Evolution of physical space in retail and hospitality

The human element of connection and service has been a key point of differentiation after the pandemic.

Article series

COVID-19 impact

- Making healthy habits stick after COVID

- Shobservatory Research Chronicles: Lockdowndiaries

- Capturing early stage consumer feedback, post-COVID

- Evolution of physical space in retail and hospitality

- November 2021 COVID-19 forecast & commentary

- Ethical brands in pandemic times

- November 14 reforecast due to OSHA rule stay

- COVID-19 December 2021 forecast for the USA

- Omicron

- COVID-19 forecast in the USA

- COVID-19 update for the USA

- COVID-19 Omicron retrospective

- Crises and community

- Research that makes a difference

Technological advances and innovations have been instrumental in shaping physical spaces in hospitality and retail, and increasingly, the human element of connection and service has been a key point of differentiation after the pandemic. Meaningful communications, human interactions and support, and tech-driven solutions are in demand from consumers eager for safe, real word experiences. Operators are blurring the lines of self-service, customer service and customer experiences within physical places. Additionally, sustainability is expected to be key in reshaping designs and services, leading to the emergence of nature-friendly concepts and efficient use of resources.

Reimagining physical space vital to curate new services and elevate user experience

Physical spaces have long faced an existential threat from the rise of e-commerce and digital platforms offering quicker, often more agile offerings for a Millennial-driven audience of digital-savvy consumers. The pandemic, however, accelerated this shift in a very short period of time. Many outlets across retail, foodservice and travel were closed as businesses went bankrupt and realised that many of the older models no longer had a future in a post-pandemic market. Consumers, meanwhile, became even more familiar with the digital offerings increasingly available.

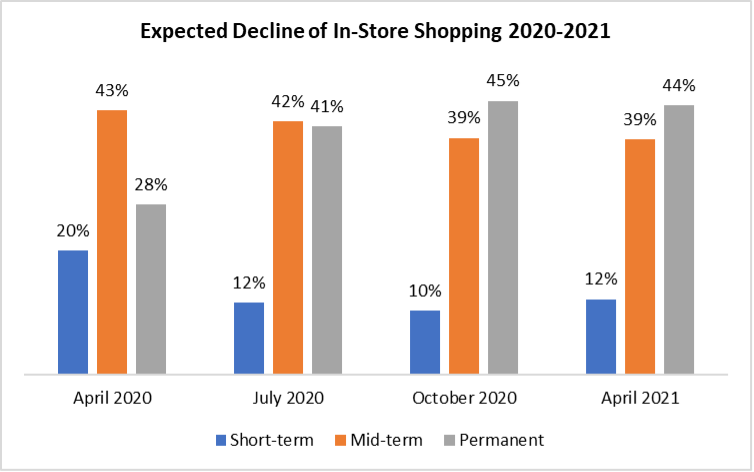

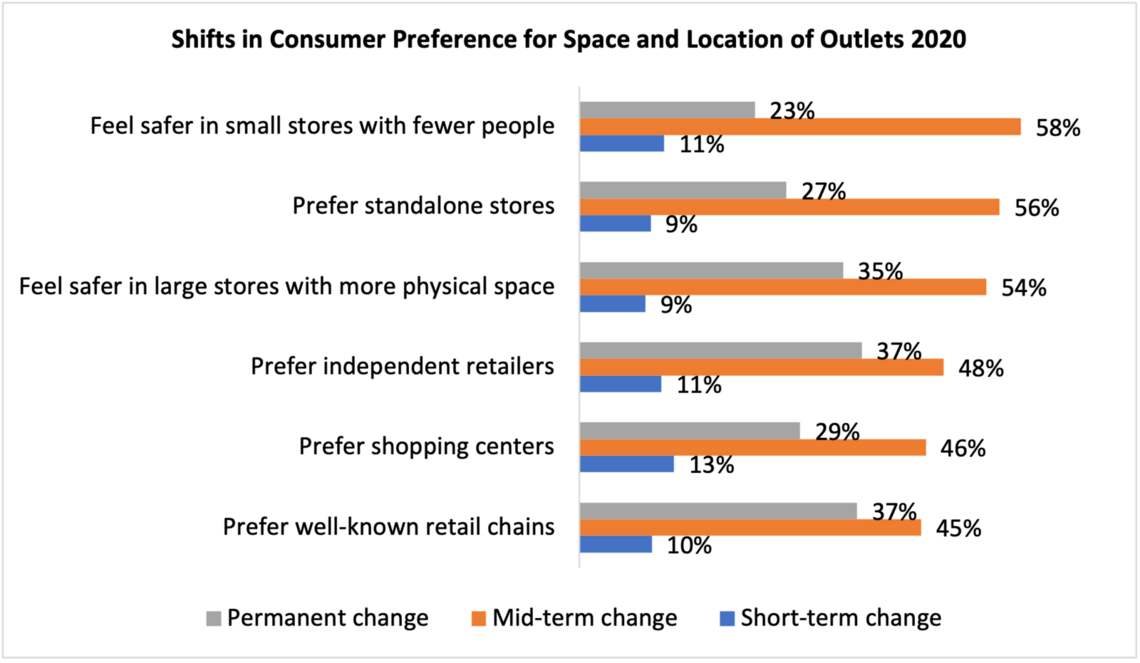

Source: Euromonitor Voice of the Industry: COVID-19 surveys

The pandemic forced operators with physical spaces to evolve very quickly to remain relevant to consumers whose expectations have changed, while opportunities are becoming increasingly clear in bringing together the best of new and existing technologies, unique local concepts, higher levels of sustainability and new kinds of experience-driven services to consumers who miss being, shopping and engaging with others in physical places.

