In-House or Agency? How Insights Leaders Are Redrawing the Line in 2025

Information for this article was extracted from ESOMAR’s Global Users & Buyers of Insights 2025, and can be further expanded by making use of the online dashboard that comes with the report.

The make-or-buy decision in market research remains one of the most strategic choices insights leaders face. New global data shows that company size, team structure, and rapidly evolving internal capabilities are driving a more sophisticated balance between internal execution and external partnerships.

Team composition and structure

Smaller organisations (<200 employees) typically field insights teams of fewer than 10 people — rarely a lone researcher — reflecting a clear preference for collaboration even with limited resources. Larger enterprises (>1,000 employees) most commonly run teams of 10–99 professionals, though surprisingly lean configurations (2–9 people) persist, particularly in pharmaceuticals and CPG/FMCG where complex projects are routinely outsourced. Technology, media, and communications companies, by contrast, maintain the largest internal teams to handle higher in-house volumes.

Team structure is emerging as the stronger predictor of how much research actually stays internal.

Centralised teams (single dedicated unit) dominate companies with 200+ employees and achieve the highest global in-house rate: 52%.

Hybrid models — combining a centre of excellence with embedded researchers — are the structure of choice in enterprises with >1,000 employees and deliver 49% internalisation.

Fully decentralised setups are less common but edge ahead at 50%, thanks to tight business-unit alignment.

Teams housed inside marketing departments trail at just 43%, suggesting that proximity alone does not guarantee ownership of the research agenda.

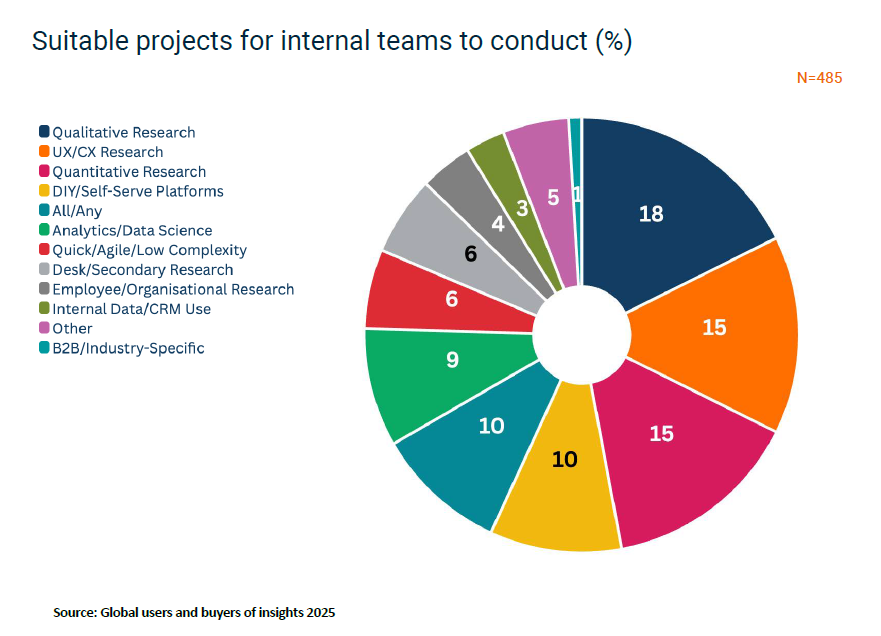

What’s Staying In-House in 2025

The profile of internally executed projects has shifted markedly since 2023. Internal teams now confidently handle work that is fast, iterative, and deeply tied to proprietary data and ongoing customer touchpoints.

Leading internal project types:

Qualitative research – 18% (strong growth)

UX/CX studies – 15%

Quantitative research – 15%

DIY/self-serve surveys – 10%

Quick-turn/low-complexity & proprietary-data projects – ~12% combined

This evolution reflects upgraded tools, stronger methodological skills, and the strategic priority of speed and agility. Confidentiality requirements and projects demanding deep company-specific context (analytics, data science, specialised B2B) also remain firmly internal.

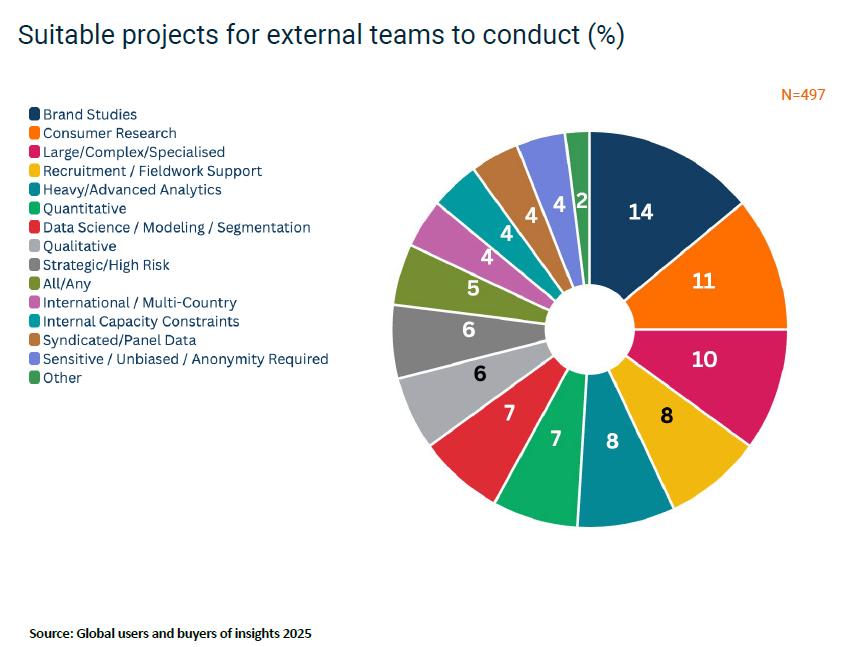

What Still Requires External Partners

When projects demand scale, specialised expertise, global reach, or strict impartiality, agencies remain the go-to choice.

Most commonly outsourced:

Brand tracking & equity studies – 14%

Broad consumer understanding – 11%

Large-scale or highly specialised initiatives – 8%

Resource-intensive quant, advanced analytics, and complex qualitative – 21% combined

Entering new international markets, accessing hard-to-reach audiences, or ensuring complete objectivity continue to make external partners indispensable — no matter how capable internal teams have become.

Curious to know more about it? Don’t lose the full chapter in the Global Users and Buyers report!

Lilas Ajaluni

Market Intelligence Analyst at EsomarLilas is Italian with Syrian origins and studied Economics and Finance in Padova and did an internship next to her studies at Generali. She was, amongst other activities, responsible for qualitative and quantitative data research, its visualisation, simulation models, and preparing data for presentations to internal and external stakeholders.

She got married and immediately after moved to the Netherlands in December 2021, and worked as Strategy Analyst at Varian for 6 months.

She joined ESOMAR in March 2023, where since then, she has been responsible for developing the different reports and studies regularly published by ESOMAR’s Intelligence Unit and aggregating materials (such as bundles of academic articles, case studies and videos), internal and/or external, that support the role of ESOMAR as a thought leader that represents the data, analytics and insights industry.