The 2022 lattice of research methods

Quantitative passive methods dominate the research data-gathering landscape, with 56.5% of global spending

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

Companies and methods rarely go hand in hand. This is demonstrated each time a company claims to merge qualitative and quantitative research or when an established firm feels that it should be recognised for its strong tech-enabled product portfolio.

The data required to tackle each research “problem” may be gathered through very diverse methods, and companies were never limited in using them!

A full-service agency may use purely technological research methods, while an analytics firm may require established ones for a specific project. Quantitative agencies may add qualitative methods to their toolbox, and face-to-face companies may complement their offer with passive collection.

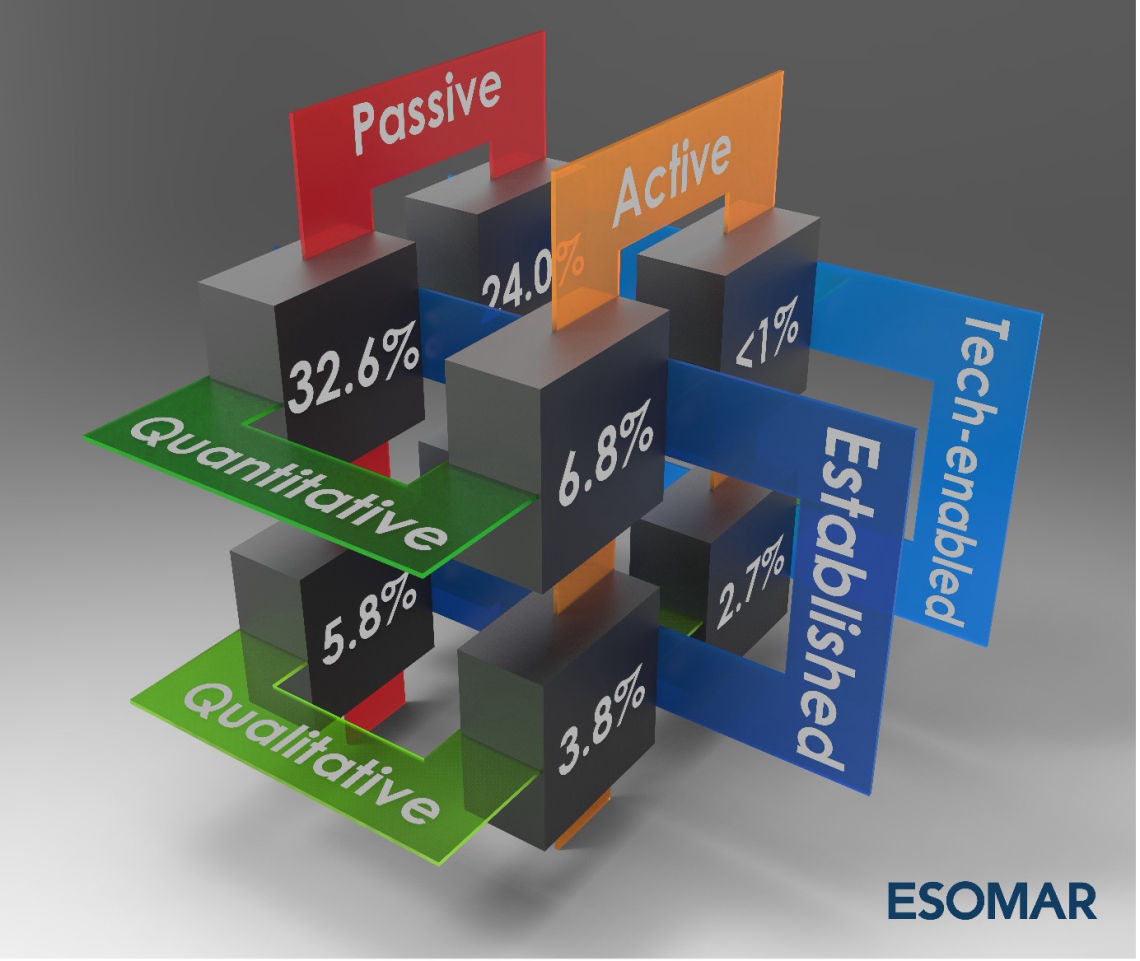

The richness of the industry is captured in ESOMAR’s Lattice of Research. This visualisation, first developed in 2020, shows that research methods can be categorised under each of three axis:

Not only the well-known quantitative or qualitative but also

Established or tech-enabled depending on whether they are proven and long-standing (the first) or came about thanks to technological advances (the second) and

Active or passive, depending on whether or not a direct and real-time interaction exists between insights professional and respondent.

The usage of diverse research methods by most, if not all, of the industry’s players are shown in ESOMAR’s Global Market Research report. The resulting breakdowns will become more refined as countries increasingly include all three sectors of the insights industry since the competitive arena is the same for all.

At a global level, quantitative passive methods dominate the research data-gathering landscape with 56.5% of global spending. The graph below clearly shows a well-known challenge for tech-enabled methods: their application to qualitative data gathering, now at less than 3%. The difficulty lies in successfully capturing the nuance that exists in the subjective opinions of individuals, one of the most difficult areas to automate and leverage through technology.

ESOMAR’s 2022 Lattice of Research Methodologies

The regional breakdowns

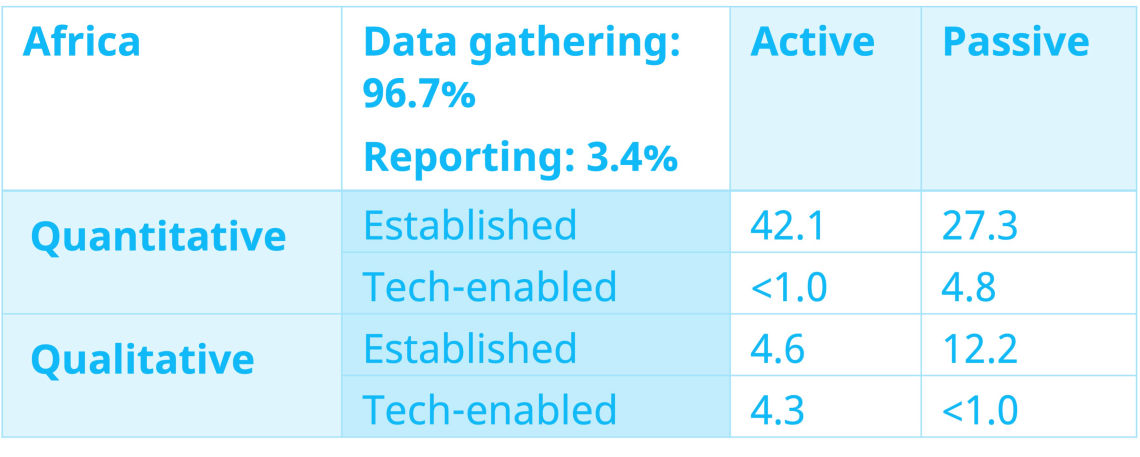

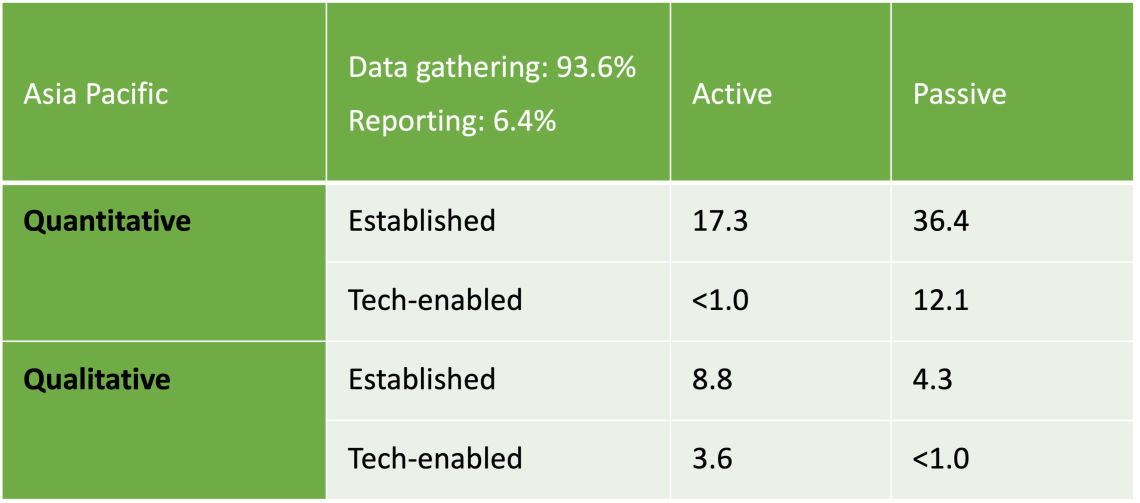

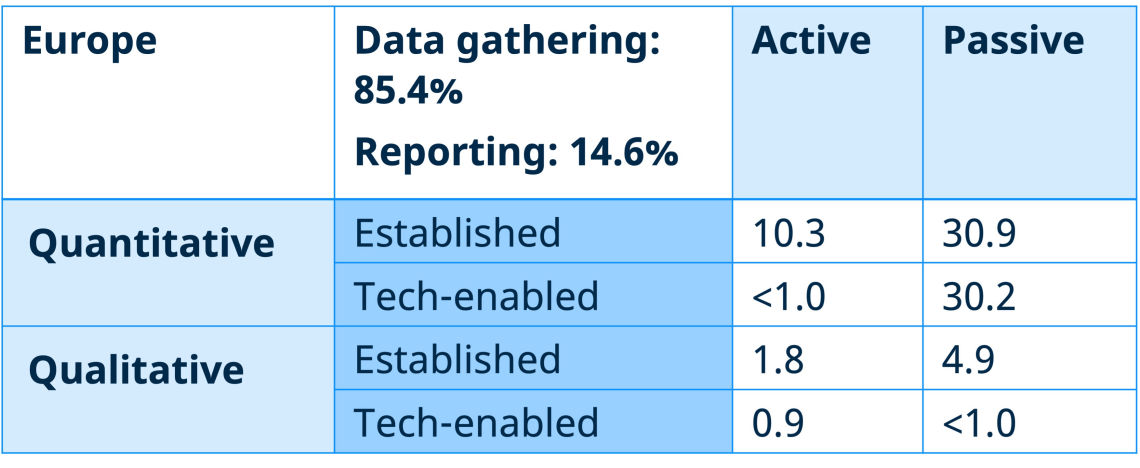

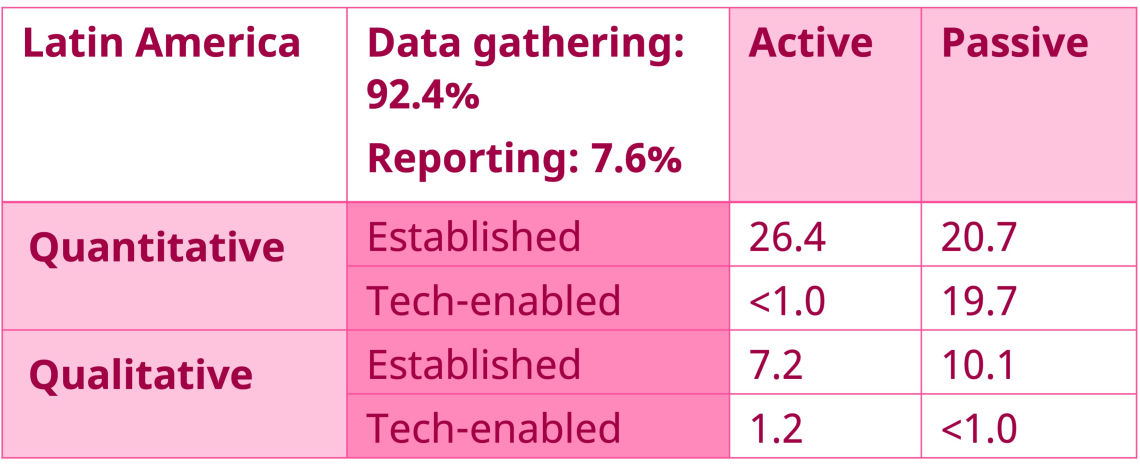

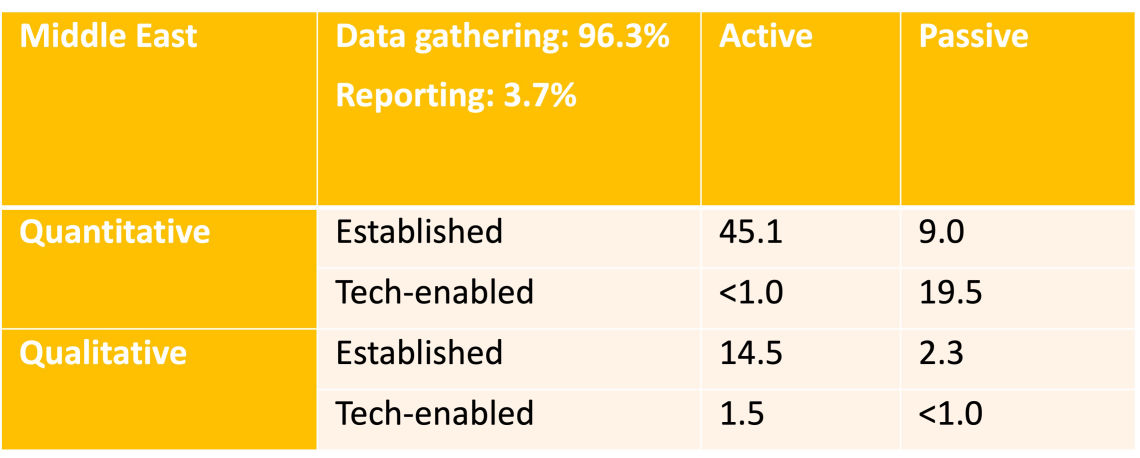

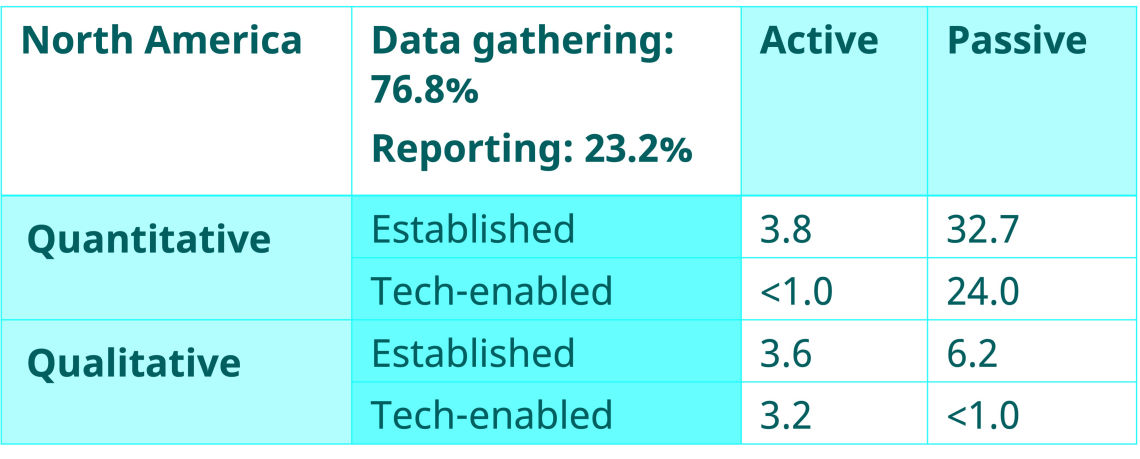

A look at the regional breakdowns shows the variation in the types of methodologies used around the world. Further detail at a country level can be found in ESOMAR’s Global Market Research report.

But, can you spot the region with the most active users of established quantitative methods, such as face-to-face and telephone? Could you identify which regions have gravitated over time towards passive tech-enabled quantitative methods such as online traffic, web analytics or social media monitoring? Does the relative prevalence of qualitative methods in regions like Latin America, Africa and the Middle East surprise you? And how about the large share of tech-enabled methods in Europe and North America?

ESOMAR will continue to monitor the global insights activity in its reports so that the wider industry can keep the pulse of this exciting journey.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact