K-shaped post-pandemic recovery of Asian Pacific insights

The turnover left untapped in the past two years, may well haunt the industry for longer.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

The overall picture

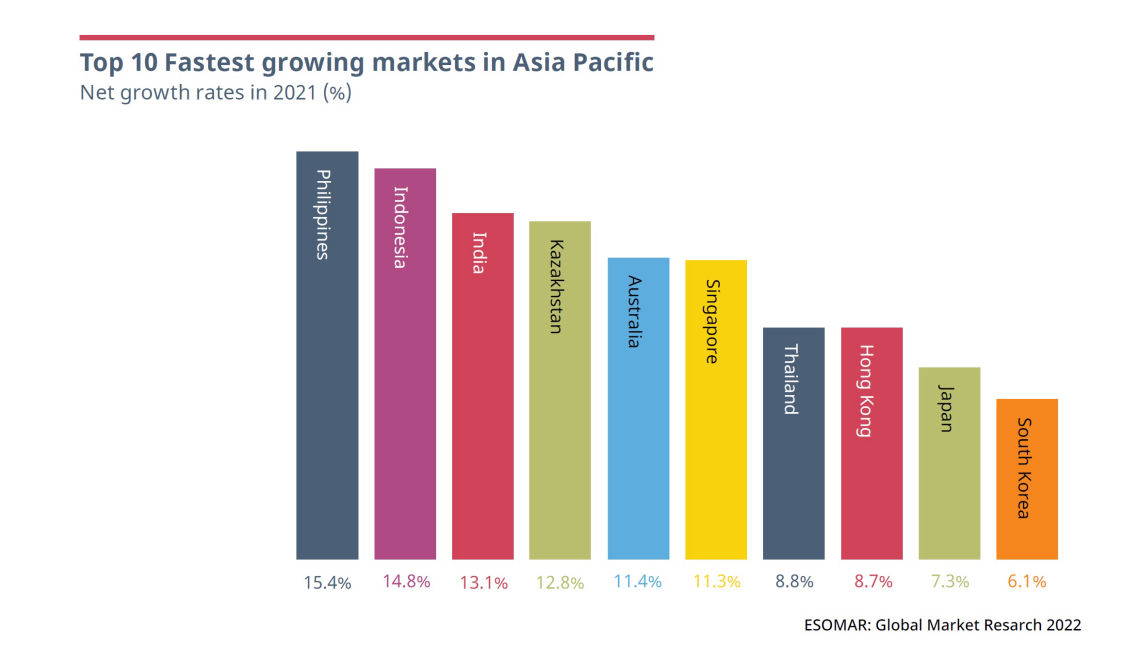

The diversity of the Asian Pacific region becomes most apparent when comparing the different behaviour of each country. The double-digit growth rates of some of the largest and/or most developed nations, such as India, Australia, Singapore, Indonesia, and the Philippines, contrast sharply with the negative growth of those countries affected by either political, social or economic instability like Taiwan, Myanmar, Bangladesh or Laos.

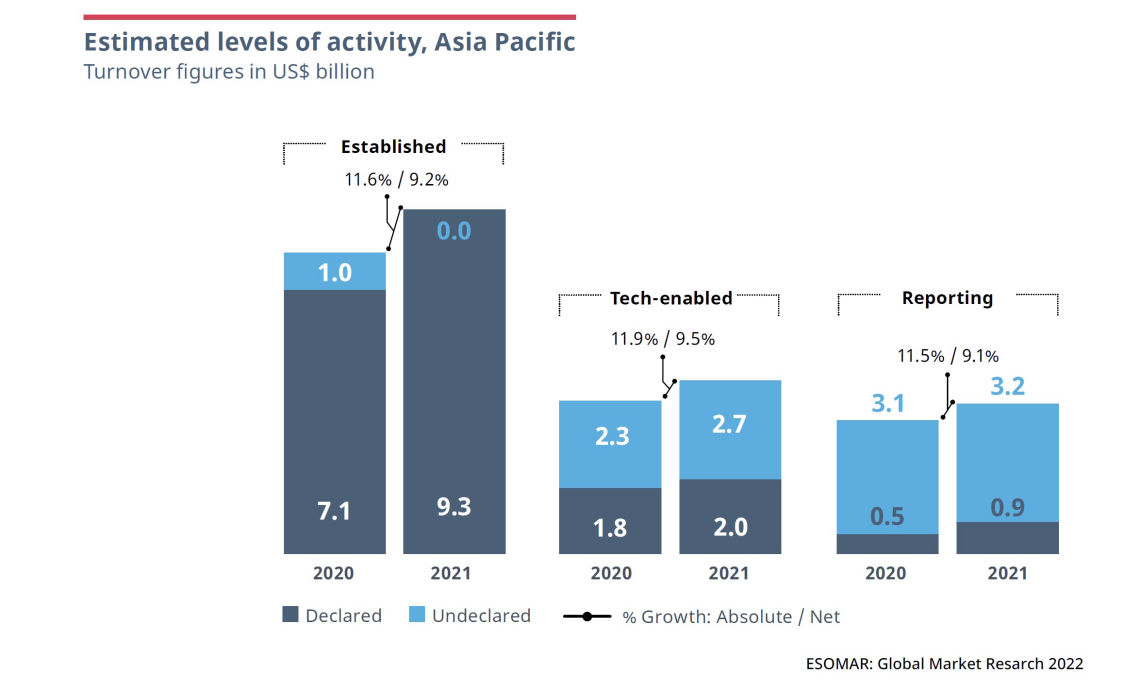

Overall, the turnover declared by the countries in this region (US$ 12,315 million) implied a net growth of +8.8%. Independent estimations made by ESOMAR’s data provider Outsell suggest an “undeclared” portion of almost US$ 6 billion and total net growth of +10.1%.

Unlike in Europe and the United States, where the tech-enabled part of the industry led the region’s growth, in Asia Pacific, each of the three sectors of the industry grew in parallel at around 9% (a significant portion of “other” research results in a slightly higher overall growth rate for the region).

This hints at the existence of regional differences with pockets where the most established side of the industry performs remarkably well compared to other countries where the tech-enabled industry takes the lead and others with a thriving reporting one. It is important to emphasise the heterogeneity that exists within the members of this world region.

The industry is expected to remain strong in 2022, particularly as inflation remains moderate in most countries – only 3.4% compared to the global 7.0%. The year may well end with a regional turnover above US$ 20 billion and the strongest net growth globally at +10.4%. As always, reality will certainly remain markedly different for each country as they struggle with their individual issues.

A look at the countries

Interestingly, those countries capable of including tech-enabled companies in their estimates present a similar growth rate to the industry at a global level. Countries like India and Australia, which recently reassessed their industry (the former last year, the latter in this one), declared growth rates above +11%. The next pages offer a closer look at both countries by their respective local associations, as well as the largest market in the region, China.

In fact, China is the only country in the region that expects a deceleration in output in 2022 amid weak economic performance and the trenchant impact of the pandemic. Net growth for this year is expected to be -5%.

This year’s report is also proud to announce the inclusion of a new region, the South Pacific, which posits +8.6% in net growth over 2021. Expectations for 2022, however, are less rosy at +0.9%. We will continue to track the development of these Pacific island nations over time.

While most countries have returned to pre-pandemic levels of turnover, there are still 9 markets expected to take longer than 2022 to recover. Provided no new shocks appear on the horizon that may destabilise the industry further, 2023 may be the year when Thailand, Hong Kong, Malaysia, Taiwan, Bangladesh, Cambodia, Myanmar, Sri Lanka, and Laos officially recover from the worst effects of the pandemic.

The turnover left untapped in the past two years, however, may well haunt the industry for longer.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact