The insights industry in Latin America

A strong recovery in 2021, but was it enough?

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

This article looks at the results of ESOMAR’s Global Market Research 2021 report, probably the most comprehensive overview of the state of the insights industry around the world to guide your business investment plans, identify growth opportunities, prepare your mergers and acquisitions, and support your insights projects, academic theses, market studies, and ads.

A unique case

The late impact of the pandemic in the Latin American subcontinent had two main consequences.

The most important one was that a year which began with the challenges of a global slowdown of the world economy – 2020 –, soon after that forced a halt in the practice of the insight’s activity in almost all countries as the pandemic reached their shores (before experiencing a modest reactivation in the last quarter in some countries).

The second was that in many countries, the social and economic shock awoke dormant feelings of unrest in the population throughout the region.

The severe, prolonged, and multi-layered impact of the pandemic and the disadvantage of a traditionally static industry, slow to change overnight to alternative research methods, resulted in an overall drop of the region’s turnover in 2020 of almost 22% after taking inflation into account.

While the region is expected to have recovered part of the lost ground during 2021 – it forecasts a 10.6% growth in real terms –the fact that it will not be enough to return to pre-pandemic levels of output shows that the impact will be long-lasting.

Local and sectorial differences

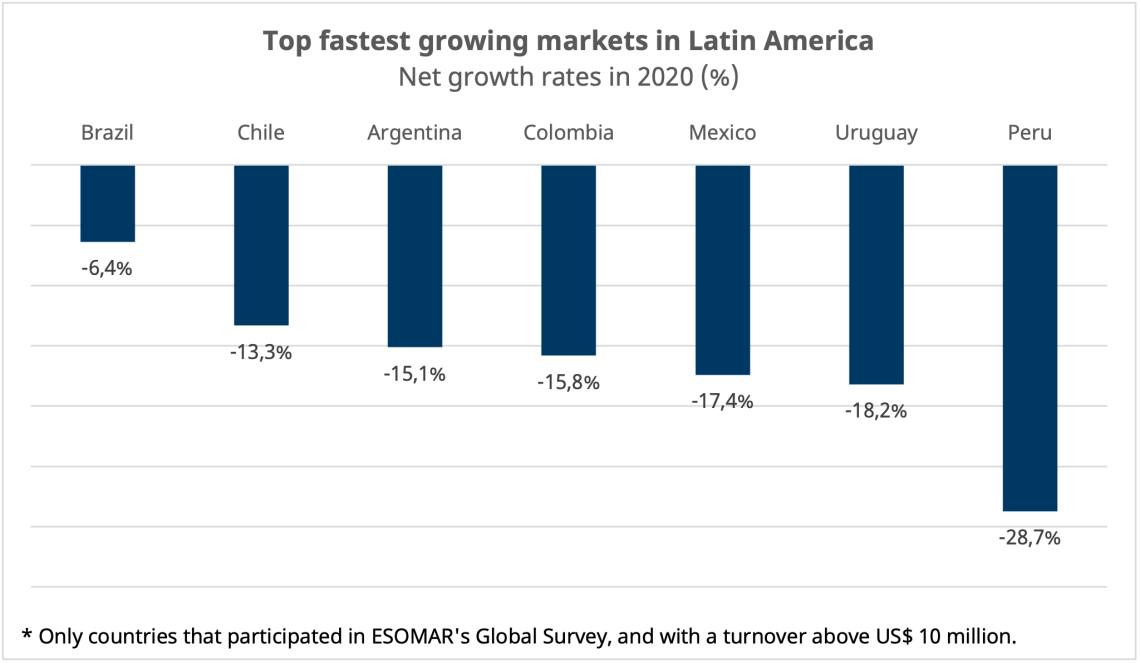

While no market reported positive net growth, only the largest country in the region managed to avoid a drop of more than 10% during 2020: Brazil. This result was largely due to digital research, and the large size of the country attracted projects centrally that otherwise may have been commissioned elsewhere. Even with an unequal deployment of the internet, other improvements in telecommunications such as 5G showed how the Brazilian market continued to evolve despite the shrinkage in insights revenue.

The forecasted growth level for 2021 shows positive growth for most of the countries in the region, though few expect to return to levels of output seen in 2019: the only exceptions being the Dominican Republic and Panama.

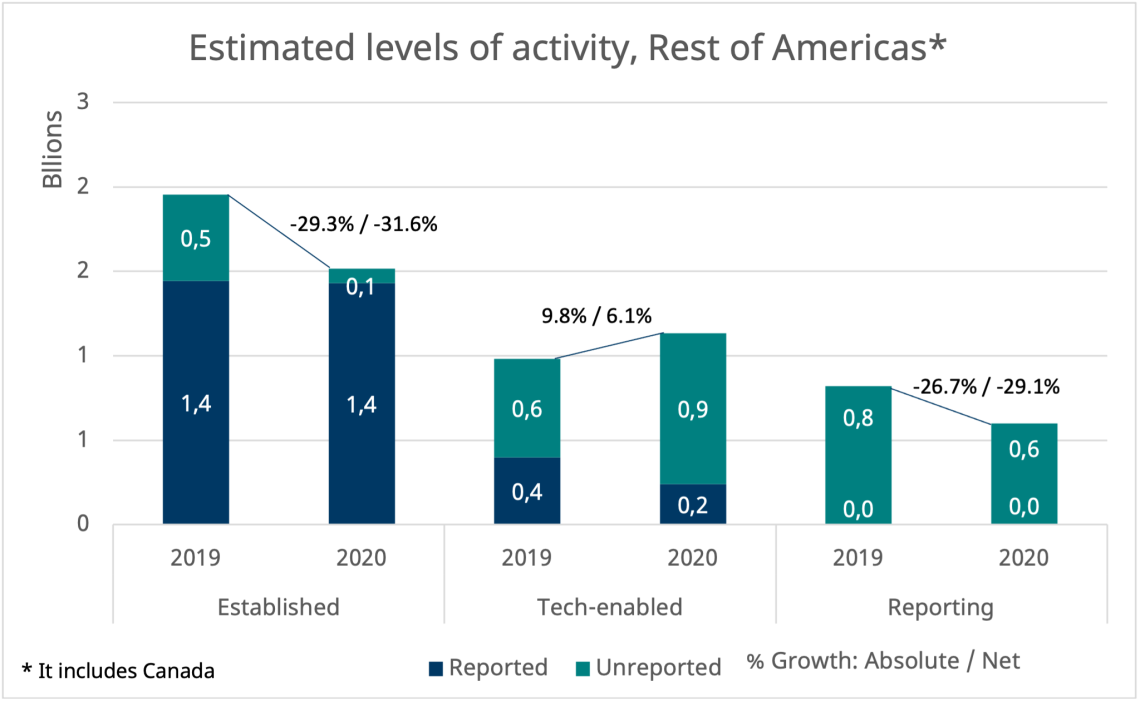

Given limitations in the source of ESOMAR’s global data, the regional assessment for Latin America includes Canada, a US-centric division of the continent also known as “Rest of Americas”.

Source: ESOMAR’s Global Market Research 2021

Source: ESOMAR’s Global Market Research 2021

When looking at this regional level, both the established and the reporting sectors appear to have suffered the largest slump in 2020, with net growth for both areas of around -30%. Again, while 2021 is expected to help gain some of the lost ground with growth rates of 9% and 14% respectively, it will not be sufficient to return to pre-pandemic levels of output.

The large weight of the established industry made it impossible for the technology-enabled side of the profession to reverse the trend. Despite the +6.1% net growth estimated for the technological sector in 2020, the overall insights industry in Latin America suffered the largest percentage decline globally, leaving 21.9% of its value behind. With an expected growth of 10.6% in 2021 – the biggest one globally – recovery is expected to be bound for the long haul.

A positive 2021 forecast

Source: ESOMAR’s Global Market Research 2021

Source: ESOMAR’s Global Market Research 2021

Individual countries also looked cautiously to 2021 and all the unobserved effects that may play in the recovery patterns of the industry. Recovery is expected to be a long process, and virtually no country in the region ventured to forecast a return to pre-pandemic levels of local turnover by the end of the year.

Recovery may need to be a mid to long-term process, as all three main insights activity branches expect similar growth levels during 2021. The established side of the industry is expected to bear the weight of the recovery in terms of US$ as it adds almost US$ 200 million and grows nearly +9% in net terms. While estimated at a lower value, the reporting activities (consulting, advisory, secondary analysis) are projected to grow by +14.0%. Lastly, the tech-enabled industry is estimated to grow +11.2% after inflation.

Regretfully, none of these (surprisingly optimistic) recovery levels will bring the industry to the levels of output seen in 2019. Even if global trends continue to be positive, the region may be looking at a year(s)-long recovery. Let’s hope that the insights industry in Latin America uses this challenging situation to continue to embrace elements of agility, innovation, and flexibility understood as the main pillars to help it recover and become a strong sector once again.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact