Longer post-pandemic recovery for Latin American insights

Positive regional growth, but sufficient?

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

Positive regional growth, but sufficient?

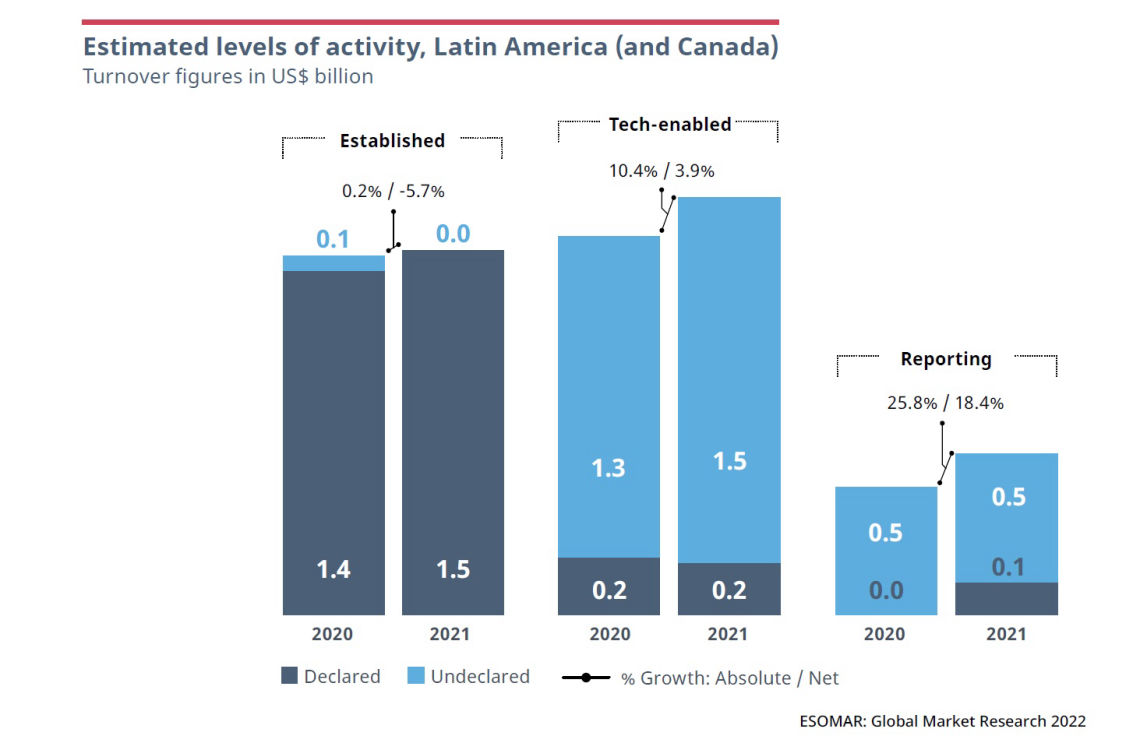

The American subcontinent is home to some of the largest interregional differences globally. The almost +20% net growth reported by Colombia – the fastest growing and third largest insights market in Latin America – indisputably contrasts with the -6.5% one reported by Argentina, the fifth largest one. Overall, the region (plus Canada) grew an expected +4.2% over 2021 and presented an aggregated turnover in excess of US$ 4 billion.

ESOMAR’s Global Market Research 2022 report also welcomes the expansion of the data included under the Caribbean region. Which until last year was an aggregated figure of five countries – Guyana, Jamaica, the Bahamas, Suriname, and Trinidad and Tobago – now unfolds to show the specific breakdowns of Jamaica along with Guyana. The growth rate for this area (more than two-fold for the area) may look staggering, though it is worth considering the low baseline for these figures and the almost-complete halt imposed on the industry by the pandemic in previous years.

The bulk of the growth in the “Rest of the Americas” (which includes Latin America and Canada) came from the tech-enabled sector (+3.9% in net terms). While the reporting sector may appear to have a higher net growth rate at +18.4%, the truth is that the area where the most dollars were generated was the tech-enabled one. Historically higher inflation rates in this region managed to lower growth substantially and even showed an established sector losing ground after a -5.7% growth rate in net terms.

The present year is expected to continue the trend of stabilisation and show an industry worth over US$ 4.5 billion after a +7.5% net growth. For the most part, however, we will have to wait longer before making assumptions with any sufficient level of confidence that the effects of the pandemic have been absorbed and overcome.

This exemplifies the unfortunate outcome severe shocks have on the different economies of the world. While the most resilient systems tend to react quicker, lose less ground, and recover faster, others appear more vulnerable, for longer. This widens the existing differences across countries in the world, weakening the global equilibrium.

Disparities between countries

No outcome better reflects the disparate recovery from the pandemic than the fact that only six markets managed to present positive net growth during 2021 – of which four were double-digit. And while overall, no country projects negative growth for 2022, only two markets expect a net growth rate of 10% or above: Colombia with 10% and Peru with 16%.

The high inflation rate that seems to have become so usual for some of the Latin American countries continues to inhibit the proper development of the industry. With an inflation rate of almost 10% expected for 2022, Latin America’s growth largely finds itself engulfed by the severe effects of these price adjustments which make it a challenge to generate substantial available capital for reinvestment.

After years of health emergencies, social unrest, and bouts of political turmoil, the region seems to be finding a new path for development. Still, anxiety remains in some countries, such as Brazil, where local commentators highlighted the level of confusion spread among the population due to the recent general elections.

Countries see 2022 with cautious optimism, and, while negative growth is generally not expected, neither is it a confident positive level that would bring countries out of the valley experienced in 2020. We will continue to look closely at developments in Latin America as its industry continues to develop and evolve over time!

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact