The opportunities of direct customer relationships - Part Three

Part Three: Understanding habitual and deliberate consumer decision behaviour

Article series

The opportunities of direct customer relationships

- The opportunities of direct customer relationships - Part one

- The opportunities of direct customer relationships – Part two

- The opportunities of direct customer relationships - Part Three

In this 3-part series, we will discuss how businesses can catch up with their consumers, build successful direct customer relationships, and set the stage for long-term, predictable recurring revenue.

The three frameworks are:

Part One: Leveraging the Direct Customer Relationship Flywheel

Part Two: Choosing among three models for building direct customer relationships

Part Three: Understanding habitual and deliberate consumer decision behaviour

Part Three: Understanding habitual and deliberate consumer decision behaviour

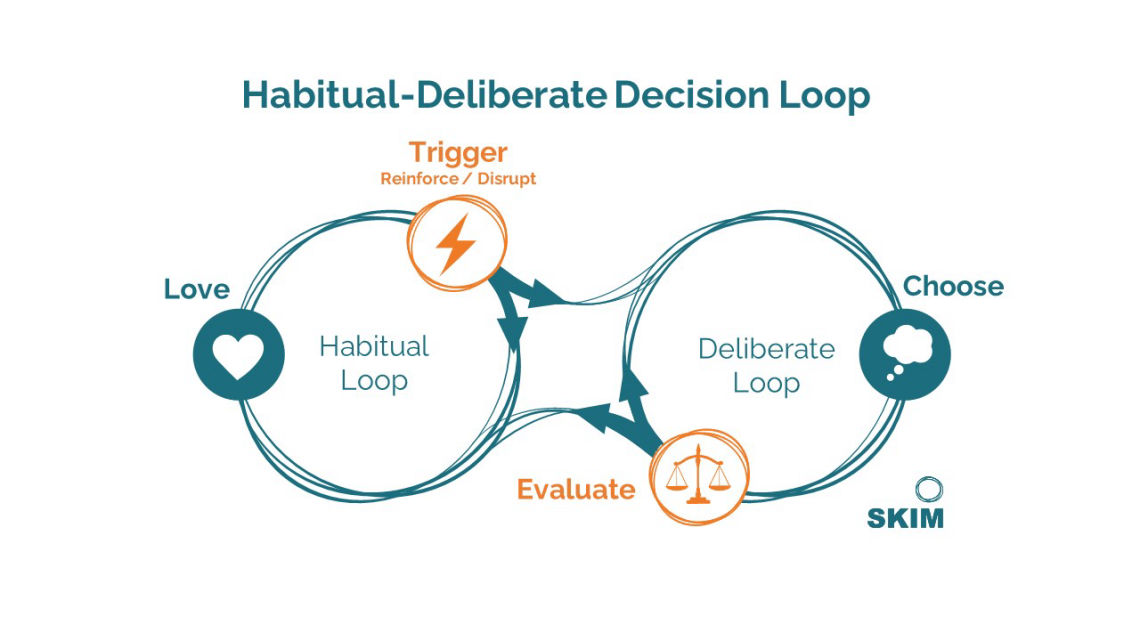

SKIM’s Habitual-Deliberate Decision Loop is a framework for understanding consumer decision behaviour. It is used to understand and leverage the relationship between two business questions: How do I reinforce customer buying behaviour? And, how do I disrupt non-customer buying behaviour? We are using it here in the context of a direct customer relationship business model.

In the framework, at one end of the consumer decision spectrum, you have habitual behavior or the Habitual Loop. This is where you want your customers to reside – they are not making a conscious choice – they are on autopilot.

At the other end of the purchase decision spectrum, we have the Deliberate Loop. Here, consumers are evaluating and choosing, making deliberate choices – they have to think about the purchase and make a deliberate choice.

Another way of looking at the Habitual-Deliberate Decision Loop is in terms of the type of decision. All three direct customer relationship models move consumer decision-making from an immediate benefit decision with no commitment towards a long-term benefit and relationship commitment. The three models are aimed at increasing and reinforcing habitual behaviour and reducing the brand’s exposure to deliberate consumer decision-making outside of the relationship.

Each direct customer relationship model requires a different type of deliberate decision-making and commitment along with a different subsequent behaviour structure in a customer’s journey to ongoing, habitual behaviour. Each model focuses on different parts of the decision process, and they reward different aspects of habitual behaviour. However, the purpose of all three models is to reward habitual behaviour.

From the consumer’s point of view, choosing to become part of a Direct Customer Relationship program means deliberately choosing to create a habitual behaviour that defines or guides future actions. The consumer is choosing to reduce their choice set and reduce the complexity and frequency of their decision-making. Consumers are choosing to remove themselves from the competitive marketplace.

Strategic implications

A significant and deliberate shift for consumers

By participating in a direct customer relationship program, the consumer is implicitly choosing to:

Create a habitual behaviour that defines or guides their future actions

Reduce their choice set

Reduce the complexity and frequency of their decision making

Distance themselves from the competitive marketplace

For brands, a realignment

This new reality means that brands must develop new positioning, narratives and value propositions that align with the changes in:

Consumer purchase decision inflexion points

Consumer decision-making parameters

Opening offer strategy

Strategy for reacquiring lost customers

An evolving consumer behaviour: When is cancelling not cancelling?

In our research, we are seeing growing sophistication in consumers’ ability and willingness to manage their portfolio of digital entertainment platforms. As the number of competitors (and therefore consumer choice) increases, consumers are becoming content chasers and subscription hoppers. In addition, inflation concerns and economic uncertainty have increased consumers’ caution, willingness to try new solutions and desire to reduce their overall costs. They will “cancel” a subscription if the content isn’t interesting to them right now. But they will be back when the content warrants it. Our recent research in digital entertainment subscriptions showed that 32% of those who left a platform had returned at a later date. We believe this is a consumer version of portfolio optimisation.

The question for brands is, should they classify this behaviour as a true cancellation or a pause? The difference is important, given the cost to acquire a new customer. In addition, there are important implications for retention, churn, communications, pricing and customer relationship strategies.

We recommend that brands consider the relationship as the foundation for their strategy. If brands do this, then they will want to introduce flexibility into their relationship models and rethink how they keep and manage customer relationships. Allow customers to come and go easily – but keep the relationship! Our research shows that customers are 4 times as likely to return if the cancellation is easy.

Although this consumer behaviour is currently most evident among digital entertainment subscribers, we expect it to become more widespread. We predict “pausing” will spread to tangible goods from digital and will become part of a brand’s customer retention strategy as brands recognise the value of their direct customer relationships.

What are the “pausing” implications for Membership and Loyalty relationship models?

Those programs are more static in structure. Nonetheless, companies will need to increase their flexibility in customer relationships. The place to start is in understanding their value proposition and defining what cancelling and churn would mean if customers could pause a membership plan for instance. For Loyalty models is rather different, because it is not really an overt cancelling decision that is the concern, it is more a form of disengagement that must be addressed. So in that case, the question will need to be reframed to address that hidden problem. However, even with Loyalty programs, there is a portfolio optimization factor because customers decide to use one of their Loyalty program brands instead of another.

3 Strategies for Direct Customer Relationship Success

1. Develop strategies to understand and influence customer decision behaviour dimensions

Moving to a direct customer relationship business model creates new customer interactions and new decision behaviour dimensions. That means you need to be ready with strategic plans to do the following:

Cater to customers with a personalised experience

Create an ongoing direct customer experience

Quantify and forecast the potential revenue stream (customer lifetime value model)

Identify the underlying consumer decision behaviour elements needed for success.

2. Reconsider aspects of your Go To Market strategy

A direct customer relationship model is an additional strategic tool that enhances many aspects of your business.

A direct customer relationship model will not replace your current GTM business model.

There are significant short- and long-term considerations when moving to one of these models. First, it can be expensive. Second, it will change your cash flow structure significantly, reducing immediate cash flow and increasing long-term recurring revenue. Third, relationships with retail partners will require careful negotiation and navigation. You may find that you need to rethink some aspects of your current GTM strategy.

On the plus side, because of the nature of the relationship and cadence of customer behaviour, it becomes a primary tool for taking some of the peaks and valleys out of your net revenue management strategy. It adds depth and speed to new product development, identifying white spaces, workshopping new messages and establishing new positioning.

3. Identify your next steps

As your next step, we recommend implementing a loyalty or subscription model or perhaps even a blend of the two. Your choice will depend on whether you have a regularly consumed product or service (that can lend itself to a subscription model) or an episodic product (that can create stickiness through rewards).

If you want to strengthen an existing direct customer relationship program…

Consider the Direct Customer Relationship Flywheel diagram and make sure you are optimizing the components of the flywheel

Consider the Customer Decision Behavior Dimensions above and create an intentional, strategic plan for each

If you are looking to get started building direct customer relationships…

Think about the simplest way to test the waters. We suggest developing a D2C product or creating a subscription channel offering and then extending that to a portfolio of products.

Review the Direct Customer Relationship Ecosystem and decide which of the three general models is most appropriate for your business.

If you want to move a D2C business to direct customer relationships…

It’s important to understand that Direct to Consumer (D2C) is not the same as direct customer relationships. D2C is not based on a continuous relationship. It is based on ad hoc decisions by consumers who may or may not purchase again. D2C is more like a retailer with a narrowly defined product set that is delivered when the customer asks for it. However, because they can capture information about their customers’ choices, D2C brands are in an ideal position to evolve to a subscription-direct customer relationship model with predictable recurring revenue.

Dirk Huisman

Founder and Chairman at SKIMDirk Huisman is the founder and chairman of SKIM Holding. Dirk is a thought leader in advanced market research methodologies, a specialist in conjoint analysis and related methods, and a recognized advocate of these methods in the market research world. In addition to developing SKIM into a leading global insights agency, he was involved in development of market research organizations MOA and ESOMAR, and has published over 30 papers on pricing, choice and decision behavior, means end, product development, future of market research, and conjoint analysis. He is known for his critical viewpoint on the role of market research in business over time. You can contact Dirk at D.Huisman@skimgroup.com

Mike Mabey

Vice President at SKIMMike Mabey is VP, SKIM. He focuses on strategy and competition in three areas: consumer journeys, subscription channel behavior and digital commerce. Based in Atlanta, he leads SKIM's global subscription practice. You can contact Mike at m.mabey@skimgroup.com

Article series

The opportunities of direct customer relationships

- The opportunities of direct customer relationships - Part one

- The opportunities of direct customer relationships – Part two

- The opportunities of direct customer relationships - Part Three