Inflation curtails promising Middle Eastern and African prospects

Inflation has converted those positive absolute growth into negative net growth in the Middle East and Africa.

Article series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation

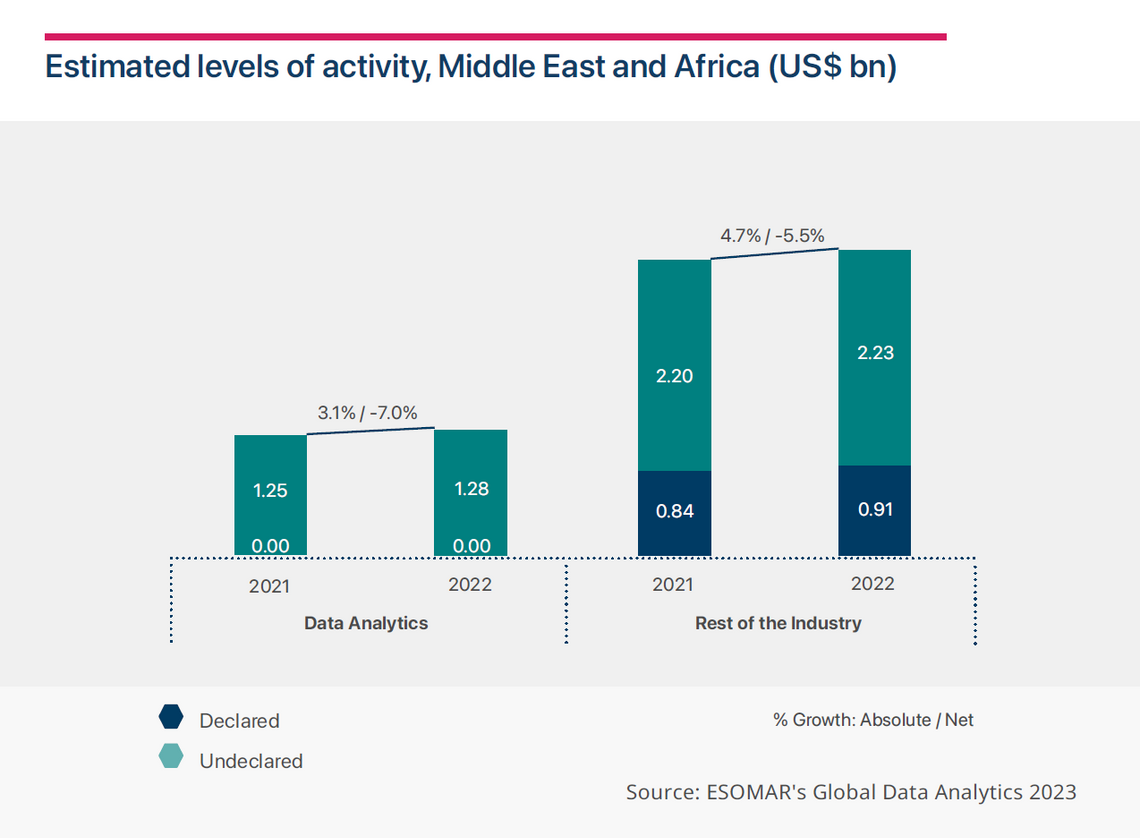

The elevated inflation rates of many of the countries in these regions turned an apparent positive absolute growth with a US$4.4 billion turnover into a negative net -6.0%, as shown in ESOMAR’s Global Data Analytics 2023. The Data Analytics sector exhibited a growth of -7.0% in net terms, while the rest of the industry experienced a slightly milder deceleration and grew at -5.5% in net terms.

The available data shows how the combined sectors of Established Market Research and Reporting hold a more prominent presence compared to the Data Analytics sector, despite certain localised technological centres like the so-called “Silicon Savannah” of Kenya and others.

Because of the limited number of countries actively monitoring the Data Analytics sector, most of the sector’s US$1.29 billion revenue remains undeclared. The reported turnover figures for the region are primarily based on data provided by Nigeria and Tunisia. In these two nations, the Established Market Research sector exhibits a more dominant presence and, as a result, they allocate less than 5% of their turnover to the Data Analytics sector.