Physical spaces must further find relevance amidst a new consumer demographic now defined by longer-term shifts in urban retreat and localised preferences as consumers become aware of the challenges and unsustainable practices of global supply chains. These broader trends are likely to favour developments with spacious designs, spread out structures and less dense human congregation. Likewise, engaging local communities and supporting local businesses becomes imperative as societies work on alleviating the impact of the pandemic on local economies.

Six major developments emerge as part of the evolution of physical space and the transformation of buildings and architecture:

Micro formats

Smaller spaces - driving costs down, boosting customer engagement and supporting local communities.

“Phygital” spaces and experiences

Aligning in-store and online experience is vital to retain revenues, loyalty and support personalisation.

Hospitality front and centre

Elevated services as a means of differentiation amidst growing digitalisation is a must.

Embracing smart automation

Increased hygiene, touchless technology and social distancing are key factors for bolstering trust.

Space repurposing

Space renewal, reimagining and fresh relevance for a post-pandemic market environment are vital.

Rise of communal spaces

In pursuit of revival, physical space are set to become centres of community and sociability.

Among those parameters, we believe the focus in the next couple of years will be on the importance of the following drivers:

Hospitality front and centre

Physical spaces are critical for brand engagement, and the need to create meaningful, personal, experience-driven concepts is crucial in order to differentiate a brand from online-only competitors. Human employees who offer elevated service are crucial in this process, as the services of hospitality they are able to provide are quickly becoming the most obvious point of differentiation.

Cost and function

Associated fixed costs, operational costs and other variable costs such as insurance and maintenance classify physical spaces as high-risk investments. The need for having a strong business case and consumer demand has always defined expansion strategies of brands in retail and hospitality. Thus, as brands rethink their future, understanding the evolving need and functionality of physical spaces is vital.

Bringing digital to physical to enhance customer journey

Post-COVID-19 business environment demands constant reinvention of physical space, which looks at how places are created to enrich communities, allow quick repurposing in times of crisis and changing customer expectations. Those solutions and settings that facilitate safe product and service access, and deliver flexibility while embracing creative technology, will help secure brand longevity and customer loyalty.

Strategies for success

What is needed for any business to achieve success in the New Normal and become tomorrow’s next leader comes down to the following aspects:

Be digital; stay human: Consumers want digital access, they are used to online engagement, but they also miss hospitality and they want to support and engage with humans after the pandemic. Leverage technology, but keep humans front and centre of the concept.

Adopt and adapt: The post-pandemic market environment is different in many ways to what it was in 2019, with different consumer demands and expectations. Physical spaces will not attract consumers if they have not improved. Build trust with safer spaces, differentiate on experience with enhanced service, and be more relevant with mixed-use concepts.

Be fit for purpose, fit for service or stand out on experience: Re-imagine and reinvigorate spaces by reinventing the purpose they serve. New models should appeal as destinations and places that offer unique experiences that cannot be replicated online. Re-think in-store logistics to reach new audiences in non-urban locations.

Embrace sustainability in space and concept: Consumer awareness of sustainability issues that affect the environment and that affect people are higher and more important than ever. Make spaces more sustainable through in-store design, changes in the supply chain, carbon pricing, transition to renewable energy or sustainable products. Bring sustainability into the brand while emphasising core values to strengthen its reputation.

Euromonitor Voice of the Industry: COVID-19 Survey Details

Results are drawn from 4,800 industry professionals spanning a variety of industries (Apparel and personal accessories, Automotive, Beauty and personal care, Consumer electronics and appliances, Consumer health, Financial services, Food and beverages, Household essentials, Leisure and entertainment, Packaging, Retailing, Technology, Travel and tourism, Consumer foodservice, Advertising, Consulting, Market research) and geographies (Algeria, Argentina, Australia, Austria, Azerbaijan, Belarus, Belgium, Bolivia, Bosnia-Herzegovina, Brazil, Bulgaria, Cameroon, Canada, Chile, China, Colombia, Costa Rica, Croatia, Czech Republic, Denmark, Dominican Republic, Ecuador, Egypt, Estonia, Finland, France, Georgia, Germany, Greece, Guatemala, Hong Kong, China, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Kazakhstan, Kenya, Latvia, Lithuania, Macedonia, Malaysia, Mexico, Morocco, Netherlands, New Zealand, Nigeria, Norway, Pakistan, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Serbia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, Thailand, Tunisia, Turkey, Ukraine, United Arab Emirates, United Kingdom, Uruguay, USA, Uzbekistan, Venezuela, Vietnam, El Salvador, Honduras, Panama, Lebanon, Nicaragua. This survey was fielded in four waves, April, July, October 2020 and April 2021.

Nadejda Popova

Senior Project Manager - Services and Payments at Euromonitor InternationalArticle series

COVID-19 impact

- Making healthy habits stick after COVID

- Shobservatory Research Chronicles: Lockdowndiaries

- Capturing early stage consumer feedback, post-COVID

- Evolution of physical space in retail and hospitality

- November 2021 COVID-19 forecast & commentary

- Ethical brands in pandemic times

- November 14 reforecast due to OSHA rule stay

- COVID-19 December 2021 forecast for the USA

- Omicron

- COVID-19 forecast in the USA

- COVID-19 update for the USA

- COVID-19 Omicron retrospective

- Crises and community

- Research that makes a difference