European Union insights revenue reaches pre-pandemic levels

Up to 22 out of 37 European countries registered a double-digit absolute growth rate during 2021.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

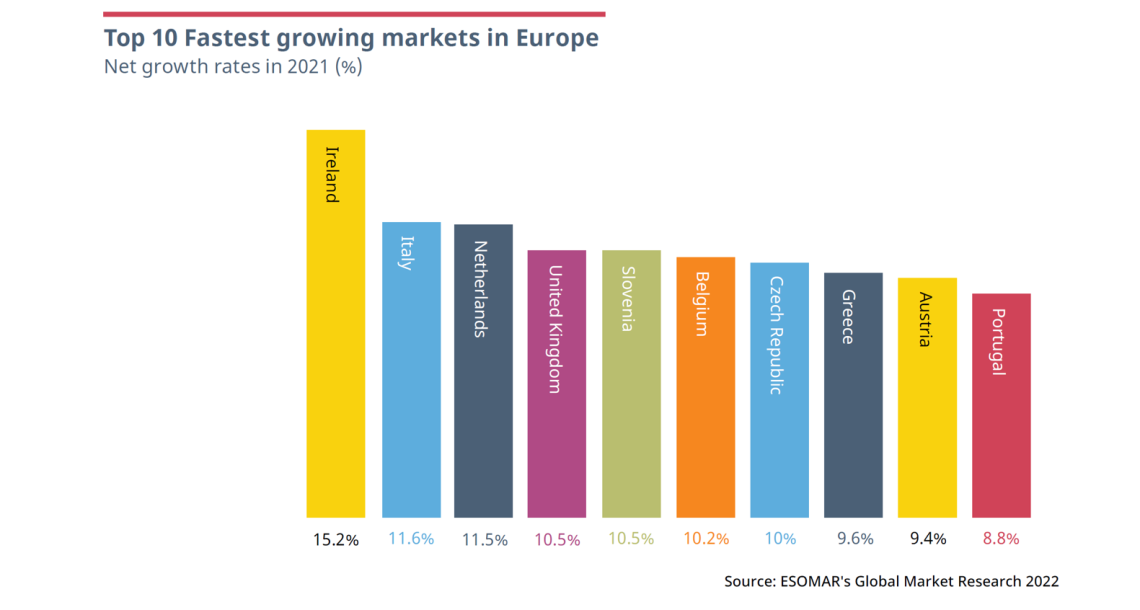

22 out of 37 European countries covered by ESOMAR’s Global Market Research 2022 report registered double-digit absolute growth rates in 2021. When adjusted for inflation, however, the 15 countries that made up the European Union after its 1995 enlargement (which includes former member United Kingdom) declared higher growth than the rest of the region.

This result mirrors and overturns the situation observed in 2020, where the EU15 countries had the biggest slump in absolute terms. However, the generally higher inflation levels of the so-called “New EU member states” – not so new anymore – means that their 2020 dip was more significant in real terms, and the 2021 recovery slightly more nuanced.

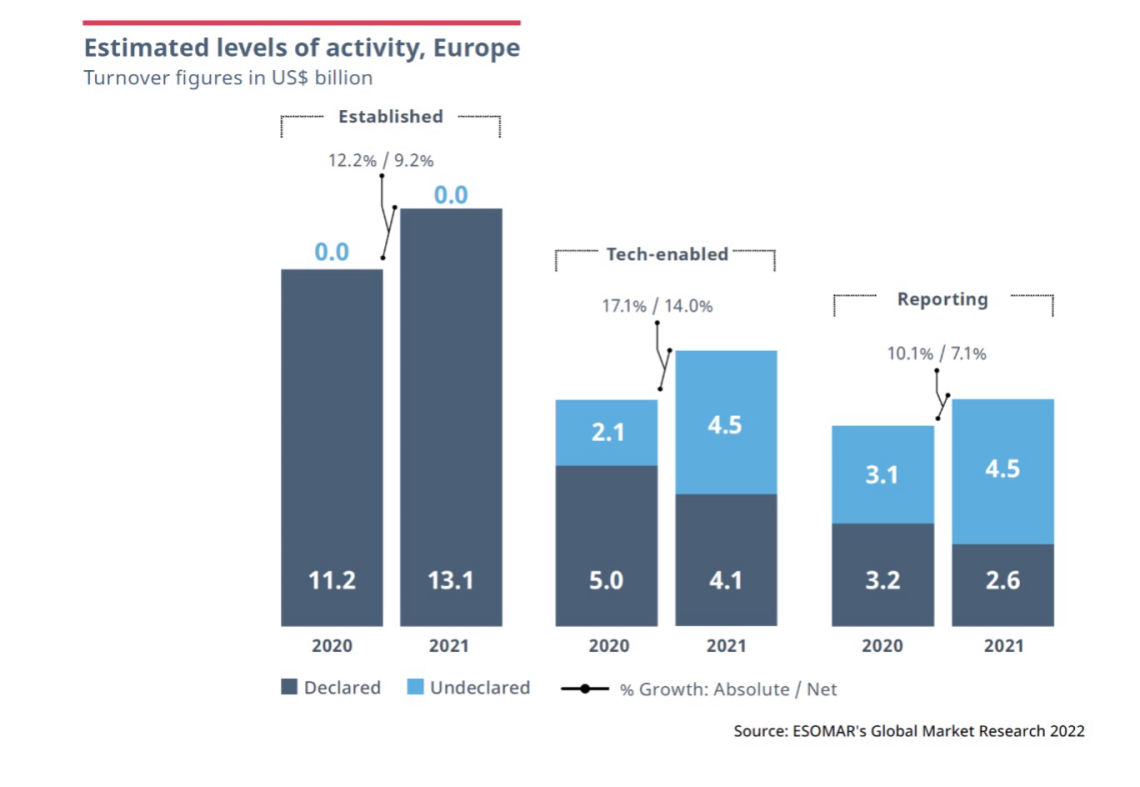

Areas of growth

The main engine of growth was attributed to the tech-enabled industry, estimated at US$ 8.6 billion in 2021, or 14% higher in net terms than a year earlier. The ESOMAR’s Global Top-50 Insights Companies ranking published in July showed the strength as well as the opportunities for investment and consolidation that exist within this sector.

While at a slightly slower pace, the established sector presented excellent growth across the region, surpassing US$ 13 billion after an almost 10% annual net growth.

The reporting sector (the part of the insights process where secondary data is analysed, the report is drafted, results presented, and the company advised) also saw growth. While part of this revenue is included in the latter part of the process for full-service agencies, it is consulting firms and other companies dedicated to industry reports and business intelligence that form the bulk of the revenue. With an estimated growth of 7%, the reporting sector surpasses US$ 7 billion in turnover.

The rebound in growth for the industry is pronounced, though high levels of inflation in 2022 will likely tone down growth in the industry to the single digits.

Main European markets

The United Kingdom, the largest market in Europe by a substantial margin, declared a growth rate of +10.5% in net terms as the industry recovered from the impact of the COVID-19 pandemic. This is illustrated by face-to-face methodologies' returning to research portfolios, and the profession continuing to reinvent itself.

Other countries with double-digit net growth and turnover above US$ 100 million were Italy, the Netherlands, Belgium, the Czech Republic and Ireland – the latter being the fastest-growing country in the region.

2022 is expected to be a year of normalisation as growth rates take on more circumspect levels, with no country expecting growth above +9%. Only 6 countries will likely see their turnover decline, four of which are Bulgaria, Croatia, Slovenia and Switzerland. The other two are Russia and Ukraine, currently engaged in a military conflict with worldwide consequences. Unfortunately, estimating the expected growth of the Ukrainian industry for 2022 proved futile, though we hope the country manages not only to maintain its industrial fabric but to return with restored energy.

We will closely follow the results and hope to report a European market with a turnover of over US$ 33 billion next year!

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact