The post-pandemic dominance of CRM and UX research

Almost all of the world’s regions experienced a substantial increase in user experience research since 2019

Article series

Qualitative methods

- Safety and (dis)comfort in qualitative research

- Predictive qual

- Insight communities – hidden depths

- Brand ethics in pandemic time

- The hidden key to happiness

- Identity conflict

- Sales and market research

- Practising empathy

- Market research vs. UX research

- What do the futures of quant and qual methodologies hold?

- Social listening has a long way to go

- What I learned in my first 6 months as a market researcher

- Asking questions that will inspire more transformative insights

- Challenges of qualitative research today - Part 1

- Welcome to the Twatterverse!

- Challenges of qualitative research today - Part 2

- Best practices in writing a discussion guide

- Experience improvement

- The post-pandemic dominance of CRM and UX research

The growth of CRM and Ux research

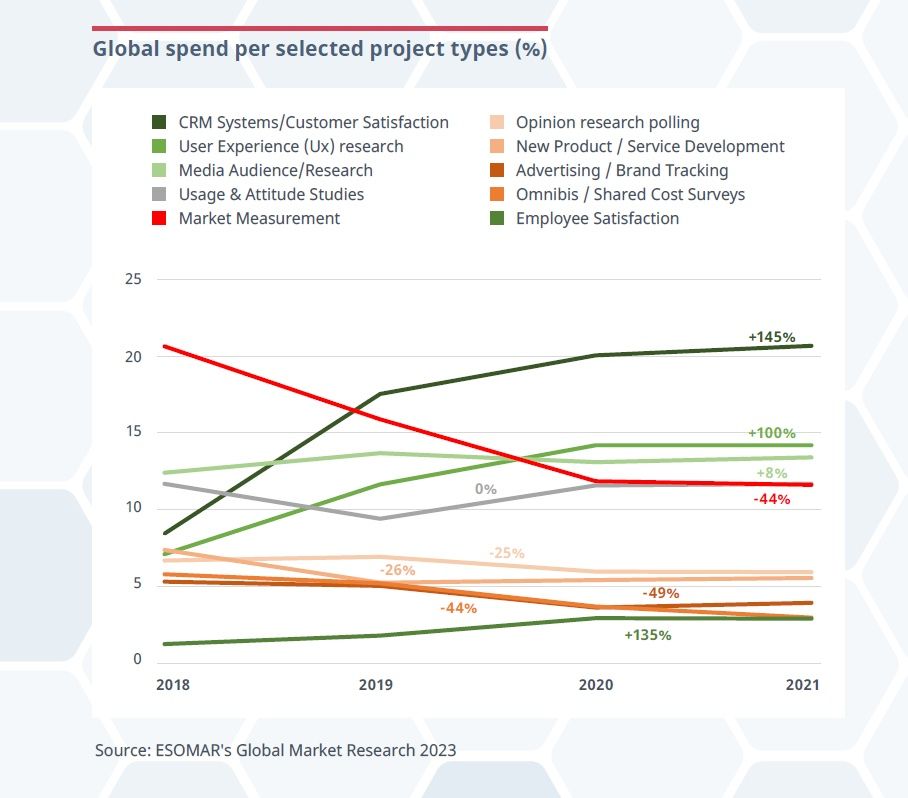

The weight of the US on the world stage becomes apparent when observing the trends of some selected project types at a global level. Much of the growth in CRM systems with a +145% increased share over the 2018-2021 period, employee satisfaction studies with +135%, and user experience research with +100% stem from a remarkable increase in these types of projects in this country.

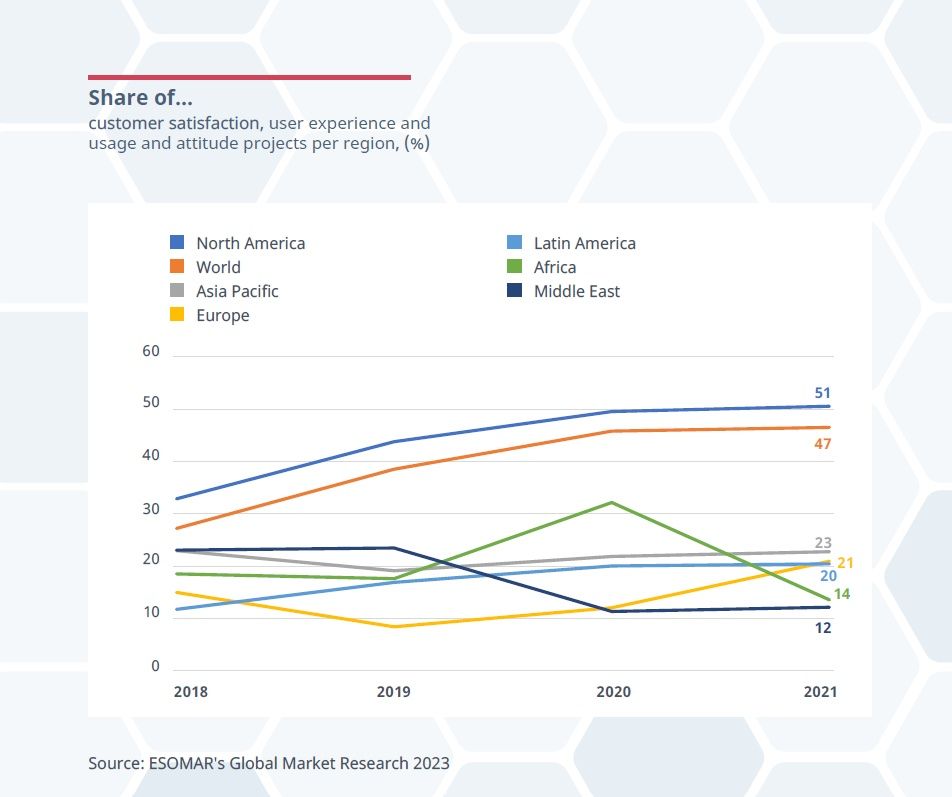

However, almost all of the world’s regions experienced a substantial increase in user experience research since 2019, even though it still represents a low share of spend for most of them. Some regions like Europe, Asia Pacific and Africa doubled their share of this project type with +186%, +97% and +295%, respectively.

Research utilising CRM systems for customer satisfaction grew only in Europe, North America and Asia Pacific since 2019. The largely tech-enabled implementation of methods usually chosen for these types of projects intuitively shows the reason behind this growth. Judging by the low level of turnover garnered through these project types in 2018, this market appears to be relatively immature. A look at the list of top insights companies presented in ESOMAR’s Global Top-50 Insights Companies, however, shows the fantastic potential that exists for these project types. The turnover of the third largest company alone, Salesforce, represents around one-fifth of global spending.

It is interesting to consider customer satisfaction and user experience projects in combination with usage and attitude studies, particularly when looking at their behaviour during 2020 – the latter shows a stable share but monetary growth between 2018 and 2021. The pandemic forced a substantial proportion of the world’s population to adapt to a new reality they had not foreseen, nor had they wished for. This new set of circumstances effectively created an unknown type of consumer that required understanding. Interest in responding to these questions cooled down over 2021 globally, though they still showed the largest growth rates.

Conversely, market measurement projects stumbled during 2020, as the worldwide shock temporarily froze the expansionist desires of companies. New product development similarly slowed down along with advertising/brand tracking, as marketing efforts were redirected towards an entirely new set of home devices. While market measurement recovered slightly over 2021, it still displayed a 44% decline over the 2018-2021 period.

Lastly, omnibus/shared cost surveys continue their downward trend, presumably fuelled by two parallel phenomena. On the one hand, the pandemic slowed the signing of new, coordinated projects. Instead, clients focused their spending on a limited number of ad hoc projects and started bringing more research in-house through self-service platforms. On the other hand, a larger portion of the research seems to have a more specific intent through panel research, with data gathered over time with a clear goal in mind. With -49%, Omnibus has declined every year between 2018 and 2021.

Ad hoc and panel research struggle for popularity

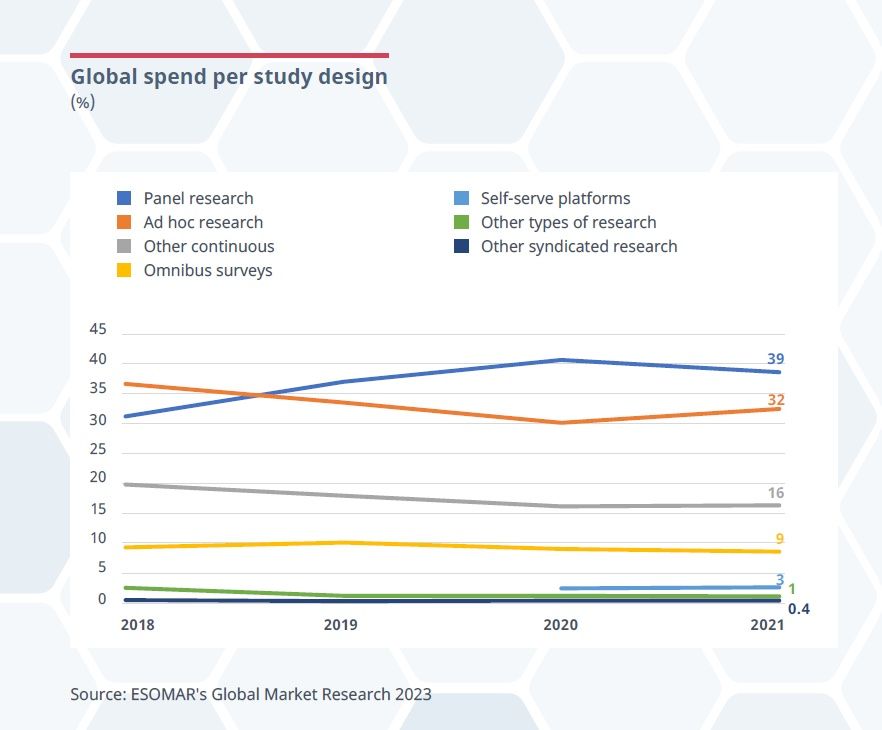

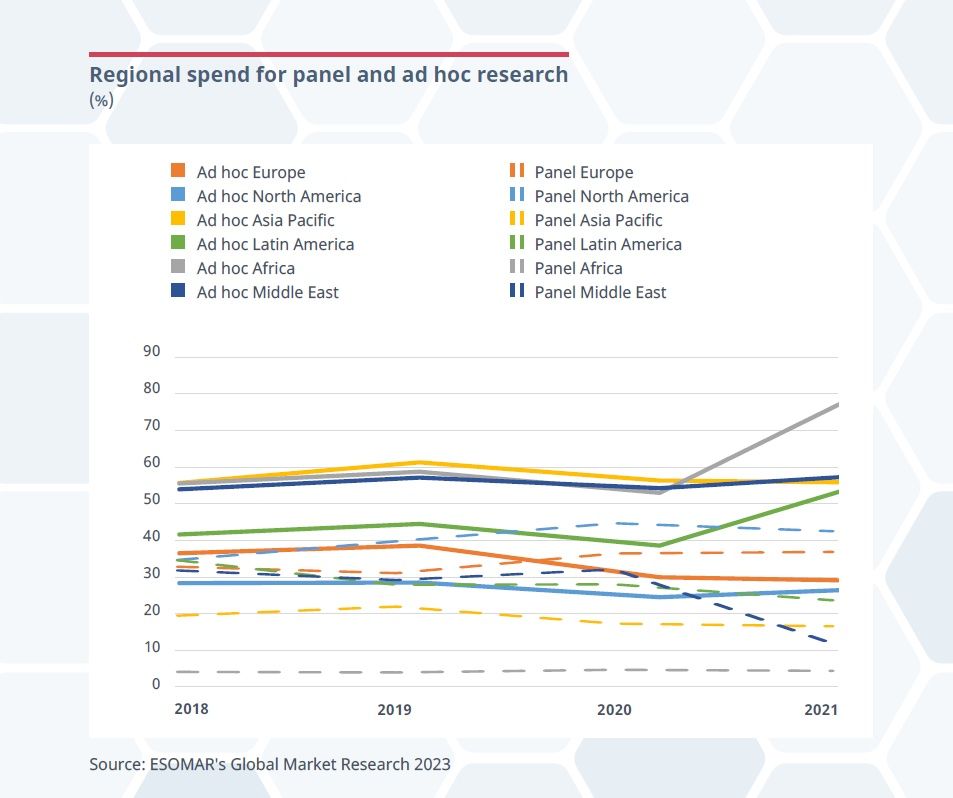

A look at the trend of study designs over time shows the instability of the past couple of years as well. The uncertainty experienced in the wake of the pandemic froze research temporarily while clients and agencies alike reassessed the situation at hand. The only types of projects that remained were longer-term commitments between the parties, such as panel research, which came to represent the largest share of study designs in the year 2020.

Panel research slowed somewhat in 2021 to 39% of total turnover, while ad hoc research gained momentum and grew by two percentage points to 32%. This type of study design, the most popular in 2018, has steadily lost ground in favour of panel research. The lack of a downward trend, however, shows the prevalence of both, and their title of most popular design will likely swap places repeatedly in upcoming years.

Self-serve platforms were recently added as a new type of study design. This type of flexible contractual arrangement, whether with end research clients themselves or with other research providers, allows for a wide array of studies which could not possibly be categorised under the other labels. While at just 3%, self-serve platforms still represent a small portion of the total, their potential is made ever clearer by the enormous amounts of capital that have recently poured over the sector. As mentioned in the ESOMAR’s Global Top-50 Insights Companies, this is one of the fastest-growing industry segments from 2021 and shows no signs of slowing down.

We look forward to seeing how the different elements of the industry come together in upcoming years to move the dials across methodologies, project types and study designs. The growth of more technological solutions may open up the opportunities for more in-house research, thereby boosting the global share of self-serve platforms or may simplify the continuous tracking of consumers. These and other questions will be tackled over time.

The behaviour observed above holds true for most of the world’s regions. While ad hoc research fell during 2020 in every region, it regained part of its lost ground in 2021 except in Europe and Asia Pacific. The opposite is true for panel research. It increased its share of spend within the industry during 2020 in all regions except for Asia Pacific but lost part of that share in all regions in 2021.

The prevalence of panel research in Europe and North America points to interesting differences in the mechanisms of the industry around the world. These are the only two regions where ad hoc research, in fact, sits below panel research. Their combined massive weight on the world stage pushes panel research above ad hoc research at a global level, though a closer look at regional shares paints a very different picture.

This points to a phenomenon of decentralisation since some study designs allow for their remote implementation. Paired up with technological advancements, the natural conclusion is a growth of these kinds of designs primarily in regions with a stronger tech-enabled sector, such as North America and Europe, at the expense of other ones with more face-to-face setups.

Lastly, other continuous research seems to be steadily losing ground at a global level. This label of different uncategorised types of continuous research continues to give way to the only two growing study designs in the industry since 2018: panel research and self-serve platforms. We will remain alert to the development of future contractual arrangements as they adapt to the emergence of new technological capabilities.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

Qualitative methods

- Safety and (dis)comfort in qualitative research

- Predictive qual

- Insight communities – hidden depths

- Brand ethics in pandemic time

- The hidden key to happiness

- Identity conflict

- Sales and market research

- Practising empathy

- Market research vs. UX research

- What do the futures of quant and qual methodologies hold?

- Social listening has a long way to go

- What I learned in my first 6 months as a market researcher

- Asking questions that will inspire more transformative insights

- Challenges of qualitative research today - Part 1

- Welcome to the Twatterverse!

- Challenges of qualitative research today - Part 2

- Best practices in writing a discussion guide

- Experience improvement

- The post-pandemic dominance of CRM and UX research