Where does the research software sector stand in 2024?

The $153 bn insights industry – Which sector drives the insights industry’s growth? What challenges did these segments face in 2024?

The following article is an excerpt from Esomar’s Global Research Software 2025. This report provides the most comprehensive overview of the state of the insights industry and the evolving research software sector worldwide, using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

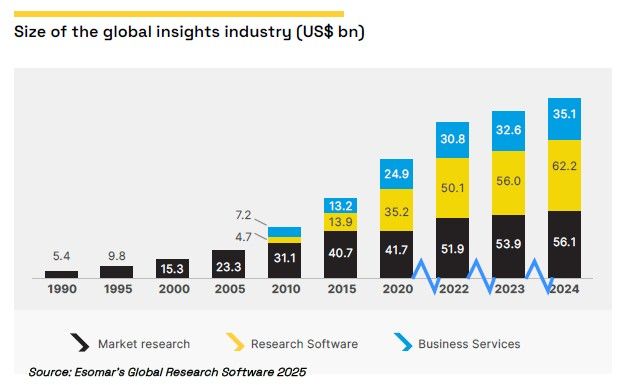

Globally, the insights industry is estimated to have surpassed US$150 billion as of 2024 and is expected to surpass US$160 billion by the end of this year. Of these, the market research sector accounts for US$56 billion, the research software sector for US$62 billion, and the business services sector for US$35 billion. Please turn to Chapter 9 to access this data in more detail.

When looking at where growth came from in 2024, one sector clearly stands out: the research software sector, which continues to drive most of the insights industry’s growth.

While 2023 was a year characterised by limited industry growth resulting from the relatively high interest rates imposed as a response to post-COVID-19 pandemic inflation, 2024 gave signs of incipient recovery. By sector, market research reflected the characteristics of a mature and consolidated industry, expanding by 4.8%. In contrast, research software continued to lead with growth of 11.5%, while the business services sector advanced at a steady pace of 8%.

Following a period of high interest rates in 2023 and slowed investment, many central banks began to lower rates slightly. However, this easing was not significant enough to prompt a full recovery of substantial investment activity. In this regard, 2024 was defined by a cautious global economy, which nonetheless showed a positive, continuous growth in all sectors.

Globally, the gap between the research software sector and market research continues to widen. While their turnover was almost equal in 2022, the difference was over US$2 billion in 2023 and over US$6 billion in 2024, with no slowdown in sight. The business services sector, composed of consultancy firms and other reporting companies, remained stable compared to 2023, accounting for around 23% of global turnover.

Nevertheless, despite being the sector with the highest industry growth, at 11.8%, the research software sector did not grow at the same pace as in previous years.

The market research sector recorded a moderate growth of 4.8% compared to the other sectors, a sign of a mature and more consolidated industry with mostly organic growth. This sector includes sample panel provider companies that play a fundamental part in many research projects. Compared to 2023 and previous years, this segment experienced a relatively higher growth (3.0%), which could be reflective of more demand from clients based on their business needs.

The slowdown in investment in 2023, which partially continued in 2024, has resulted in a more moderate growth for the research software sector, composed of four segments as illustrated in the table below (digital data analytics, social listening and communities, self-serve research platforms, and enterprise feedback management). While growth for each of the four segments was in double digits during 2022, only one of the four segments has maintained double-digit growth: digital data analytics (+15%), which remains one of the largest segments worldwide and seems poised to challenge the market research sector soon.

Compared to 2023, the other segments are maintaining their pace of growth, with the exception of self-serve research platforms, for which demand appears to have declined.

The breadth of the industry, representing companies with a business model very different from that of familiar project-based agencies, makes it increasingly important to remind the entire industry of the need for self-regulation. A more heterogeneous industry makes the role of Esomar and the other associations around the world even more consequential. The revision of the 2025 ESOMAR/ICC code, combined with our collaborative efforts to ensure ethical and fair practices, will help ensure the industry's longevity and success for many years to come.

Don’t lose the chance to read the full chapter in the Esomar’s Global Research Software 2025!

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.