How have study designs evolved in 2024?

This excerpt from ESOMAR’s Global Market Research 2024 offers a comprehensive overview of the market research industry.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry

The following article is an excerpt from ESOMAR’s Global Market Research 2024. This flagship report of ESOMAR, often dubbed as the “Bible of Market Research”, provides you with the most comprehensive overview of the state of the insights industry and the market research sector around the world using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

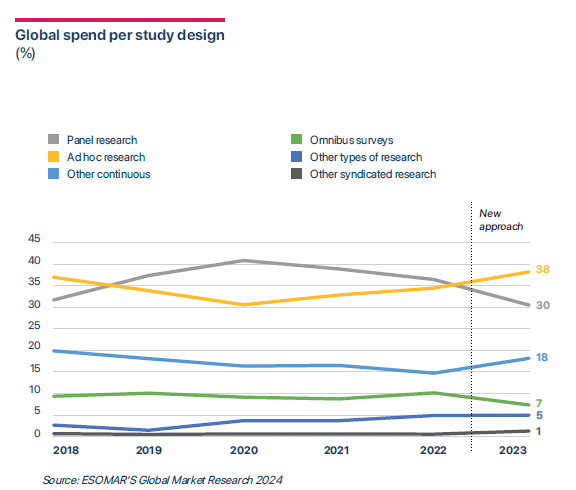

Regarding the study design, the impact compared with the 2022 findings is not so great, and some comparisons with earlier years can still be sensibly made.

Another change to the study design question is the exclusion of self-serve study design, which has been folded into “others”. In previous years, self-serve platforms were included as a form of study design, and they constituted only 4% of the total study design in 2022.

Readers may consider a share of 4% in 2022 to be surprisingly small when there has been so much industry discussion. Please note that this reflects only a portion of market research firms’ turnover venturing into the research software sector, which ESOMAR reported as 29%. This low share shows that self-serve is mostly provided by research software firms instead of market research companies. For instance, clients, NGOs, and universities that were conducting their own studies use the research software packages (please refer to the Global Research Software 2024 report for more information on this sector). ESOMAR’s Global Users & Buyers of Insights 2023 confirmed that there was significant research conducted by clients, accounting for around 50% of their total spend.

Despite some changes to the questionnaire, the results were still reasonably comparable to the previous year. The movements in the market in the study design were not so remarkable, but there is certainly a story to be told.

A tale of panel research and ad hoc research

Prior to the COVID-19 pandemic, ad hoc research was one of the most important designs, but during the years of the COVID-19 pandemic, ad hoc lost the mantle to panel. What is “panel”? The term “panel design” may confuse some as it is not the panel of companies such as Dynata or GMO but mainly continuous and syndicated such as TV ratings (e.g. Nielsen Media), retail audits (e.g. Intage or GFK) and consumer panels (e.g. Kantar World Panel). The method of collection is generally conducted without an interviewer; consequently, during COVID-19, panels were able to continue largely unaffected. Consequently, during the years of 2019–2022, the panel became the leading study design. Ad hoc also suffered in those years as budgets were cut while panel budgets were less affected because of long-term contracts.

Now that global business is generally back to normal, so too are the clients. For some years, manufacturers and marketers have not introduced new products and are less able to conduct product or image studies. That scenario seems to have changed in 2023, and ad hoc research has had a new burst of life.

Overall, ad hoc research now is responsible for 38% of study design with panel dropping back a little to around 30%.

Omnibus, which has been declining in many markets (but not the USA) has fallen to around 7%. Omnibus has traditionally been a design to offer low prices for a large sample when only a few questions are required. However, low cost online for small studies can now be found at much faster turnaround times.

Other continuous designs have shown a recovery as well at 18%. This is understandable as these would be mainly tracking studies that were also affected by COVID-19 when marketers could not act on the data at that time and cut back expenditure.

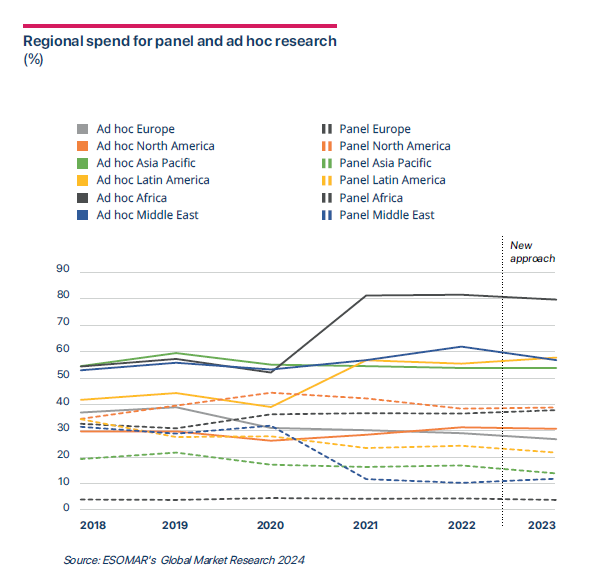

The two major regions, Europe and North America, exhibit similarities in ad hoc and panel design shares while Europe has considerably more other continuous design and North America more omnibus.

Philippe Guilbert

Consultant at Syntec ConseilPhilippe is the former Managing Director of Toluna France and Senior Vice President Quality of the Group. He is now a consultant in research methodology for companies and SYNTEC Conseil, and contributes to the dissemination of rules, standards and best practices in the industry through conferences, academic courses and articles, including his "Did you know?" section on the French website MRNews.

In the 1980s, he developed advanced statistics, survey methodologies and new marketing approaches in research agencies. Then in the 90s, he initiated the survey digitisation by launching an international panel of Internet users, the web audience measurement and the sampling/questionnaire adaptation to the Internet. In 2007, he joined Toluna, a French start-up, to bring his methodological expertise and make it the world's #2 online panel and survey solution.

Philippe is a member of the ESOMAR Professional Standards Committee since 2014.

John Smurthwaite

Ambassador for the Asia-Pacific Region at Esomar, President at Marketing Research Society of MalaysiaJohn Smurthwaite is the ESOMAR Ambassador for the Asia Pacific region which covers 18 countries from NZ in the south to Mongolia in the north, Philippines in the east and Pakistan in the west. John took on this role after retiring from KANTAR in 2016.

The role of Ambassador is to work closely with all the ESOMAR representatives in the region as well as link up with the national associations to support your needs in the region. In normal times, John manages ESOMAR Best of Series events as well as assisting in the many ESOMAR events in APAC.

John is based in Malaysia and is currently the President of the Marketing Research Society of Malaysia.

John began his research agency career with an Australian company in Melbourne called Frank Small and Associates which was later acquired by Sofres/TNS/KANTAR and continued working with the acquiring companies John transferred to Malaysia in 1977 and then to Hong Kong in 1981 to begin developing Frank Small and Associates throughout the region developing offices in Philippines, Indonesia, Korea, Taiwan, Japan, Vietnam and India. John managed the APAC region as TNS CEO/Chairman for many years until his retirement.

John is a member of ESOMAR advisory panels and committees such as on Global Market Research and Pricing reports as well as the Association Executive and Representative committees.

Article series

Global Market Research

- Drivers of our $142bn insights industry

- 2023’s Market Research Anchor Europe’s Insights Industry

- The Remarkable Ascent of Asia Pacific in Global Insights

- The Economic Awakening of Latin America

- Navigating trends and challenges in the Africa and Middle East region

- Why the demise of tracking cookies signals a win for market researchers

- How are research methods evolving?

- Global evolution of market research projects

- How have study designs evolved in 2024?

- Inside the $153bn Insights Industry