Insights in Asia Pacific, set to dominate in 2024

The low inflation experienced in the region enabled the insights industry to avoid net growth turning negative.

Article series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation

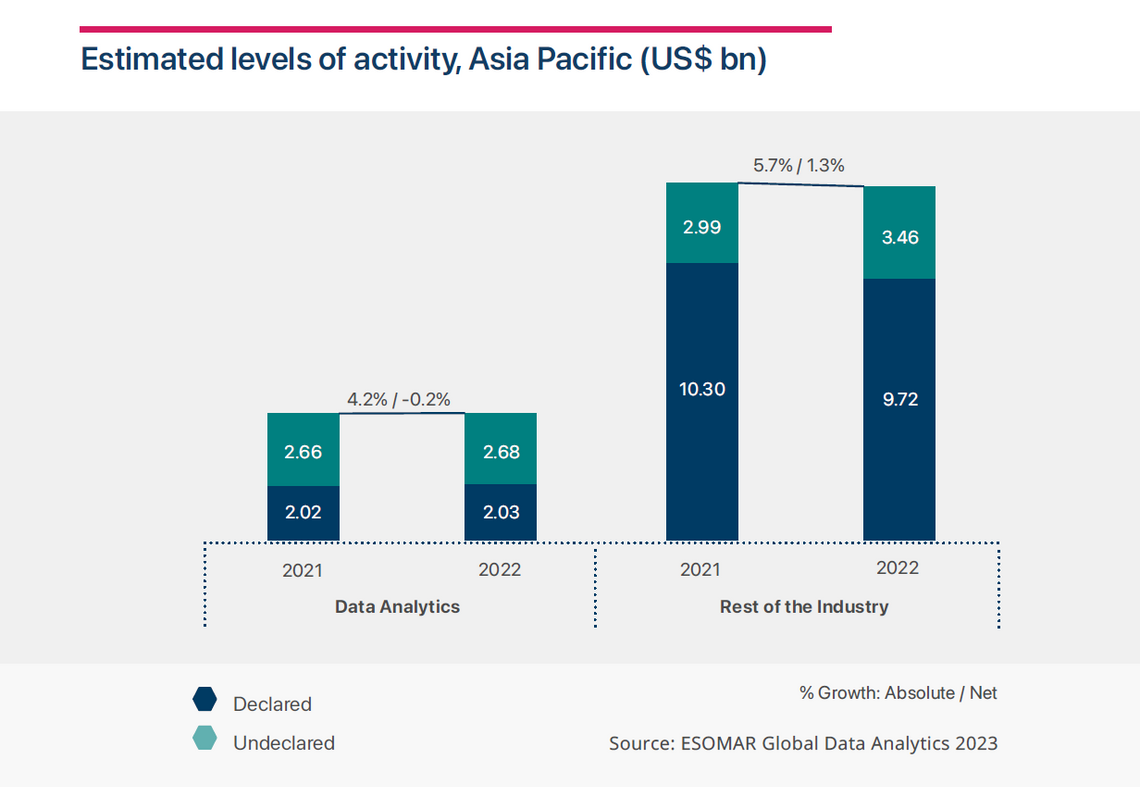

The insights industry in Asia Pacific witnessed significant growth during 2022, with an expansion of +5.3% in absolute terms to a total turnover of US$17.9 billion. The comparatively low inflation rate experienced in the region, at 4.4%, managed to prevent net growth from sliding into the negative and registered a moderate +0.9%.

The Established Market Research sector continues to dominate the region with a revenue twice that of the Data Analytics sector, the latter showing a flat net growth of -0.2% compared to the rest of the industry’s combined +1.3%.

India is at the forefront of the Data Analytics sector, allocating as much as 57% of its total insights revenue to this segment. Taiwan attributes nearly 21% of its total revenue to data analytics companies, and Australia attributes 16% to them.

Conversely, the undeclared revenue for the Data Analytics sector in the region is estimated at US$2.68 billion. ESOMAR hopes to welcome more countries from this region to survey data analytics, DaaS, SaaS, and other platform and subscription companies to present a better picture of this sector and the overall industry.

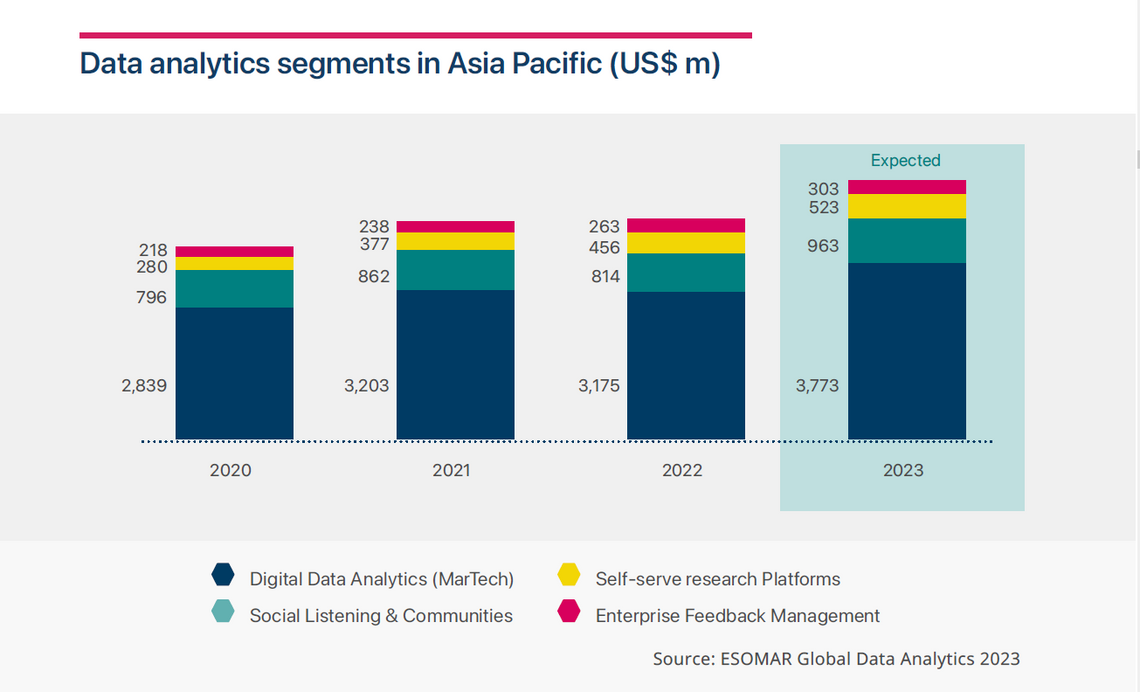

The positive growth of the Data Analytics sector was primarily thanks to the Self-serve Research Platforms segment, which showed an absolute growth of 25.4% for the region. This result shows the shift towards digitalisation of the research function some countries are experiencing and a shift towards internalisation from several countries in this diverse region.

Although starting from a lower base, Enterprise Feedback Management was the only other segment to present growth, at 14.4%. With a turnover of US$263 million, this segment is but a fraction of the sector’s US$4.7 billion within the region.

The largest segment, Digital Data Analytics, showed a moderate absolute growth of 2.7% in 2022, even though it experienced a fall in turnover from US$3.20 billion in 2021 to US$3.18 billion in 2022. The largely US origin of most of the companies operating in this segment makes the negative impact of a strong dollar in exchange rates unlikely.

With an even more pronounced decrease of -2.1% in absolute terms, the Social Listening & Communities segment lets go of almost US$50 million and declares a total turnover of US$814 million.

Overall, the turn to remote self-service tools managed to soften the result of the Data Analytics sector. For 2023, however, Digital Data Analytics (MarTech) is set to dominate results, and we should expect a substantial increase of almost 19% in absolute terms.

The overall insights industry in this region is poised to undergo a robust expansion of +7.2% after factoring in inflation, reaching a total revenue of almost US$20 billion. This notable growth trajectory will be substantially propelled by the Data Analytics sector, which is expected to experience an impressive surge of +13.7% to US$5.56 billion!

Whether you have been following this series about the Data Analytics sector in various regions or, even better, have read the Global Data Analytics report, you would have been correct in realising that Asia Pacific is set to experience the largest growth of the Data Analytics sector globally!

Curious to learn more about the Data Analytics sector? Get your copy of the Global Data Analytics report today.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation