Any solution to the challenges insights teams face?

Challenges for insight generation come from within

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution

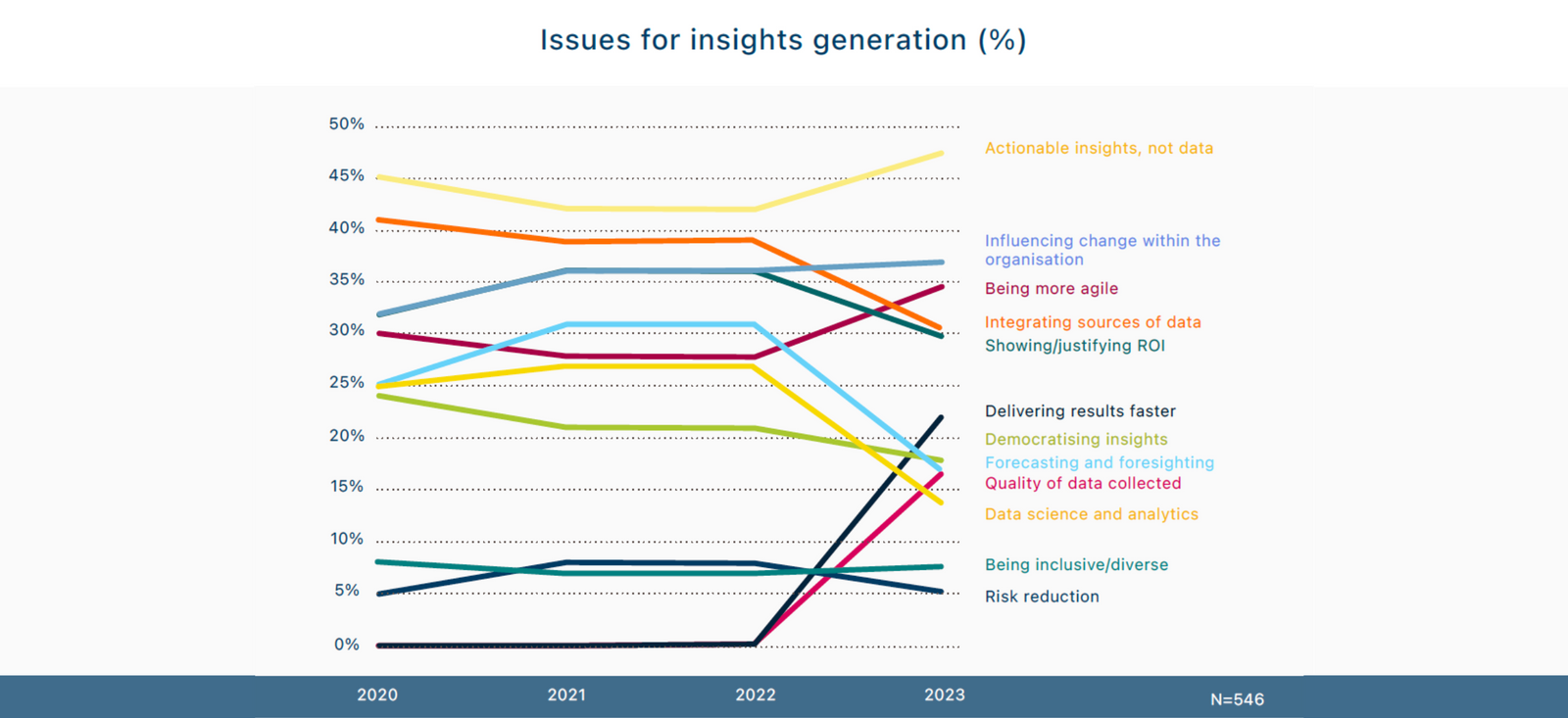

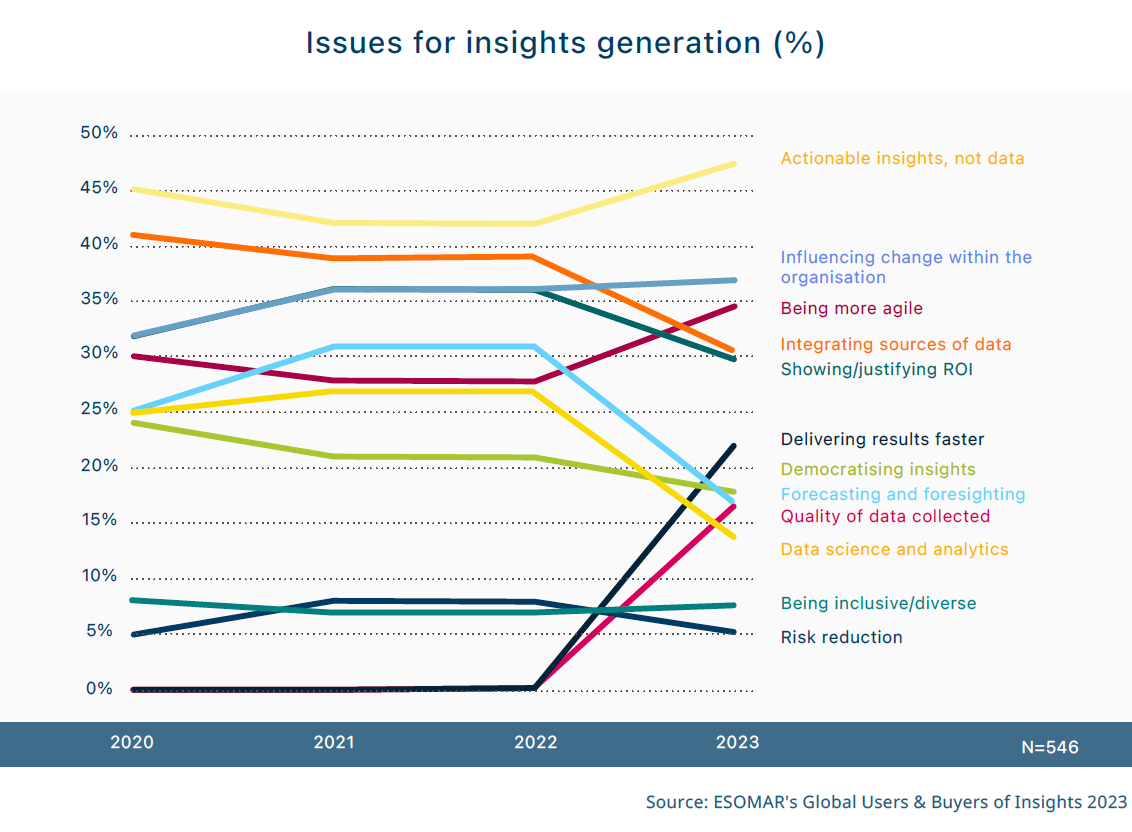

Users and buyers do not seem to hold vastly different opinions than those presented in previous editions of ESOMAR’s Global Users & Buyers of Insights report. The main issue, identified by almost half of all respondents, is providing actionable insights instead of data.

This will not come as a surprise when looking at the main challenges they expect to face in the medium term, where the impact of research sits in a prominent position. Nor is it when looking at what users and buyers wished providers did more of, where expertise, actionable insights and strategic guidance are all at the top of their wish list.

Influencing change within the organisation is another major issue for insights generation currently for 37% of respondents. When looked at in combination with the main issue – providing actionable insights instead of data – it becomes clear, and perhaps surprising, that the main challenges have an internal rather than an external cause.

Being (or becoming) more agile is an issue recognised by 35% of professionals, overtaking the issues of integrating different sources of data and showing/justifying the return on investment (ROI) of insights. Interestingly, these issues are expected to remain part of the range of primary concerns declared by respondents in the medium term.

The remaining categories are seen as current issues by fewer than 25% of respondents. Delivering results faster becomes a main issue, particularly when combined with challenges to the quality of data being collected and the multitude of different sources of data to be processed and combined.

Interestingly, forecasting and foresight have lost substantial ground and are not perceived as such a significant issue as in the past. This may be due to several reasons, such as growth in the level of certainty over the current market and customer base after the pandemic. It may also be due to insights teams having upskilled their forecasting, as well as their data science and analytics capabilities, to the point that they do not represent such a challenge. Or perhaps it is because the overall focus of the insights function simply has shifted towards other, more pressing areas, such as the impact of AI and other technologies.

At the bottom of the current issues sits being inclusive/diverse, as well as risk reduction, with less than 10% of mentions. It may be surprising to find that certain categories which are usually heralded as the most ethically laudable, such as aiming towards goals of inclusivity and diversity, are not as pressing when compared to other, more ordinary, concerns.

Resources, an old item likely to remain a future challenge

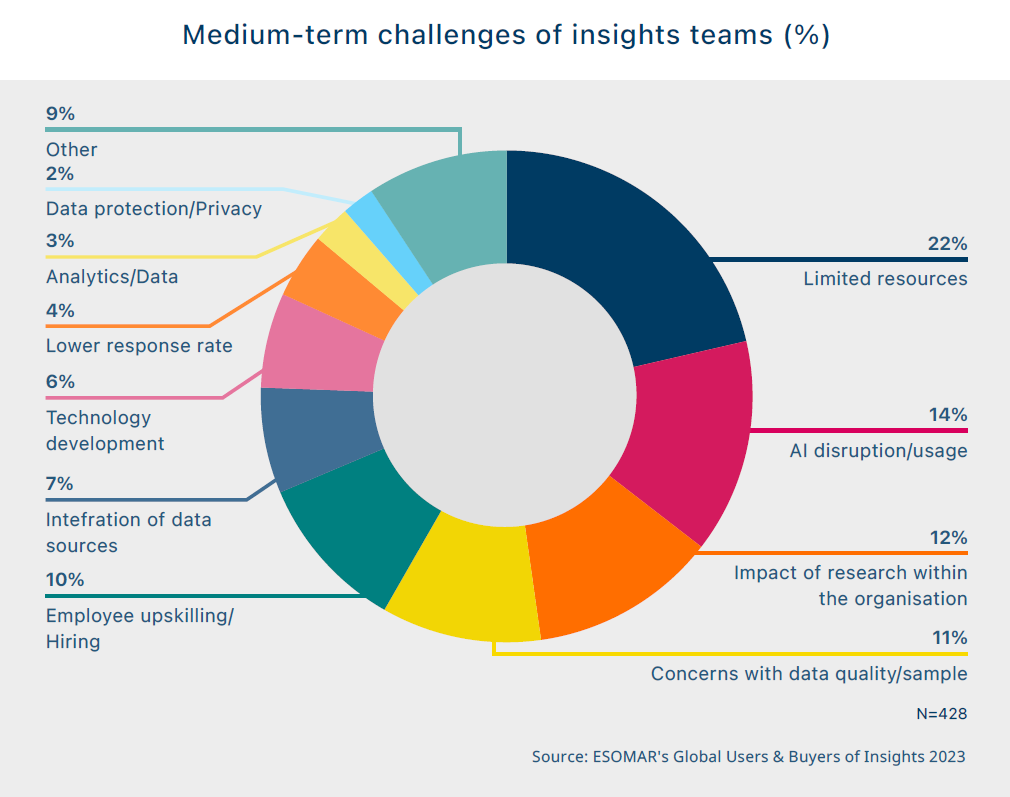

Which challenges do insights teams expect for the medium term? ESOMAR’s Global Users & Buyers of Insights report explains how projects are internalised when they already own or can gather the data from their current customer base or when the research is related to the specific circumstances the company may find itself in. Some of the biggest challenges they face, logically, are in cases related to these areas and, of course, to the overall impact of their work.

The main challenge, with 22% of all mentions, is linked to limited resources, as insights teams are requested to achieve the same results and even surpass them with the same or dwindling resources. When the impact of research – something that ESOMAR touched upon in its How to Demonstrate the Value of Investing in Customer Insight report – is not clearly perceived by management, they may be tempted to question the current levels of investment dedicated to the insights department. Alternatively, these departments may be engaged in more projects without the corresponding increase in resources. Either way, it does not seem incidental that concerns about the impact of research also sit at the top with up to 12% of all mentions.

The rise of new technologies and team readiness for their impact is the second main worry of insights professionals, both in terms of the impact of artificial intelligence (AI) as well as, at a distance, technology in general. The practical applicability of generative AI, which has more discernibly been achieved rather recently, is seen as the second largest medium-term challenge with 14% of mentions.

This is particularly true when combined with two parallel scenarios: on the one hand, concerns over data quality and counting with a sufficiently large, representative sample in ever-shorter time frames. It is difficult for insights teams to guarantee data quality and to combat respondent fraud or bots in panels.

On the other hand, either upskilling the current workforce or recruiting the necessary talent to be able to face and leverage the opportunities AI provides in a responsible manner. There is a sentiment that the tempting appeal of AI-powered tools may persuade management to push their implementation without sufficient understanding. Being able to react and work with AI and forecasting how its disruption will play out within the department is a substantial concern within insights teams.

How insights teams will deal with these challenges is yet to be seen. But, while technology may evolve over time, perhaps losing its position as a primary concern, the historic worry over the impact of research and the challenge of having to maintain output with constrained or even insufficient resources is set to remain over time.

The danger of rewarding excellence with a higher workload

In terms of workload, the amount of work in the past 12 months compared to a year prior increased for the majority of respondents (56%) or, at most, remained the same (32%). This situation is expected to remain unchanged in the upcoming 12 months. Despite the assurance that workload undoubtedly sits in an upward trend, most respondents are equally certain that their resources, which include both headcount and budget, did not increase in the past 12 months and are not expected to do so in the next 12.

A similar comparison can be made on resources, even though respondents did not appear as optimistic as they were with workload. While many of those who saw their resources increase in the past 12 months expect them to continue to increase in the next 12, a substantial portion expect them to stay the same.

A last point of comparison is that of expected workload with expected resources. If companies expect an increase in the number of projects in the next 12 months, will they be granted the necessary resources, in terms of headcount and budget, to achieve them?

It cannot be said that such a scenario will take place. The most popular response points to an expectation of higher output through the same resources, though the level is quite similar to those who anticipate resources to increase. This means that for those whose output is expected to increase, around half of them will not see any increase in resources. It is always dangerous to reward excellence in the workplace with a higher workload.

A more detailed look at the data can be accessed through the online dashboard offered with the Global Users & Buyers of Insights report itself. You can download it to further your analysis on this and other topics related to users and buyers of insights.

Want to learn more about the Users and Buyers of Insights? Get your copy of the study today:

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution