The industry in Europe

Turbulence in European insights during the pandemic, tempered by the tech-enabled industry

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact

This article looks at the results of ESOMAR’s Global Market Research 2021 report, probably the most comprehensive overview of the state of the insights industry around the world to guide your business investment plans, identify growth opportunities, prepare your mergers and acquisitions, and support your insights projects, academic theses, market studies, and ads.

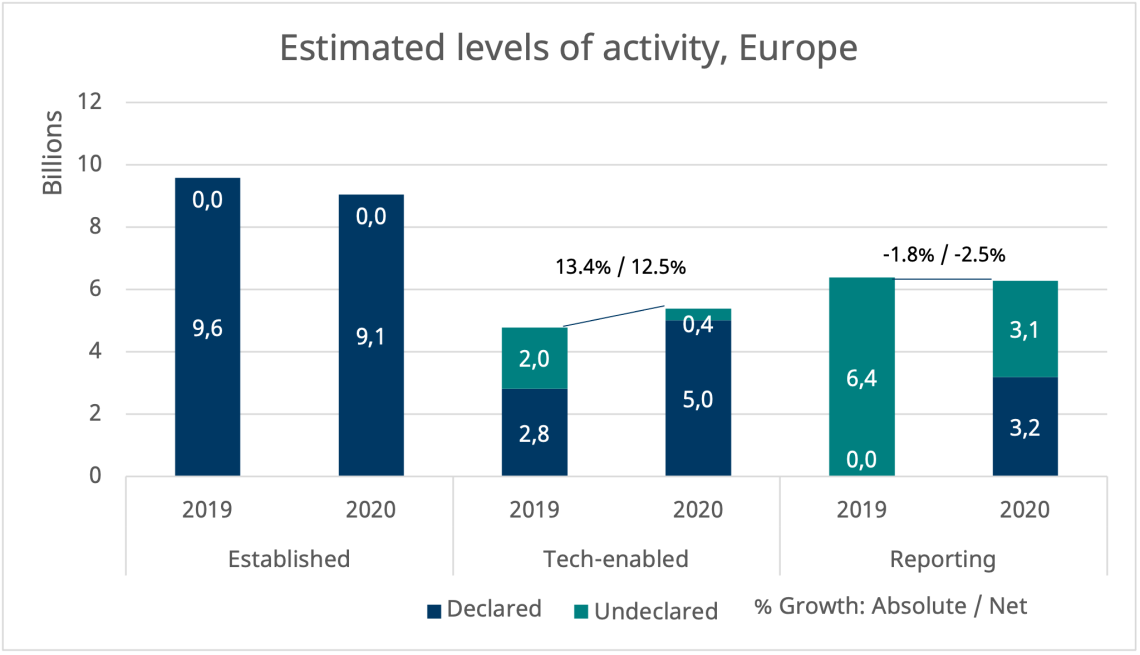

In general terms, Europe’s growth levels in 2020 mirrored the performance of the global insights industry as a whole: a shrinking established sector, a buoyant tech-enabled one, and a rather static reporting side. Overall, the industry grew at an estimated +1.8% in absolute terms that translated to a more subtle +1.0% in net ones. In monetary units, the European industry remained flat, barely increasing its output by more than US$ 100 million.

This estimated growth rate is arrived at by the addition of two elements. On the one hand are the responses provided by the region’s countries, which jointly report a drop of 7.7% in net terms. On the other is the estimated total size of the industry by ESOMAR, which softens this picture with the positive performance of the tech-enabled and reporting sectors and estimates the mentioned 1.0% growth in net terms for the overall European insights industry. ESOMAR’s Global Market Research 2021 report offers a more in-depth look at these figures.

The established industry, the most severely hit by the rarefied situation undergone by the world in 2020, decreased by 4.5% in net terms and saw a value drop in excess of half a billion US dollars. However, the gap left by the established methods of research was picked up by the technology-enabled ones, which increased in value by almost the same amount (close to US$ 600 million), growing by an estimated 12.5%. Lastly, the reporting side of the industry (consultancy, industry reports and secondary analysis) maintained the same level of output with a drop of just US$ 100 million that translates to a net decline of -2.5%.

ESOMAR’s Global Market Research 2021

ESOMAR’s Global Market Research 2021

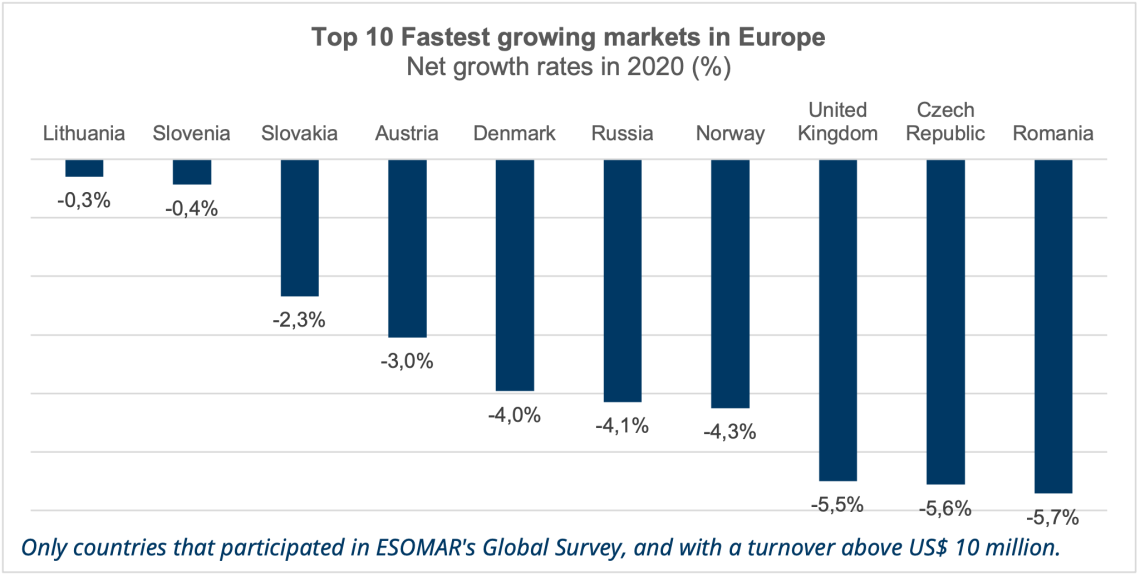

No country in Europe managed to report a positive net growth in its insights industry in 2020. The only two countries that registered absolute positive growth, Lithuania and Turkey, saw their growth turn negative when factoring in inflation. The situation is expected to reverse with the data for 2021 (to be published in the upcoming edition of the Global Market Research report), with all the countries expecting to declare growth except for, again, Turkey.

The imperative to move to online methods of research created a feeling that the price of carrying out research projects is low. This impression, indirectly, sends a message to clients that the financial barrier required to set up an insights department on their own is now lower, adding to the pressures some full-service insights agencies were already facing, and much to the joy of self-service platforms and SaaS companies (and the ResearchTech sector at large).

Easier access to research, however, does not guarantee quality of the insights. Instead, as ESOMAR’s Users and Buyers Global Insights Study 2020 showed, it is now more important, as well as challenging, than ever to maintain online quality, which exposes the true mirage of lower costs; the old proverb that says “cheap now, expensive later” may still be very much in place.

The freezing of budgets was a last hardship that provoked an even-greater shift into remote and indirect methods of research in 2020. While lower prices (one of the findings of ESOMAR’s Global Prices Study 2021) imply that clients can obtain greater insight for the same price, the impact affects the human element (since this industry generally requires substantially fewer employees to function, albeit with oftentimes higher salaries), but also impacts upon quality measures, as maintaining online quality parameters is considerably more challenging than is believed.

Top 10 fastest growing markets in Europe

Top 10 fastest growing markets in Europe

Despite the substantial drop in turnover, the countries of the region expect to have regained a part of the lost ground during 2021. The overall expectation is for an absolute growth of +8.4% to be moderated by inflation to a net growth of +6.7%. If this forecast is correct, it will imply that for the European insights industry in some countries, a recovery from the economic shock of the pandemic may not be seen until at least 2022.

ESOMAR is currently working on a new edition of the Global Market Research report, to be published at the annual Congress in September.

Xabier Palacio

Head of Intelligence, Advocacy and Standards at EsomarXabier guides the creation of influential studies, reports, and guidelines at ESOMAR while overseeing the Departments of Professional Standards, Intelligence, and Public Affairs. He leads efforts to provide industry insights, maintain ethical standards, and advocate for the sector’s interests. ESOMAR, a global hub for research, insights, and analytics since 1947, supports over 50,000 professionals and companies worldwide. Under Xabier’s leadership, these departments ensure the industry’s continued growth, fostering collaboration and advocating for responsible practices with regulators and legislators.

Originally from Spain, Xabier has been living in the Netherlands for a number of years, where he studied a Master in International Economics followed by a Master in Marketing at the Erasmus University of Rotterdam. He is fluent in Spanish and English, has a decent command of Dutch, and loves music about as much as analysis.

Article series

ESOMAR Publications

- ESOMAR’s global top-25 insights companies

- Climate crisis

- Verdane: Investment in the Insights industry

- Who has the most developed insights industry?

- …What now? Pricing insights

- Drivers of change in the Insights industry

- The industry in Europe

- 2022 is pronounced “2020-too” for a reason

- Insights in Asia Pacific

- Evolution

- The insights industry in Latin America

- “The Price is Right” in 7 research projects

- Insights into Africa and the Middle East

- What makes for interesting investment

- Insights against chaos

- Is the insights industry too complex?

- What’s the lever for growth nowadays?

- European Union insights revenue reaches pre-pandemic levels

- K-shaped post-pandemic recovery of Asian Pacific insights

- Longer post-pandemic recovery for Latin American insights

- Long road for post-pandemic insights in Africa & Middle East

- A threat to the industry?

- The shifting impact of technology on the industry

- Human involvement in tech-intensive insights

- Possibilities and limitations, of unstructured data

- A future of hyperconnected insights platforms for enterprise-grade support

- The true cost of the “data rush”

- The importance of reinforcing self-brand connection

- The 2022 lattice of research methods

- Pandemic rebound through the eyes of research methodologies

- Growth in strategy and AdTech to outpace competition

- Shaping insights into impact