Research software in the US: Who is pushing the envelope forward?

The US research software sector has been flourishing over the years. But do you wonder which segments within this sector are pulling the heavy load? Read on to find out!

Article series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data

The following article is an excerpt from ESOMAR’s Global Research Software 2024. This report provides the most comprehensive overview of the state of the insights industry and the evolving research software sector worldwide, using data collected by national research associations, leading companies, independent analysts, and ESOMAR representatives.

This is an excerpt from the Insights Association’s view on the state of the insights industry in the United States.

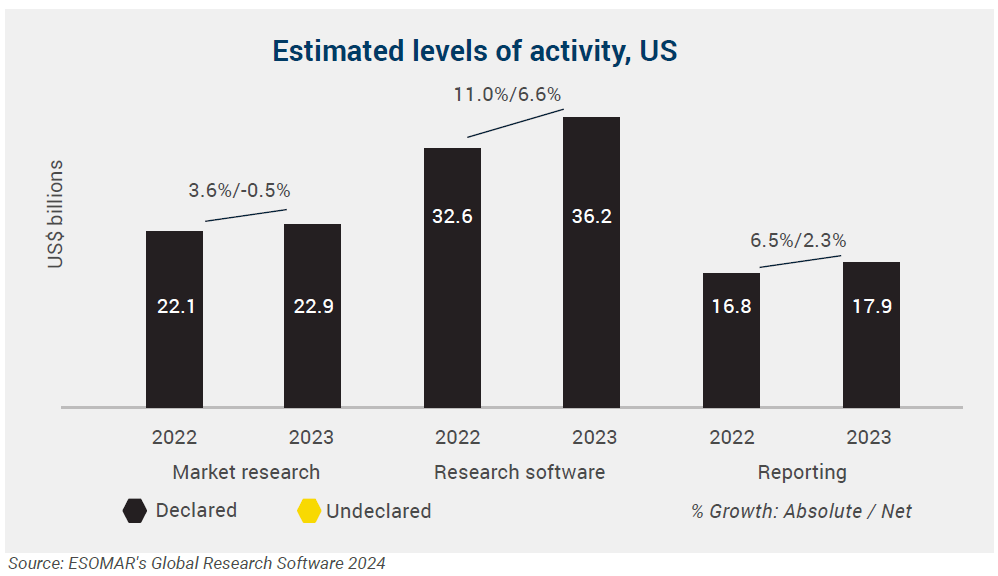

Growth in the consumer insights industry in the United States continued to level off in the high single digits after unprecedented turbulence — the 2020 COVID-19 pandemic cratering and the unsustainable resurgence that followed in 2021. Still, these growth levels are solidly above historic averages. The insights industry in the U.S. grew from US$71.6 billion in 2022 to US$77.0 billion in 2023, with a projected US$83.6 billion in 2024. While the overall growth rates were 14.3% in 2021/22, 7.6% in 2022/23, and a forecasted 8.5% for 2024, the slower growth in 2023 compared to 2022 reflects the above-referenced return to normal business operations, as well as market saturation, economic uncertainties, and the maturing of some rapidly growing sectors. The forecasted growth for 2024 suggests a trend towards more sustainable growth.

- Insights Association

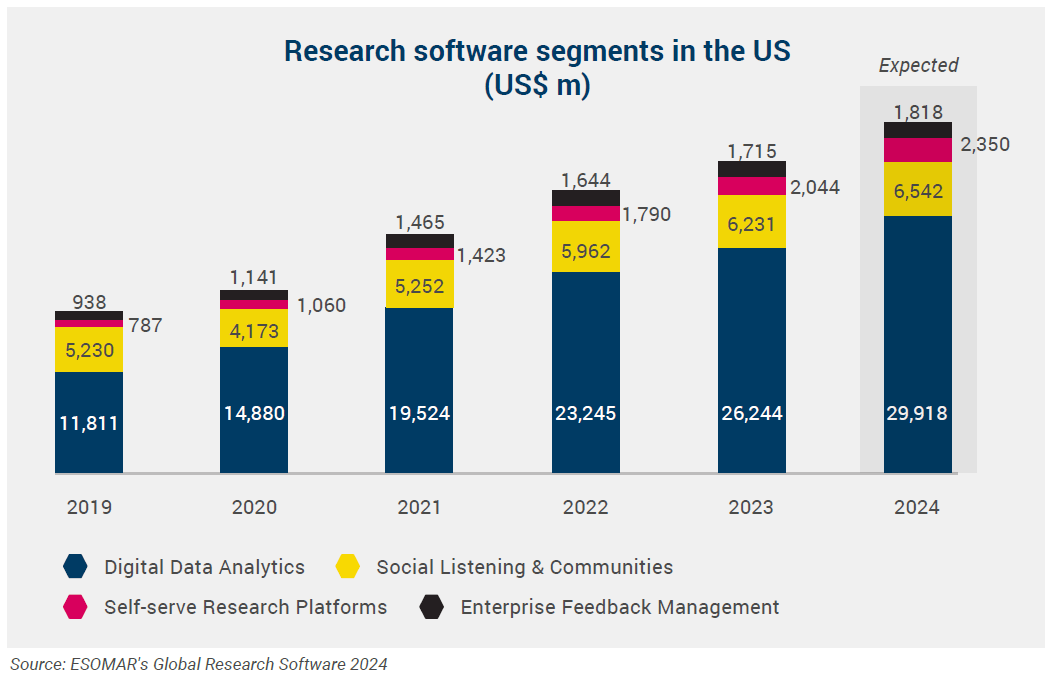

The US research software market experienced notable growth between 2019 and 2023, mainly driven by digital data analytics. This segment grew by 12.9% between 2022 and 2023, reaching US$26.2 billion in 2023, compared to US$11.8 billion in 2019. Representing 72% of the total US market in 2023, digital data analytics’ dominance highlights the industry’s focus on leveraging advanced data tools for strategic decisions. This reliance on data-driven insights will likely continue, with organisations seeking more sophisticated analytics capabilities.

While growing at 4.5% in the last year, social listening and communities captured 17% of the market, reflecting its steady role in consumer sentiment analysis. As social media continues to influence businesses, this segment’s relevance is expected to grow, although not as rapidly as other sectors.

The most exciting development is the 14% growth in self-serve research platforms. Alternatively known as DIY platforms, this segment represents almost 6% of the sector’s turnover in the US, indicating the shift toward democratising these research tools. A possible implication is that more organisations, even small-scale firms, are adopting these flexible, cost-effective platforms to extract insights rather than relying on conventional full-service agencies. For the industry, this trend means increased competition for full-service market research firms and opportunities for hybrid models that combine professional research guidance with self-service technology.

Enterprise feedback management (EFM) grew by 4.3%, showing stable but moderate demand as companies focus on improving customer experience through feedback systems.

The saga continues in ESOMAR’s Global Research Software 2024. Download your copy now!

Also, for an extra EUR 90, readers can now download the report on the core market research sector—ESOMAR’s Global Market Research 2024.

Ajitha Lakshmi Gopalakrishnan

Junior Data Analyst at EsomarArticle series

Global Research Software

- Is the growth slowdown of research software a sign of trouble?

- Can Europe’s research software catch up to its potential?

- Research software in the US: Who is pushing the envelope forward?

- Asia Pacific, the fastest-growing insights industry in the world

- The evolving insights landscape in the Rest of the Americas

- Africa and Middle East: Unpacking growth amidst challenges

- Synthetic data and its transformative power in the future – part 1

- Synthetic data and its transformative power in the future – part 2

- A regulatory perspective on synthetic data