The shield of Pricing Power: why strong brands don’t blink at inflation

The secret behind brands that grow margins while others cut prices.

In a world where volatility is the only constant - where inflation bites, supply chains buckle, and consumer confidence teeters - brands need more than agility. They need shield. And that shield is Pricing Power. You know you’ve got it when consumers don’t flinch at your price corrections, nor do they swap your brand for a cheaper alternative. This isn’t a case for charging more or profiteering; it’s a compelling demonstration of the margin advantage that comes from being perceived as worth more. As Jeremy Bullmore and Stephen King once said, “most knives cut, but people are happy to pay more for some.” That “something more” is a strong perception in people’s minds, a kind of brand goodwill that sits well above book value.

Pricing Power: what it is, what it’s not and why it matters more than ever

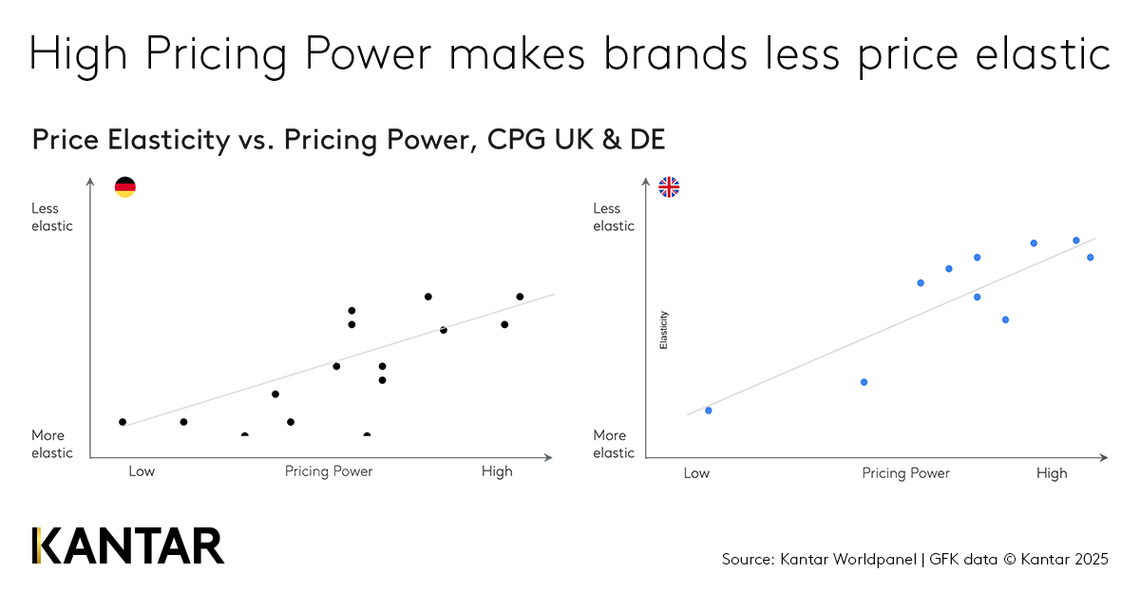

The concept of price elasticity of demand comes from a simple empirical truth: when prices rise, unit sales fall. But not all brands fall equally. Some take a hit; others barely wobble. That difference? It’s Pricing Power.

What it is: a reflection of price sensitivity - your earned ability to desensitise people to higher prices.

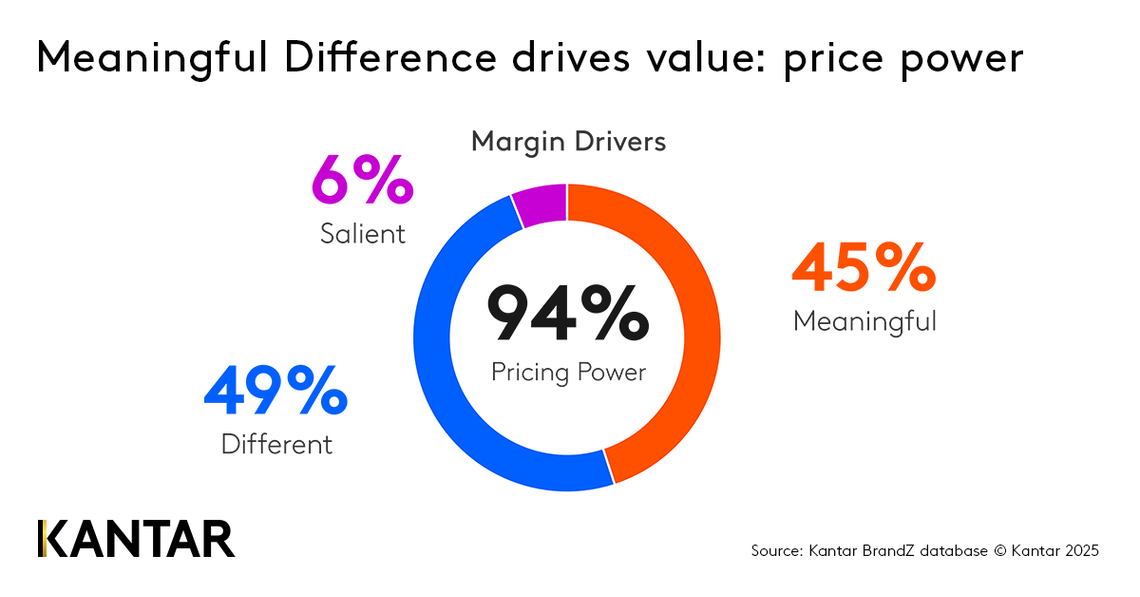

What it’s not: Pricing Power isn’t about being known; it’s about being known for something. It’s built on meaningful difference. Our data shows that 94% of a brand’s Pricing Power is explained by how meaningfully different it is perceived to be.

Why it matters more than ever: Over the past two years of high inflation, prices rose faster than they had in decades. Yet not everyone traded down. Many consumers stuck with their preferred brands - like Gillette, Hellmann’s, Hermès, Caterpillar - allowing those brands to hold firm without the expected volume loss. In uncertain times, Pricing Power isn’t just a buffer, it’s how strong brands protect margins and keep growing while others struggle.

Brands that wield Pricing Power. And how they earned it

It all comes down to one thing: years of consistent value delivery and brand building.

Take Hermès. It never goes on sale. Its Birkin bags have waiting lists and resale values that often exceed retail. Why? Because Hermès has spent decades crafting a brand rooted in scarcity, craftsmanship, and timeless style. It doesn’t sell leather, it sells legacy. But Pricing Power isn’t reserved for the luxury tier. Starbucks, for instance, proves that even in the everyday, brands can command a premium. A £4.20 latte isn’t a necessity, it’s a ritual. Starbucks has built emotional preference through experience, consistency, and personalisation. Even during inflation, customers didn’t trade down, they queued up. Apple? It’s the gold standard. In 2008, during a global financial crisis, people still lined up for the new iPhone. That’s not just functional appeal, that’s Pricing Power in action. And then there’s Magnum, which defended its price premium during the UK’s cost-of-living crunch by reminding consumers that indulgence is worth it. No discounts, just a confident brand promise.

It’s misleading to see Pricing Power as merely a metric or a ticket to charge more. Each of these brands has built Pricing Power by ‘owning’ a value position and executing it in a consistent, methodical, and unmistakably clear way that no one else can mimic. They’ve created a perception of value that transcends function, and they’ve protected it fiercely.

What it takes to build (and boost) high Pricing Power?

Pricing Power isn’t built overnight and it certainly isn’t a happy accident. It’s earned, through years of brand consistency, value delivery, and strategic discipline. It’s not a campaign. It’s not a clever tagline. It’s the cumulative effect of every product decision, every customer interaction, every moment your brand shows up and delivers on its promise.

So, what does it take exactly?

1. Meaningfully Different as a foundation

If your brand doesn’t meet real needs in a way that stands apart, you’re just another option. Pricing Power comes from being the brand people actively choose, not just recognise. Apple, for instance, didn’t become Apple only by being known. It became Apple by being known for something; its design, innovation, and a seamless ecosystem.

2. Perceived value, not just product value

People seek function plus. They pay more because they believe it’s worth more. That belief is built through storytelling, emotional connection, and consistency. Lindt, for instance, doesn’t merely sell chocolate, it sells indulgence. The gold foil, the master chocolatier, the truffle melt. All wrapped up in a sensory promise that justifies the price.

3. Consistency that keeps the promise

Pricing Power is fragile. One slip in quality, one off-brand campaign, one broken promise and the premium you’ve earned will likely to erode. The brands that hold their price are the ones that hold their standards. Colgate, for example, has been delivering on its promise of trust and efficacy for decades. It’s not flashy, but it’s reliable and that reliability commands a premium in a commoditised category.

4. Confident pricing

If you’ve built the value, don’t be afraid to ask for it. Too many brands underprice themselves out of fear. But if your brand is meaningfully different and trusted, you’ve earned the right to charge more. Use it. Did you know that Hermès raises prices annually? It’s not because it can, but because it’s earned the right to. And its customers are largely desensitised to it.

5. Pricing is a marketer’s responsibility

Ok, it might be a shared responsibility with finance. Still, marketers must own the pricing conversation because it’s the clearest expression of brand value. If your brand can’t justify its price, it’s not a pricing problem. It’s a brand problem. Unilever’s Hellmann’s invested in brand storytelling - about food waste, quality ingredients, and taste - and used that to defend its price point during inflation.

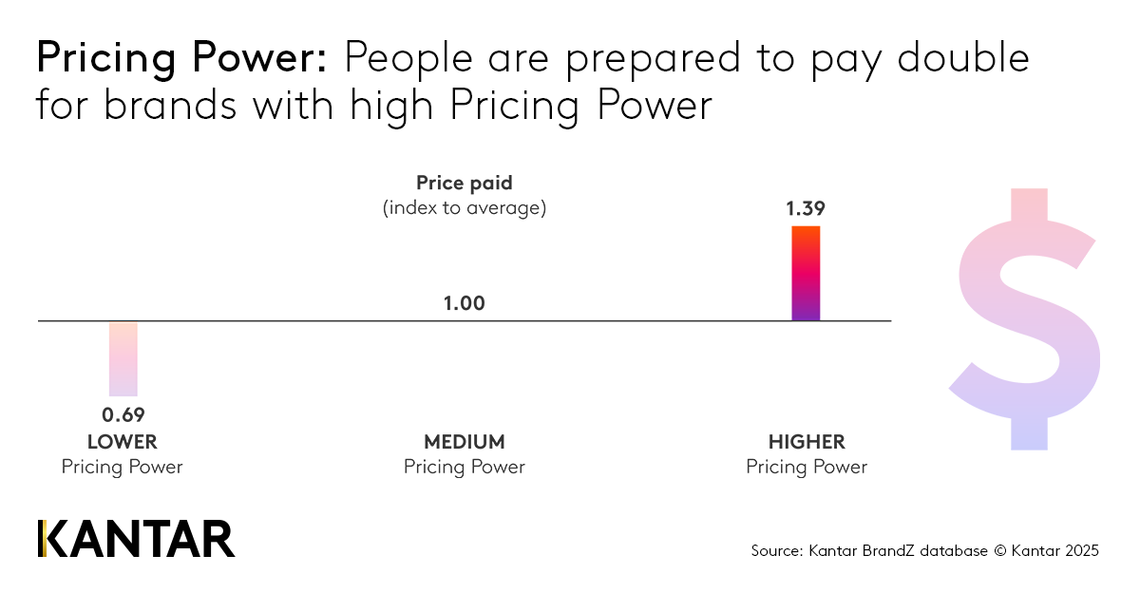

That’s how you stop being one of many and start being the one people will pay more for. Our data shows that people are willing to pay up to double for brands with high Pricing Power (vs. those with lower Pricing Power).

How to track and sustain Pricing Power

You can’t manage what you don’t measure. And Pricing Power - like brand equity -isn’t something you feel in your gut. It’s something you track, test, and prove. If you want to build it, you need to know where you stand. If you want to sustain it, you need to know what’s moving the needle.

Start by measuring the fundamentals: how meaningfully different is your brand perceived to be? Would consumers still choose it if it cost more? Would they recommend it? Would they miss it if it disappeared? These are not vanity metrics, they’re early indicators of Pricing Power. Kantar’s Pricing Power Index, for example, quantifies the premium a brand can command based on consumer perception. It’s a proxy for elasticity, and a powerful one.

Then, link brand metrics to financial outcomes. Use econometric modelling or marketing mix analysis to show how improvements in brand equity translate into pricing tolerance, margin growth, and profit. This is how you turn brand-building into a boardroom conversation. It’s how you move from “nice to have” to “need to invest.”

And finally, monitor the market. Pricing Power is relative. If a competitor closes the gap in quality or starts mimicking your value cues, your premium position is at risk. Stay vigilant. Keep testing. Keep listening. Because Pricing Power isn’t a one-time win, it’s a long game of brand discipline.

Mary Kyriakidi

Global Thought Leader at KantarMary Kyriakidi is a Global Thought Leader at Kantar, where she spearheads the company's brand guidance agenda, blending cutting-edge research with data-driven insights to shape the future of marketing effectiveness.