Understanding Europe’s Data Analytics $1bn growth

The Data Analytics sector continues to propel the insights industry in Europe.

Article series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation

The views presented here are part of the Global Data Analytics 2023 report. The report is the first edition of the annual series that will delve into the size, characteristics, and performance of the evolving sector of the insights industry – the data analytics sector.

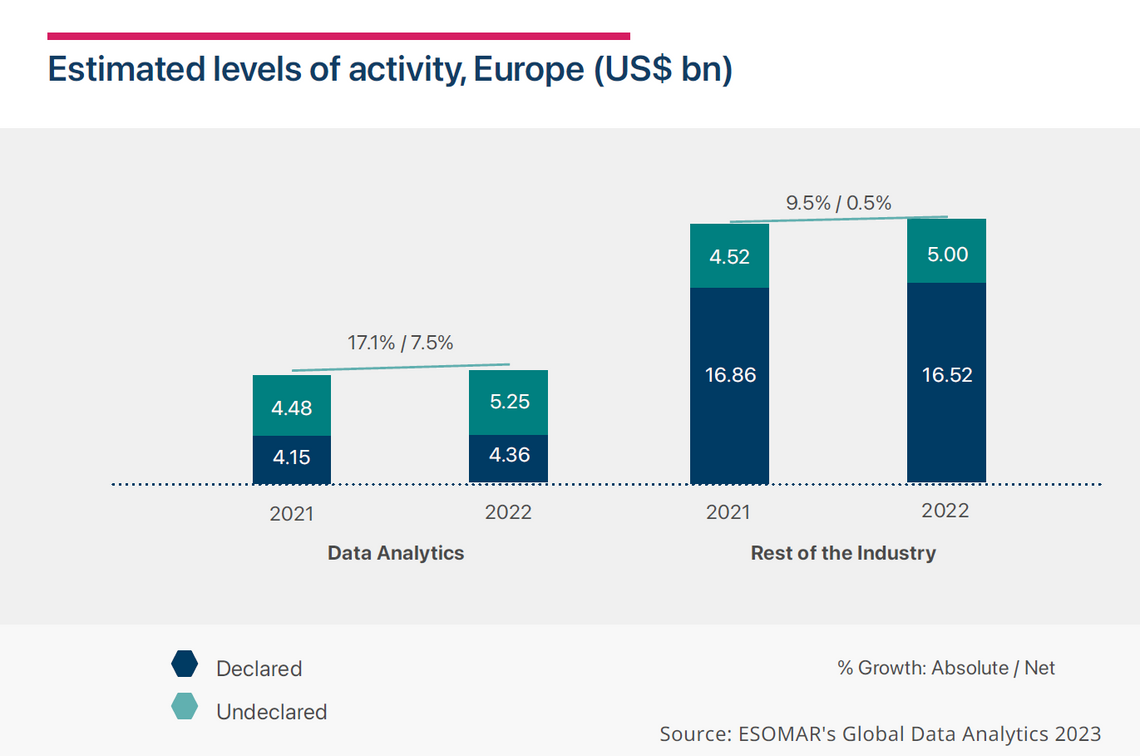

Despite the recent surge in inflation, energy crises, and an ongoing armed conflict, the European insights industry exhibited expansion throughout 2022 of +2.0% in net terms. With the projected decrease in inflation and the alleviation of other supply chain issues, a modest enhancement in the industry is anticipated for 2023, leading to an expected net growth of +3.1%.

The main contributor to Europe's growth in 2022 was, at 7.5% in net terms, the Data Analytics sector. This result contrasts with that of the Established Market Research sector, at -2.0%, as well as the Reporting sector at 1.8% (please, see ESOMAR’s Global Market Research 2023 report for more information). These two sectors, overall, represent a combined net growth for the “rest of the insights industry” of 0.5%.

For 2023, the Data Analytics sector is predicted to expand from its 2022 level of US$9.6 billion to reach US$10.7 billion. As a result, the sector is projected to grow by +4.6% after inflation, which is a more nuanced outcome than the current growth rate of 7.5%.

The United Kingdom has emerged as a leader in terms of its overall insights industry size and displayed a modest industrial net growth of +1.8% during 2022. The main challenges the country faces are the lingering effects of Brexit and the cost-of-living crisis.

Overall, the UK attributes around 36% of its total insights revenue to the Data Analytics sector. Spain and Poland are also emerging as significant players within this sector, each contributing an estimated 25% of total insights revenue towards the sector.

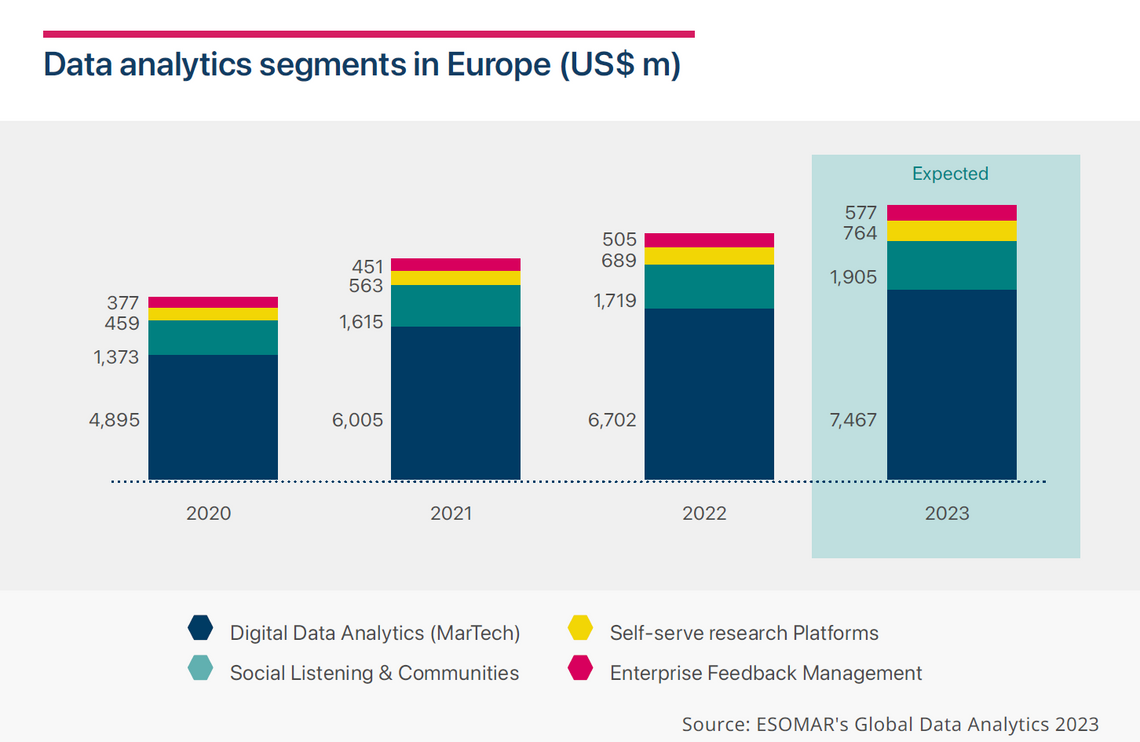

The insights industry in Europe is at very different developmental stages. Still, companies related to the Digital Data Analytics segment added US$700 million to the regional industry during 2022, translating to a growth of 17.4% in absolute terms and a turnover of US$6.7 billion. This segment represents almost 70% of the entire Data Analytics sector in the region.

At a distance lies the Social Listening & Communities segment, valued at US$1.7 billion in the region. Despite its positive growth, it was the lowest one in the region, at 11.9% in absolute terms. It comes after significant expansion in 2021, perhaps boosted by increased demand during the pandemic; now, the segment seems to be showing signs of deceleration.

Starting at a much lower base are companies specialised in Self-serve Research Platforms, which represent an estimated turnover of US$689 million. Possibilities for expansion within this segment do not seem to have been exhausted after the increase in the pandemic and continue to grow at 28.8% in absolute terms during 2022,

The European Enterprise Feedback Management segment continued to expand during 2022 and, with an absolute growth of 17.9%, surpassed the half-billion-dollar level. Although positive, its modest growth will not be sufficient to overtake the Self-Serve Research Platforms segment anytime soon.

Overall, the Digital Data Analytics segment generated the largest added turnover for the industry during 2022 and will continue to modulate growth in upcoming years. It will be interesting to see how the remaining segments position themselves in the next few years.

If Europe were to follow the global trend, the turnover from the Data Analytics sector could surpass that of the Established Market Research sector in about 3-5 years!

Interested in learning more about the Data Analytics sector? Get your copy of the Global Data Analytics report today.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation