The projects insights clients externalise to agencies

ESOMAR’s Global Users & Buyers of Insights 2023 report shows that around half of all projects (48%) are conducted internally, with signs hinting at a preference for simpler, likely cheaper projects being chosen for internalisation.

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution

ESOMAR’s Global Users & Buyers of Insights 2023 report shows that around half of all projects (48%) are conducted internally, with signs hinting at a preference for simpler, likely cheaper projects being chosen for internalisation. What does the data say about which types of projects tend to be internalised and which ones tend to be commissioned to external agencies?

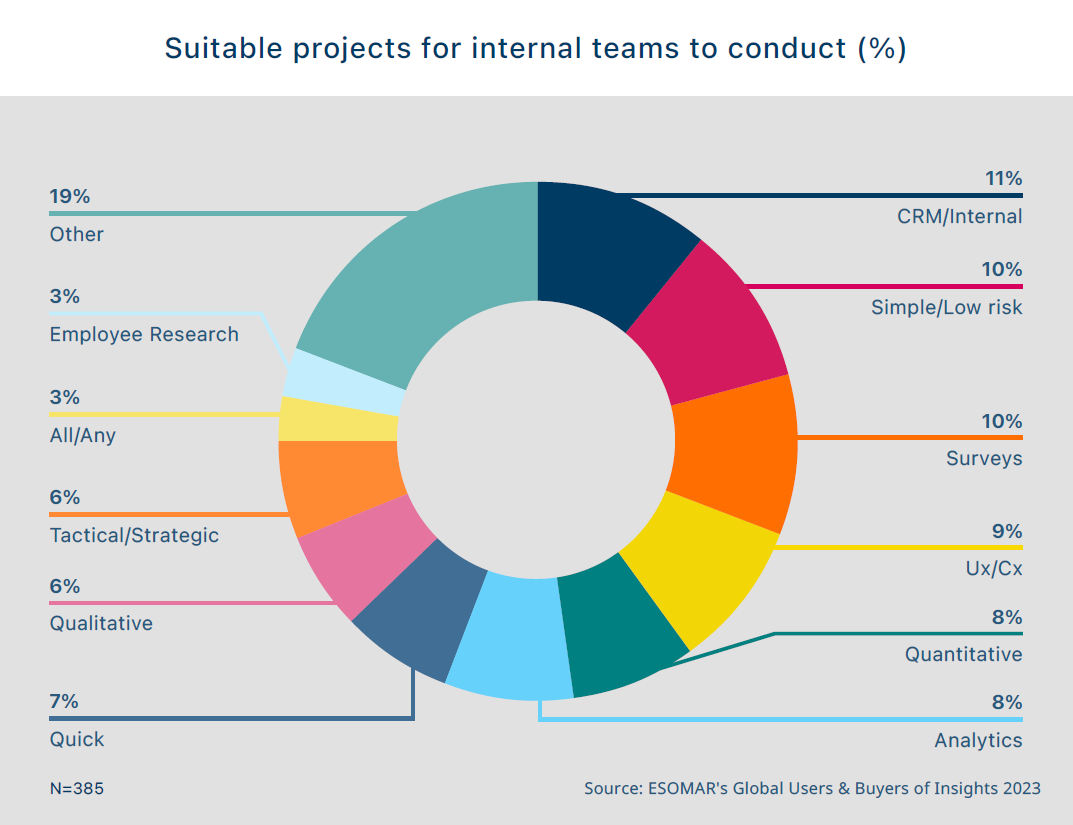

Types of research projects conducted internally

A look at the qualitative responses provided by users and buyers of research for ESOMAR’s report of the same name (see above) sheds light on a series of common themes for many respondents. Research is more likely to be internalised in order to leverage from data collected by the company itself and/or research performed on the company’s current customer base. This is done through internal datasets, customer relationship management (CRM) tools or through other means at the company’s disposal.

Internal research is usually relatively straightforward to implement through the use of questionnaires and other tools to survey the target population and tends to be relatively simple and devoid of risk. Because of the nature of many of the software tools at the users’ disposal, research tends to include a heavy quantitative element. However, they benefit from quicker turnaround and allow users to conduct shorter but regular “pulse” surveys on their known customer base.

A company may choose to conduct a project internally when the nature of the ask is confidential and of particular strategic value or when the study requires very specific and deep knowledge of the company, the segment or certain internal circumstances the company may find itself in.

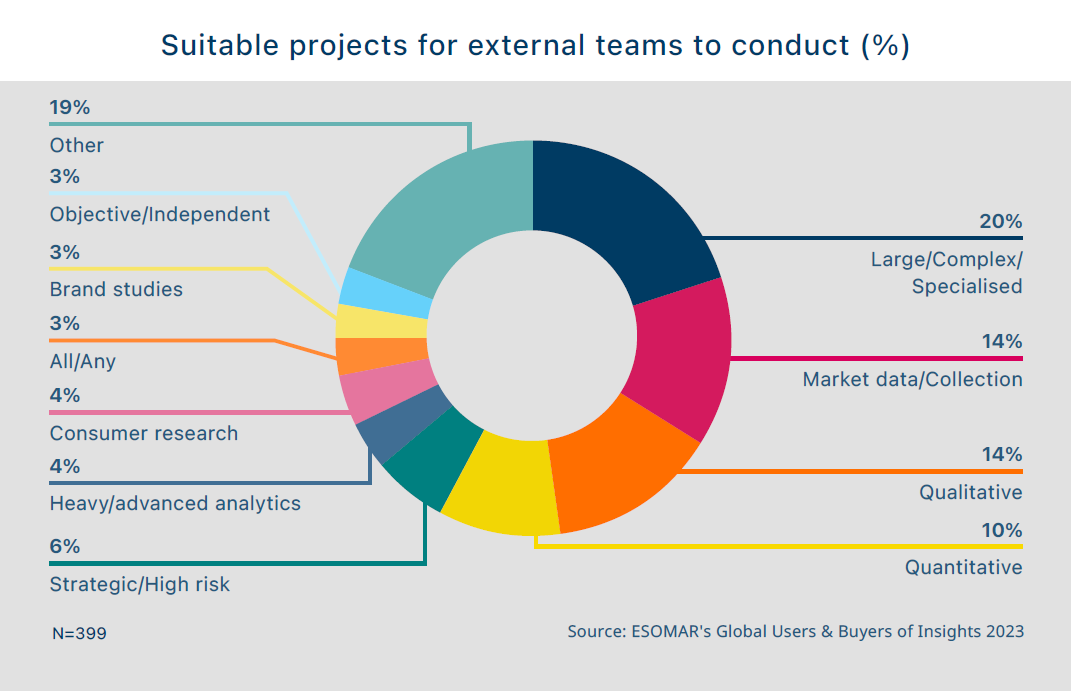

Types of projects conducted through external partners

It is important to understand that users and buyers of insights will choose to externalise those projects that they simply cannot conduct internally. This obvious truism carries a consequence some agencies may yet need to grapple with, which is that expectations from insights partners have evolved accordingly. ESOMAR’s Global Users & Buyers of Insights 2023 report sheds further light on what insights users and buyers wished agencies and insights partners did.

Insights buyers choose to leave the most complex projects to their external partners. Complexity may arise from very different areas, such as the geographical scope of the intended audience, the specialisation required to tackle a particular study or implement a chosen method of either data collection or analysis (conjoint, behavioural, etc.), or unfamiliarity with an audience or market.

The inability to reach out to audiences who are not already engaged with the brand also represents a major factor in why companies would reach out to external agencies since they have the means to study a broader range of individuals. Similarly, studies about target markets, global trends, sector-wide assessments, or competition are examples of projects that are oftentimes delegated to external insights agencies.

The high cost and skill to carry out qualitative projects would also push companies to externalise research, as well as certain quantitative projects, particularly those that require high-level analysis or are particularly complex.

Lastly, certain high-risk projects may be commissioned to external partners, particularly when looking for a new strategic direction.

The online dashboard offered with ESOMAR’s Global Users & Buyers of Insights 2023 report can be further leveraged to dive into these and other considerations for different regions of the world. As the industry evolves over time and tools and technology become more sophisticated, so will the types of projects commissioned externally.

Want to learn more about the Users and Buyers of Insights? Get your copy of the study today:

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Global Users & Buyers of Insights 2023

- The looming threat of insights internalisation

- Why some industry sectors internalise more of the insights function

- The projects insights clients externalise to agencies

- Any solution to the challenges insights teams face?

- Growing internal expertise, higher external demands in research

- How insights agencies will benefit from their clients’ internalisation

- Why insights teams need the agencies’ unique added value

- Understanding the next insights revolution