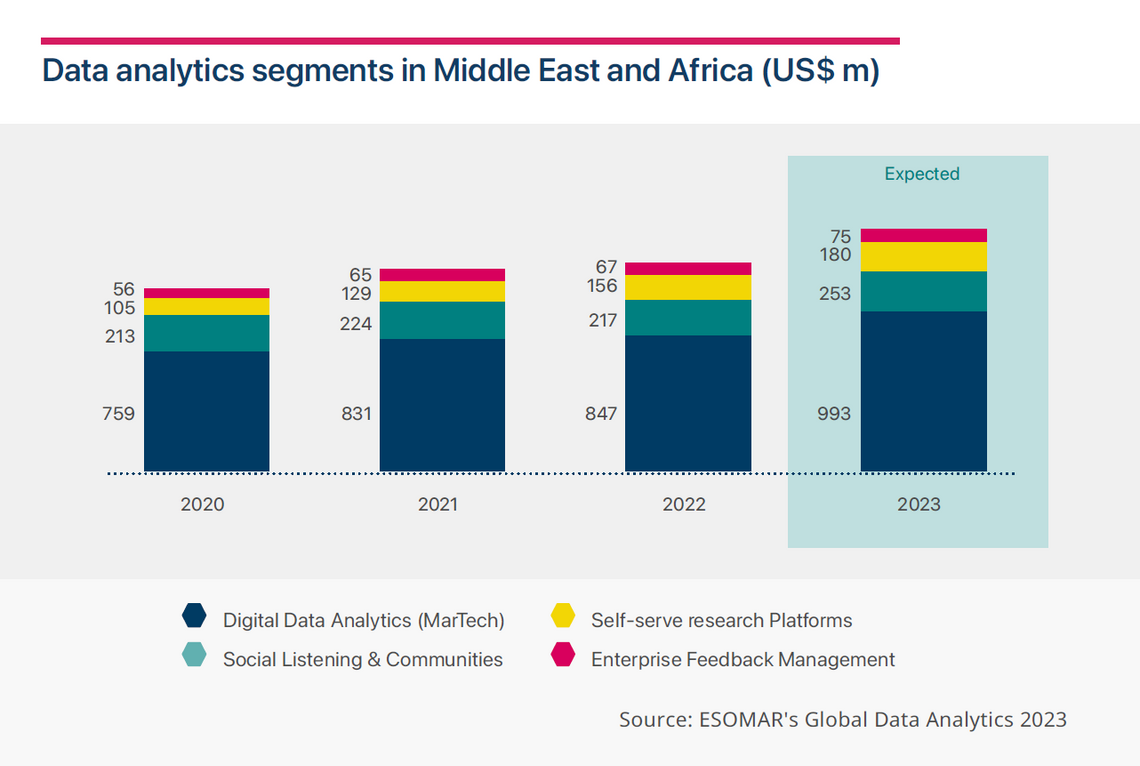

Most of the growth in the Middle East and Africa is attributed, curiously, not to its largest segment, Digital Data Analytics (MarTech), but to Self-serve Research Platforms. This segment grew 21.1% in absolute terms and, despite its small base of just US$156 million, has managed to expand by around 50% between 2020 and 2022.

This result shows the transition in the approach to research within the regions and how different business models are adapting to the resulting changes in demand. Self-serve Research Platform companies added more than US$27 million to the industry output, the highest of all four segments.

The only segment that showed a decrease in turnover was Social Listening and Communities, with -2.9 % in absolute terms and a fall from US$224 million in 2021 to US$217 in 2022, a level not too different from 2020.

Digital Data Analytics, however, managed to present modest absolute growth of -1.8%. With an added output to the industry of around US$16 million, the segment shows signs of stagnation within the region. As hypothesised previously, this may be a sign that the segment is not as deeply rooted in the regions, making it more vulnerable to headwinds. This is supported by the general reliance on established research in these regions.

Starting from a low base of just US$67 million, Enterprise Feedback Management companies present a combined absolute growth of +3.5%. Along with Self-serve Research Platforms, this is the only segment to present positive results in 2022.

The year 2023 is anticipated to offer a degree of relief to the industry. Forecasts indicate a rebound of the Data Analytics sector to +7.3% in net terms, ultimately reaching a turnover of US$1.3 billion. This positive result, combined with the modest growth of the rest of the industry, is expected to result in an overall growth of +1.1% in net terms and a total revenue for the region of US$4.9 billion.

Curious to learn more about the Data Analytics sector? Get your copy of the Global Data Analytics report today.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation