The ongoing transformation of market research methods

Technological advancements have reshaped market research, but it's not that simple. Here, we provide an edited extract of a chapter that can be found in ESOMAR’s Global Market Research report.

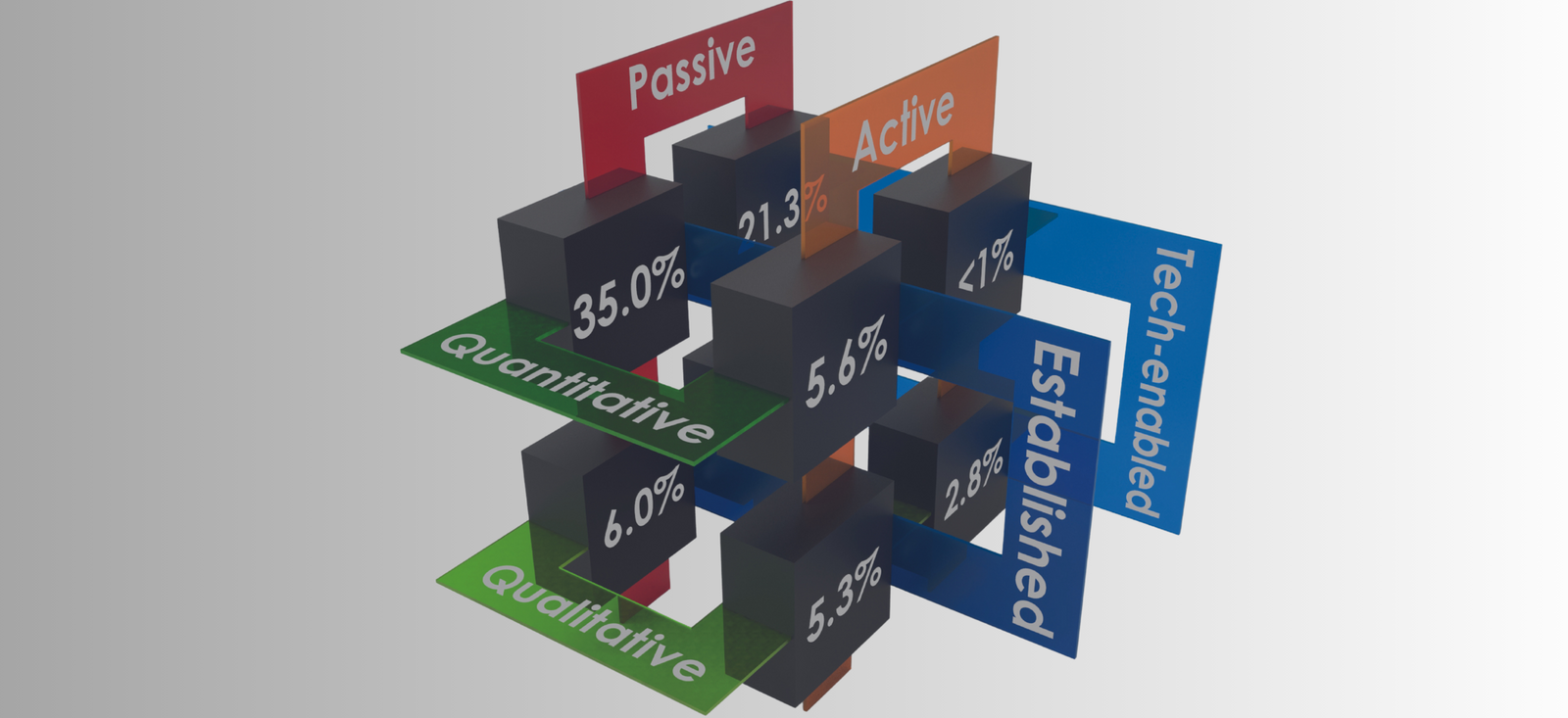

Technological advancements have been at the forefront of the development of much of the insights industry over the past ten years. The methods that emerged as technological applications or software have become an integral part of the practice of research and analysis. However, a return from the bizarre reality of the pandemic has translated into a reemergence of established methodologies, the gradual growth of qualitative methods, and continued reliance on online questionnaires. The Lattice of Research was thus created to present the interconnectedness of the industry and highlight a new layer within the practice of the research profession.

Here, we provide an edited extract. The whole chapter can be found in ESOMAR’s Global Market Research 2023 report.

Quantitative/Qualitative methods

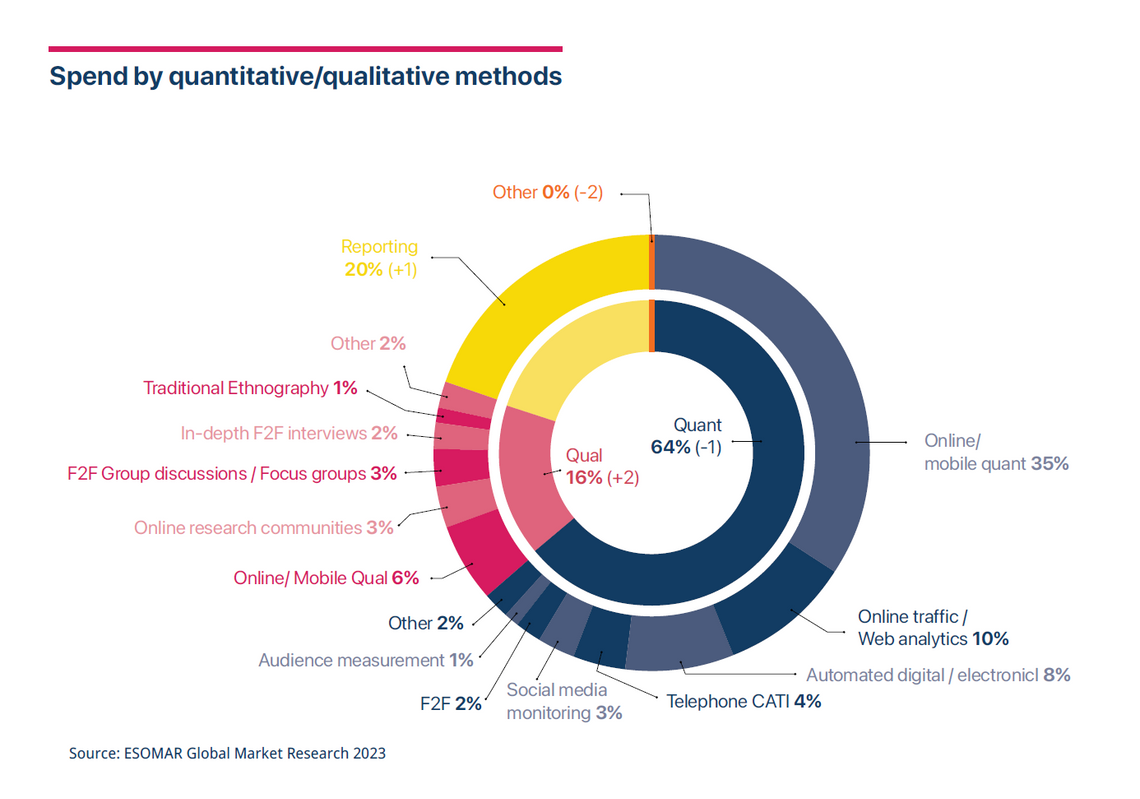

In 2022, the use of qualitative methods increased further and represented up to 16% of global spending; this was a historic level of reported use, marked by increases in both Europe and Northern America. Part of this increase came at the detriment of quantitative data collection, which decreased by one percentage point and represented 64% of global spending.

In 2021, quantitative methods grew significantly, with a year-over-year increase of US$8 billion. This trend, however, cooled down in 2022, partly because of the modest growth declared by some quantitative-heavy countries. Almost all the US$4 billion growth in spending on quantitative methodologies can be attributed to the increased use of online quantitative research. Unlike other quantitative methodologies, this was the only method to have shown an increase in its spending—of almost US$5 billion.

With an almost 30% linear growth rate from 2021, qualitative methodologies gained more than US$3.5 billion globally in 2022, rising to a total of US$17 billion. The post-pandemic rebound has continued over time, with spending on qualitative research methods more than doubling in just two years.

Continued technological advancements will likely allow for further expansion of qualitative data gathering in the overall mix. However, it will also facilitate the collection of more data for analysis, further blurring the lines between what the industry has traditionally called quantitative and qualitative.

Established/Tech-Enabled methods

The report’s data showed a return to established methods of data collection, even if they did not necessarily require the physical presence of the data subject. This was the case with the most popular method: questionnaires.

Questionnaires represent one of the earliest methods humans have used to collect data. The most significant change they have experienced happened in the mode of collection, moving from a primarily face-to-face setting to an online environment. Given that the general considerations for collection and analysis have been well studied over the decades, online quantitative research counts as an established method—now done on a digital platform.

The recovery in the use of established data collection methods in 2021 continued apace in 2022, as the industry saw an increase of over US$7 billion in the practice of these methodologies. The bulk of this growth was attributed to online quantitative research, but the increase in qualitative methods, some of which are established, helped significantly.

Technology-enabled methods remained popular, but spending did not increase in 2022, remaining around US$26 billion.

Active/Passive methods

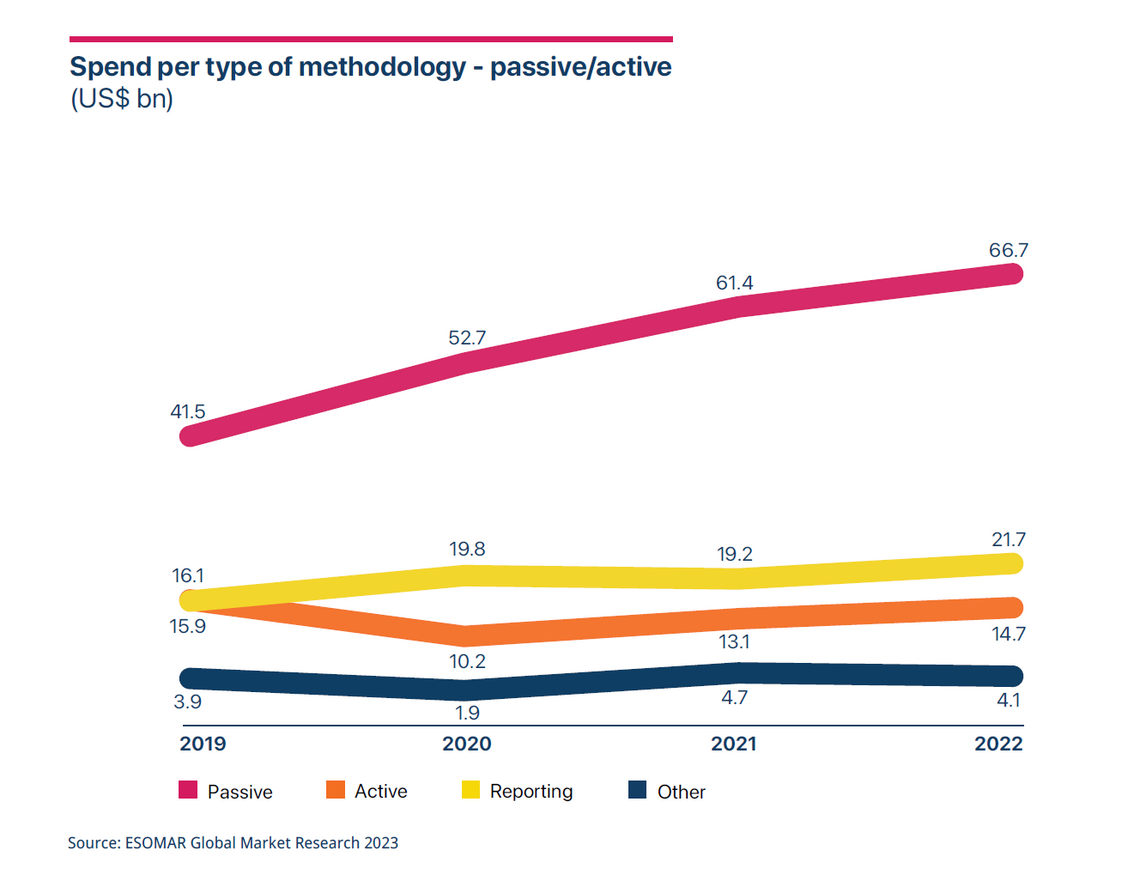

The return to active research methods became apparent in 2022, with a gain of another percentage point after the pandemic. Active methods went from representing 14% in 2022 to 12% in 2021. This result was surprising given the surge in popularity of methods such as online quantitative and qualitative research during 2022.

While movements of methodologies have been minimal, the results continued to show the prevalence of passive data collection and, particularly, of online questionnaires. Over time, research has relied increasingly on passive methods of data collection. As a result, global share has increased more than 60% in the past four years, in 2023 representing a group of methodologies with global spending above US$66 billion.

While active methods may have gained one percentage point of use globally in 2022, their use has actually declined over time by 8%, moving from global spending of more than US$16 billion in 2019 to around US$14.5 billion in 2022.

Curious about the state of the Insights Industry? Get your copy of the Global Market Research report today.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.