The $36bn hegemony of Data Analytics in the US

In recent times, the U.S. witnessed a notable upswing in the insights industry, achieving a substantial absolute growth of 14.3% and reaching an overall turnover of US$71 billion.

Article series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation

The views presented here are part of the Global Data Analytics 2023 report. The report is the first edition of the annual series that will delve into the size, characteristics, and performance of the evolving sector of the insights industry – the data analytics sector.

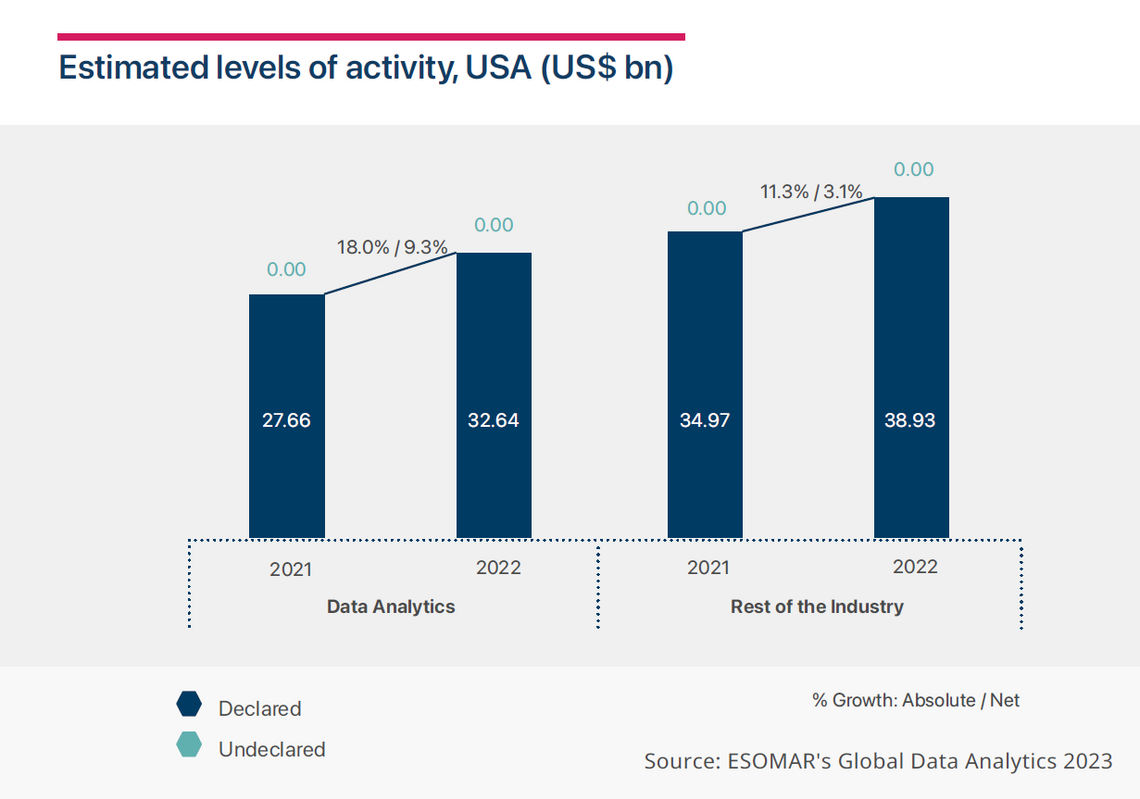

In recent times, the U.S. witnessed a notable upswing in the insights industry, achieving a substantial absolute growth of 14.3% and reaching an overall turnover of US$71 billion. However, an inflation rate nearly parallel to the global level, standing at 8%, turned net industry growth into a more nuanced 6%.

The principal driver behind the industry's expansion was the Data Analytics sector, with a net growth of 9.3%. This contrasts with the Established Market Research and Reporting sectors, which, combined, experienced a more modest net growth of +3.1%. This notable growth resulted in the Data Analytics sector surpassing the Established Market Research sector in turnover for the first time. As such, up to 45% of its total revenue corresponded to the Data Analytics sector in 2022, amounting to US$32.6 billion. This result showcases the dominant influence this region exerts globally within this sector, leading as one of the top three largest markets globally.

In 2023, the insights industry in the US is poised to sustain this trajectory of expansion to attain a turnover of US$77 billion, with the Data analytics sector maintaining its dominance with a turnover of US$36 billion. The effect of inflation is expected to have been more moderate in 2023, resulting in a net growth of +4.0% for the overall industry and +7.0% for the Data analytics sector. At the time of publishing the Global Data Analytics report, the recession prophecies of 2023 were unfulfilled as the policies adopted by the Federal Reserve Board successfully helped the nation achieve the proverbial “soft landing”. However, as market experts highlight, this could imply that the market is merely moving from one idiosyncratic disequilibrium to another.

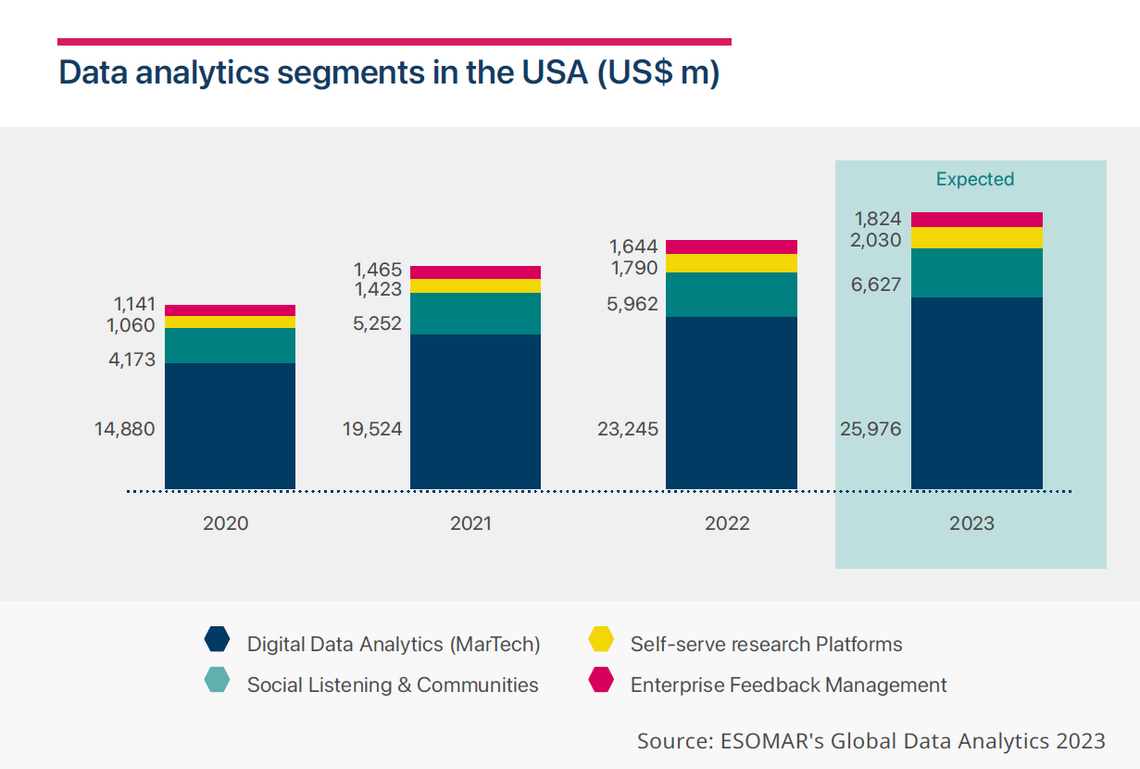

All segments experienced significant absolute growth in the US, especially the Digital Data Analytics and Self-serve Research Platforms, with around 19.1% and 25.8%, respectively. The development of the Data Analytics sector in the US is indicative of two specific factors.

On the one hand, it indicates the lack of saturation within the market as new companies continue to appear in the landscape, technological developments open up new capabilities and reduce implementation costs, and demand remains strong.

On the other hand, strong investment in the sector allows for a substantial level of expansion, leading to mergers and acquisitions and overall consolidation of the industry. While the largest players enjoy a substantial market share, they are continually challenged by a constellation of companies appearing with new tools and business models.

The Social Listening and Communities segment presented an absolute growth of 13.5%, reaching almost US$6 billion in 2022. While growth may not seem as significant, this segment’s turnover has expanded by more than 40% since 2020.

Similarly, the Enterprise Feedback Management segment presented an absolute growth of 12.2% in 2022, surpassing US$1.5 billion in turnover.

The Data Analytics sector is expected to continue to propel the USA’s insights industry forward in 2023 with a net growth of 6.9%, reaching more than US$36 billion in turnover. Globally, the US market share will remain at 65%, with the overall Data Analytics sector reaching new heights of US$ 56 billion in turnover!

Interested in learning more about the Data Analytics sector? Get your copy of the Global Data Analytics report today.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Data Analytics 2023

- Understanding Europe’s Data Analytics $1bn growth

- The $36bn hegemony of Data Analytics in the US

- Insights in Asia Pacific, set to dominate in 2024

- Rest of the Americas’ journey through the inflationary hurdles

- Inflation curtails promising Middle Eastern and African prospects

- Insights industry: The tech vendors remix

- Self-regulation - a reliable compass for Data Analytics?

- The role of software providers in the insights industry

- From transaction to integration thanks to the digital transformation