Long road for post-pandemic insights in Africa & Middle East

These two regions,continue in their struggle

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

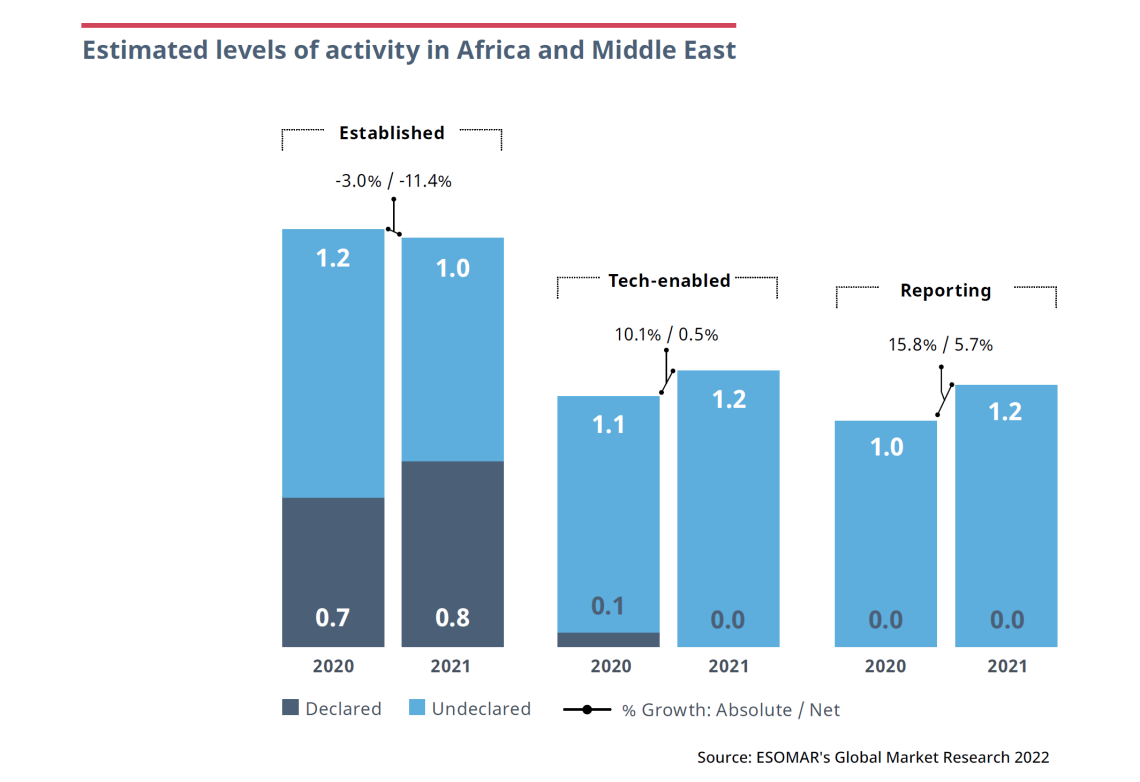

ESOMAR’s Global Market Research 2022 report witnessed how these two regions, which saw their turnover drop over -10% in net terms during 2020, continued in their struggle to absorb the negative shock during 2021 and presented an overall flat behaviour for the year. Positive absolute growth of +5.4% turned into a negative -3.8% after factoring in inflation.

As happens with some countries in the Latin American region (also covered in Research World), a tardier recovery only adds to the differences in development that exist between these and other regions, which have already managed to reverse the negative impact of the pandemic successfully. Thankfully, the net growth in 2022 is expected to bring the turnover of the insights industry in these regions closer to a combined US$ 5 billion.

The impact of inflation

Whether it is due to high levels of inflation or other economic, social or political factors, these regions were the only ones with countries declaring substantial drops in their industrial output during 2021 (the latest full fiscal year recorded).

Examples are Sudan, where the staggering inflation (almost 360%) turned an absolute growth rate of over +150% to -44% in net terms, and Lebanon, where the same phenomenon managed to turn an absolute growth rate of +28% to a net one of -60.5%, or Iran where an absolute growth rate of almost +29% falls to a level of -8% in net terms.

Only Egypt reached a level of industrial output above that of 2019. The remaining countries with available data remain at lower levels and may require some time to pull the industry out of the pandemic pit. Recovery, however, is expected to be erratic.

Sectorial performance

The sector that managed to add the most revenue to the industry, with over US$ 160 million, was the reporting sector. This absolute growth of +15% hints at the emergence of a type of business where the traditional emphasis on data gathering gradually gives way to the higher added value that generally exists in the advisory, business intelligence and consulting functions.

Similarly, the strong growth seen in the tech-enabled industry – over 10% in absolute terms, though flat after inflation – appears to show the development of new techniques and companies in these regions. While the bulk of this turnover remains undeclared, we hope to be able to present breakdowns that include the turnovers of all three main sectors of the industry in each country in upcoming editions of the Global Market Research reports.

We will continue to work to ensure the inclusion of more countries in the pages of the Global Market Research, as well as other ESOMAR reports, and would like to acknowledge the work of all those collaborators who take the time each year to help us compile this information.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact