Rest of the Americas’ journey through the inflationary hurdles

Though the rest of the Americas demonstrated its economic strength, its growth was impeded by inflation.

Article series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation

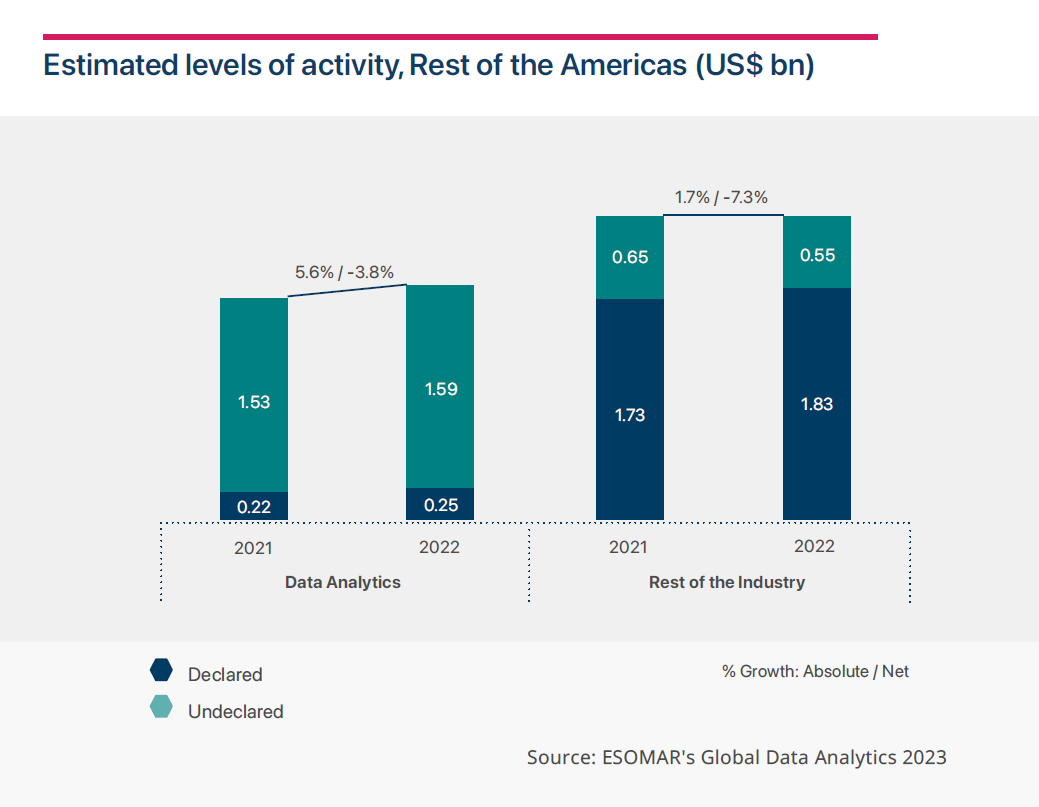

The economic resilience shown during 2022 by the rest of the Americas - a US-centric term encompassing Latin America and Canada - was challenged by the high inflation experienced in many countries. The absolute growth of +6.7% recorded by the industry turned negative after factoring in inflation, at -2.8% in net terms.

The Data Analytics sector performed much better than the rest of the insights industry and grew by +5.6% in absolute terms to US$1.84 billion. This contrasts with the Established Market Research and Reporting sectors, which presented +1.7% of absolute growth and a turnover of US$2.38 billion. The impact of high inflation, however, turned this positive absolute growth into a negative net one, with the Data Analytics sector contracting by 3.8% and the rest of the industry contracting by 7.3%.

Brazil attributed nearly half of its total insights revenue towards the Data Analytics sector, indicating a higher share of the sector over the Established Market Research and Reporting sectors. However, in other countries with available data, the opposite is true.

Overall, the Data Analytics sector is expected to attain a net growth of +4.4% in 2023, reaching a turnover of US$2.2 billion, while the entire insights industry is set to grow by +2.4%, reaching a total turnover of US$4.8 billion.

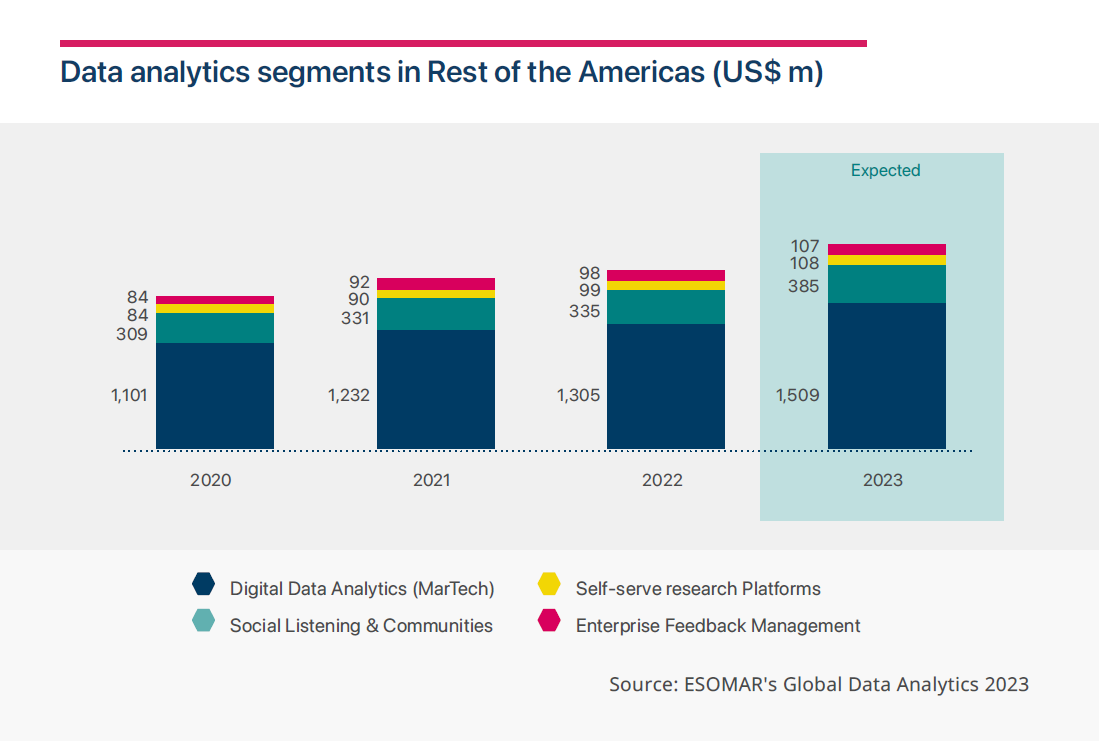

The largest segment in the region, Digital Data Analytics (MaTech), was estimated at over US$1.3 billion and presented an absolute growth rate of 6.4%. The relatively sluggish growth of the segment compared to its behaviour in other regions of the world shows how lightly rooted it remains, perhaps because of the reliance on established market research practices that have proven reliable and easier to implement over the years.

The fastest-growing segment in the region, with 9.9% in absolute terms, is Self-serve Research Platforms. As the research function becomes easier to internalise, the tools that facilitate this transition continue to observe increased demand. This is reflected in the segment showing some of the fastest growth rates globally for the second year in a row.

The Social Listening and Communities segment showed rather flat growth in the region over 2022, with an absolute rate of 1.4%, whereas Enterprise Feedback Management mirrors the behaviour of Digital Data Analytics and grew 6.3%.

The expectation for 2023 is that inflation will once again stifle the growth of the Data Analytics sector and turn what could be considered a promising 14.8% growth in absolute terms into a more nuanced 4.4% in net terms.

Curious to learn more about the Data Analytics sector? Get your copy of the Global Data Analytics report today.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation