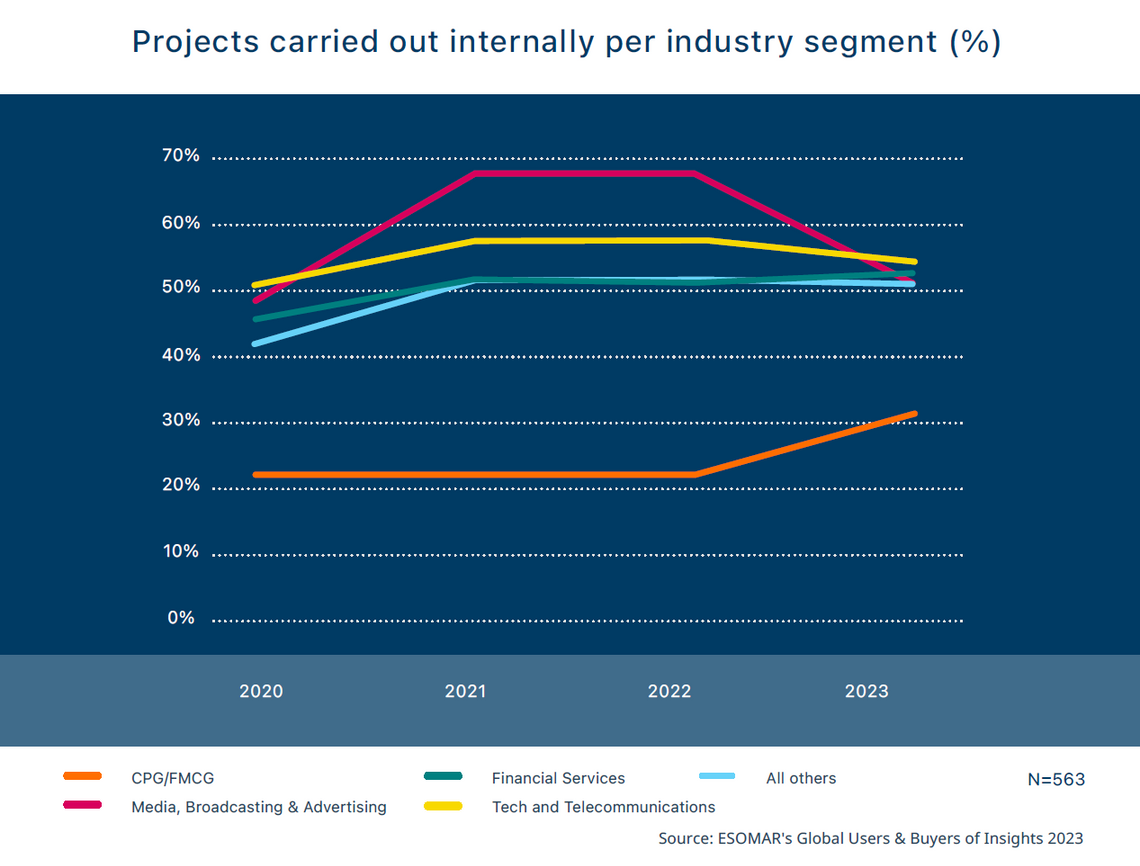

Project sourcing per industrial sector may appear rather intuitive, with those with currently higher in-house expertise being in a prime position to internalise projects. Such is the case of academia and education, where one imagines institutions leveraging the body of trained in-house researchers to tackle more projects or technology and telecommunication companies doing the same with their large pools of analysts.

Conversely, companies battling in highly competitive segments or needing to track diverse and geographically dispersed consumer groups tend to rely more on external suppliers to execute their more complex projects. This is the case for fast-moving consumer goods (FMCG) or, to some extent, pharmaceutical companies.

The spread across industrial segments, thus, is over 30 percentage points, from the lowest level of internalisation for the FMCG segment at 32% to the lowest reliance on external suppliers in academia and education at 63%.

Evolution over time suggests how the impact of the pandemic, which led to a shift towards internalisation, turned into a new normal for some segments. For others like media, broadcasting, and advertising, the trend returned to the level reported in 2020, whereas the FMCG segment in 2023 became less reliant on external suppliers.

Size of internal insights teams

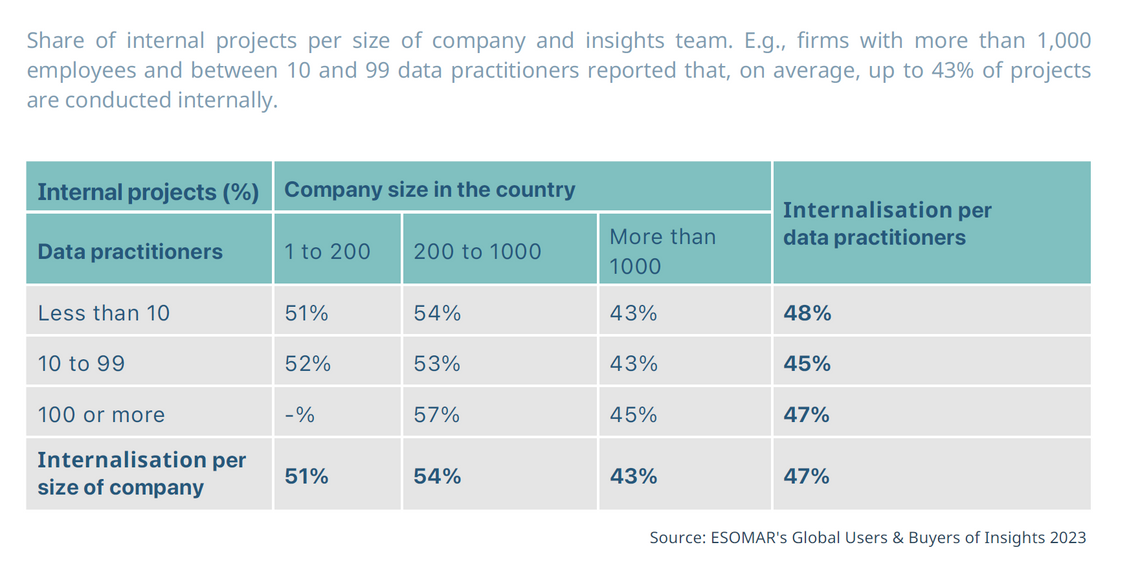

How to dedicate resources most efficiently to the extraction of insights is a delicate balance. Small companies may be drawn to internalise research, but their more limited resources may act as a barrier to accomplishing this goal. Instead, they may have to choose either between simpler in-house research or sporadic outsourced research. Larger companies may be able to afford more complete insights teams but, as explained through their qualitative answers, the complexity of their operations may require the expertise, reach, and access to audiences available in dedicated agencies.

Companies with up to 200 employees tend to have insights teams of fewer than 10 people. These teams represent between 5 and 10% of the company’s workforce, but interestingly, they are rarely composed of just a lone insights professional.

The most common setup for the largest corporations – those with more than 1,000 employees – is to have teams between 10 and 99 insights professionals, though teams between 2 and 9 people are also rather common. Given that teams of either size are responsible for the same level of internalisation of the insights activity within the company (43%), this seems to be an area where insights teams yield the most.

While respondents declared how many projects are carried out internally versus externally, this does not inform of the potential cost they would have had if externally sourced. Temptations to claim that “half of all research is done internally,” thus, should be complemented by the disclaimer “in terms of number of projects” to ensure that audiences understand the base of the calculation.

The next edition of ESOMAR’s Global Users & Buyers of Insights report will be released in 2025. We will see whether internalisation has indeed increased, as respondents to this year’s exercise expected.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution