“The Price is Right” in 7 research projects

Seven “dummy” projects to describe the pricing mechanism within the Market Research Industry.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

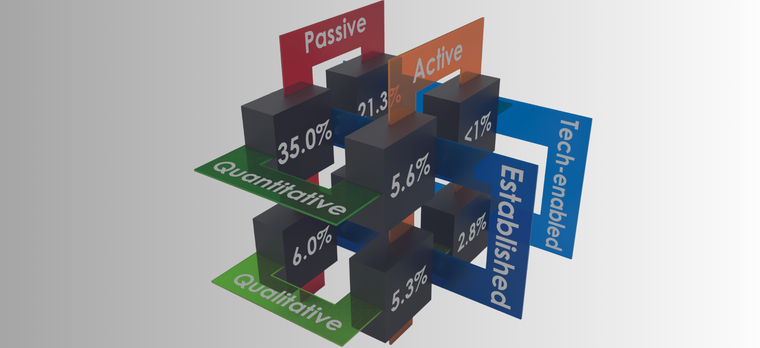

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

The trends described in the article are among the insights and findings of the Global Prices Study 2021, also including relevant topics for the industry such as the cost of incentives to participants in market research projects, the choice of data collection methodologies, and the evolution of professional tariffs. A must-read for both suppliers and buyers in the industry, available on the ESOMAR website.

In the wake of the pandemic, we have become accustomed to believing in predictions and speculation. Yet sometimes the best way to find out what has happened or what to expect is... to ask. This is what has been done for ESOMAR's Global Prices Study 2021. We asked market research agencies around the world what the effect of the pandemic had been on their prices.

The result is the most comprehensive price analysis report on the market.

ESOMAR's Global Prices Study has been published biannually for the past twenty-five years to benchmark the sector's pricing structures regularly. The 2021 update is based on quotes provided by 521 respondents across 106 countries. This edition provides an exclusive insight into how research pricing has adapted to the ever-increasing technology imperative and the unforeseen global pandemic; as a result, it offers unrivalled guidance in the planning and purchasing of primary data collection projects.

Seven “dummy” projects to depict the industry

Participating agencies in this study had to quote what they would charge for seven generic projects. The definition of the projects is defined by the project Sounding Board, which is made up of industry experts from all over the world. Below are the highlights of the projects:

The Usage and Attitude (U&A) study with consumers is the most typical of all the quantitative projects included in the Global Pricing Study. The versatility of U&A allows clients to answer questions about consumer behaviour and enables a holistic understanding of market demand for the product. As a survey-based study, its pricing has been evaluated based on three modalities of data collection: face-to-face (F2F), telephone (CATI) and online access panels.

The Tracking study is another industry-standard type of quantitative project that monitors changes in consumer perceptions of a product. Unlike U&A, this type of study requires a greater sample size and the ability to keep tracking over time. Quotes were also collected for three modalities, face-to-face, telephone and online. Both the U&A and the Tracking Study suggest that online research tends to be cheaper than CATI, which tends to be cheaper than F2F – in markets where all three of these options are offered.

The Focus Group is one of the most representative types of qualitative projects in the market research industry. The dynamics of this type of study allow participants to interact with each other and a moderator in real-time. This project can be quoted as a typical qualitative F2F project and/or its online equivalent to evaluate it in terms of two methodologies. In markets where there is a choice between online and F2F for focus groups, F2F is 21% more expensive on average.

The Online Discussions are, together with Focus Groups, the qualitative projects covered in the Global Prices Study. These involve opening an online forum on which consumers can comment on their experience regarding their use of a product. The discussion takes place over a few days (in this case, five days) on a platform suitable for both mobile devices and computers. Unlike Focus Groups, there is no real-time interaction between participants. Online discussions show the greatest variation between the lowest and highest price (of the projects included in this study), with a ratio of 39% between Armenia and Switzerland.

The Social Media Listening project diverges from the other projects in that the information is collected directly from publicly posted opinions rather than through a survey or pre-set interview approach. It differs the most from the analogue methods collected in the seven standard projects of the Global Price Survey. However, the responses for Social Media listening highlight the difference between simply collecting data and creating analysis and a presentation. Data-only has a global median of $7000, while the median for the analysis/presentation option is $24000.

The Business to Business (B2B) study may involve various stakeholders, including prospective buyers, former customers or employees. Broadly speaking, B2B projects comprise two phases: data collection and analysis. The project described on the questionnaire involves two approaches to data collection, namely CATI and online. In addition, agencies were asked to bid for the project on the assumptions a) that the client would provide the sample or b) that the agency would have to find the sample.

The last of the standard projects covered in this report is a Consultancy project. The inclusion of this project, which differs from other more traditional projects, lies in the broadening of the boundaries of the Market Research industry, which integrates consultancy and advisory services and business support. This project is based on secondary data analysis (rather than data collection) and asks the respondent company to extract action points and concrete recommendations to the client.

Two opposing trends

Many of the trends identified in previous editions of our Global Pricing Survey not only continued in 2021 but saw an acceleration. The 2016 and 2018 reports had already predicted a decline in prices for online methodologies and an increase in the cost of F2F, and that is clearly apparent; as an example, the cost of undertaking a U&A project using F2F in 2016 was 56% more expensive than online, in 2018 it was 79% more expensive, and this edition now shows it to be more than twice as expensive - 105% (given all of the health and safety measures necessitated by COVID).

This price divergence of methodologies contrasts with the convergence of average prices in the Key Markets (i.e. the seven largest markets) with respect to the rest of the world. The Key Markets tended to be more expensive than the median for all methods in the past. That is, despite the apparent standardisation of prices in the industry, where countries with a well-developed industry offer more competitive prices, the prices of analogue methodologies are soaring in nearly all regions, and the opposite is true for online methods. This change could indicate that online quantitative research is increasingly a commodity.

Meanwhile – and resulting from lockdowns and restricted travel opportunities – the “human factor” was negatively affected during the pandemic and experienced a sharp drop in the rates charged by all types of professionals: juniors, mid-level, and seniors fell by 32-40%, while marketing scientists and advanced analytics experts fell much less, by 15%. This may lead to a transformation of the industry towards a model in which professionals become more technology-driven and move towards higher professional rates, leading to increased competition in online methodologies or a shift towards self-serve (DIY) platforms involving process automation.

Cristina Buerbaum

Data & IT Risk Advisor - Center of Expertise Risk at RabobankCristina is an econometrician and quantitative analyst. She is the main analyst for Global Price Study 2021 and supported ESOMAR in the development of data-driven initiatives to increase value for members. Originally from the Canary Islands, Cristina has a background in economics and a Masters in Econometrics and Operations Research from the Vrije Universiteit Amsterdam. She is interested in programming and data science and is passionate about time series modelling. She is fluent in Spanish, English and is still in the process of learning German... yet the best conversations are always over coffee.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact